Key moments

- Significant market-wide liquidations totaling $1.09 billion in 24 hours.

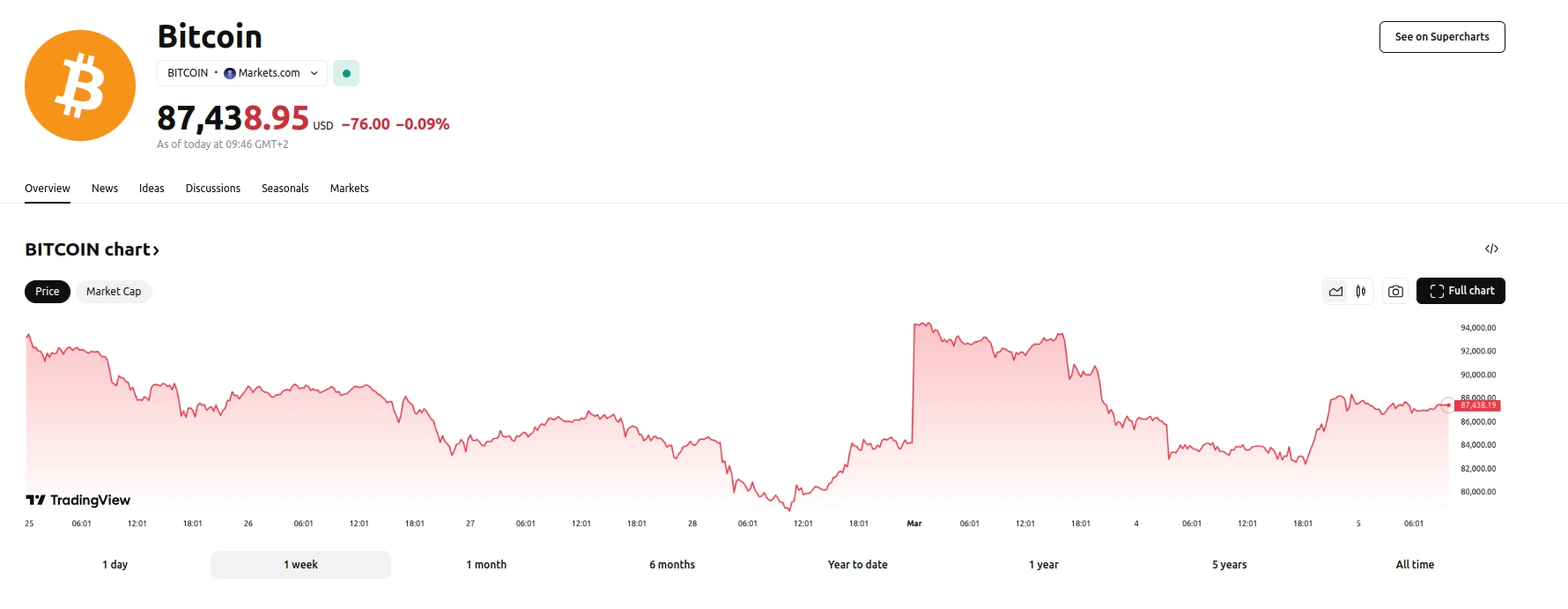

- Bitcoin price decline from a recent peak of $94,000 to approximately $84,000, with a further drop anticipated.

- Major altcoins experiencing corrections of up to 25%, significantly impacting market expectations.

Tariffs and Volatility Trigger Market-Wide Liquidations and Price Drops

The cryptocurrency market has experienced a substantial downturn, resulting in a loss of $460 billion within 24 hours. This decline is largely attributed to increased selling pressure and liquidations, driven by a combination of market volatility and external economic factors. The implementation of trade tariffs, particularly those impacting Canada and Mexico, has contributed to a climate of uncertainty, affecting investor confidence across risk assets. This instability has prompted a rapid reassessment of trading strategies among market participants.

Bitcoin has been heavily impacted by the recent selloff, with liquidations exceeding $400 million. This contributed to a broader market cap reduction. Before this event, Bitcoin had achieved a peak of $94,000 following positive market sentiment related to a crypto reserve announcement. However, this optimism proved short-lived, as prices quickly retreated. The current trading volume for Bitcoin has surged by 15%, indicating heightened selling pressure. Analysts suggest that if this trend continues, Bitcoin could potentially test support levels around $75,000 before a possible recovery.

The altcoin market has also experienced significant corrections, with major cryptocurrencies such as Ethereum, XRP, Solana, and Cardano seeing declines in the range from 15% to 25%. Ethereum, for example, reached lows of $2,030. These corrections have dampened expectations for an anticipated altcoin season. Despite the current market volatility, analysts advise against panic selling, emphasizing that market fluctuations are a normal part of the cryptocurrency cycle. There is a general feeling amongst analysts that a bottom could be found near 70,000 USD for Bitcoin.

While the immediate outlook remains uncertain, historical trends suggest that market recoveries often follow significant corrections. Experienced traders are encouraged to maintain a strategic and logical approach to their investment decisions, focusing on careful analysis of market trends and potential opportunities.