Key moments

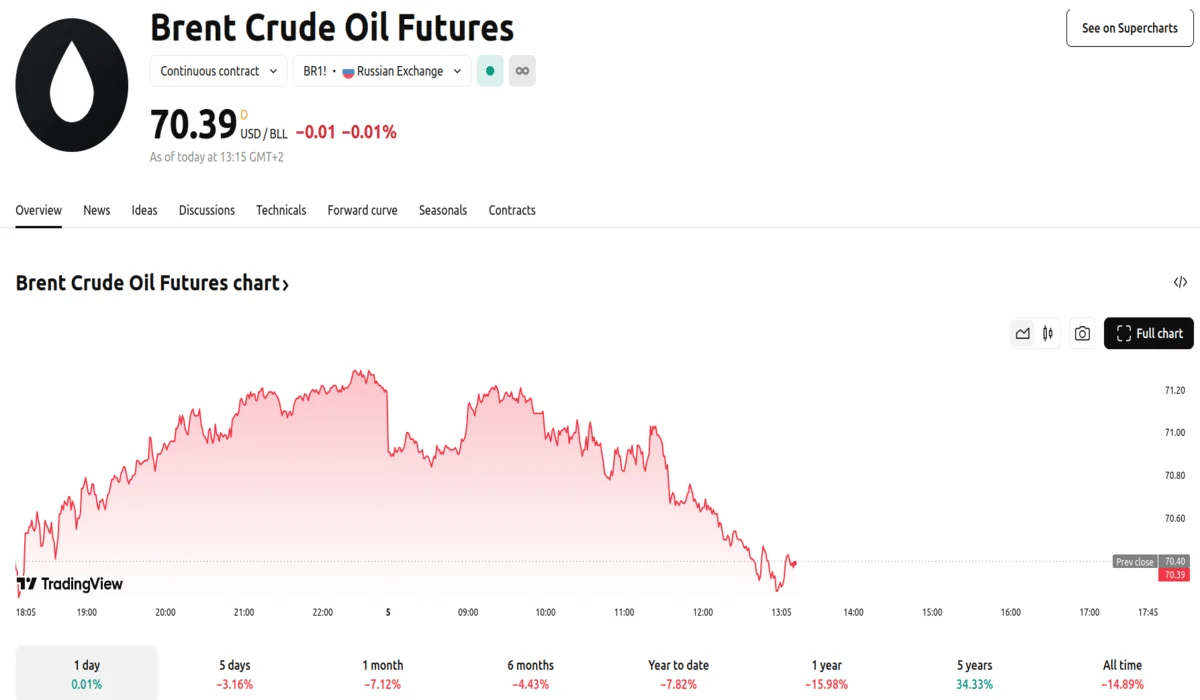

- Oil prices declined for a third consecutive session, with Brent futures falling 0.63% to $70.59 a barrel.

- OPEC’s intentions to increase daily output by 138,000 barrels from April will unwind daily cuts of nearly 6 million barrels.

- US West Texas Intermediate crude also experienced a notable decline of 74 cents, sliding 1.08% to $67.52 per barrel.

OPEC+ Plans of Increasing Daily Output by 138,000 Barrels Continue to Wreak Havoc in Oil Markets

Oil prices extended their decline for a third straight session on Wednesday, driven by investor concerns over OPEC’s decision to gradually increase production and the escalating trade tensions triggered by U.S. tariffs. Brent crude futures dropped 45 cents, or 0.63%, to $70.59 a barrel, while U.S. West Texas Intermediate (WTI) crude fell by 74 cents, or 1.08%, to $67.52 a barrel.

The Organization of the Petroleum Exporting Countries and its allies, collectively known as OPEC+, announced plans to raise output by 138,000 barrels per day starting in April. This marks the first step in a series of planned monthly increases aimed at unwinding the daily cuts of nearly 6 million barrels implemented since 2022, equivalent to nearly 6% of the global demand. Analysts, however, remain cautious about the market’s ability to absorb the additional supply.

Giovanni Staunovo, an analyst at UBS, stated that there was some concern regarding the OPEC+ decision potentially resulting in a series of monthly supply increases. However, he also noted that the group had stressed that supply would only be increased if the market could absorb it. Morgan Stanley Research echoed this sentiment, suggesting that OPEC+ might only implement a few monthly increases rather than fully reversing the cuts.

Adding to the market’s woes, U.S. President Donald Trump’s decision to impose tariffs on Canada, China, and Mexico has sparked immediate retaliation from these nations, raising fears of a global economic slowdown. Canada and China responded swiftly to the tariffs on Tuesday, while Mexico’s President Claudia Sheinbaum indicated that her country would also retaliate, though details remain unclear.

Ashley Kelty, an analyst at Panmure Liberum, expressed an opinion that the implementation of tariffs and the resulting counter-measures had amplified worries about a possible deceleration in economic growth, which, she indicated, could have a substantial effect on energy demand.

In a separate development, the Trump administration announced the termination of a license granted to U.S. oil producer Chevron to operate in Venezuela and export its oil. This decision, effective since 2022, puts approximately 200,000 barrels per day of supply at risk, according to ING commodities strategists.

Meanwhile, U.S. crude inventories fell by 1.46 million barrels in the week ending February 28, as reported by the American Petroleum Institute. Investors are now awaiting official government data on U.S. stockpiles, due later on Wednesday, for further market direction. As OPEC+ prepares to increase output and trade tensions continue to escalate, the oil market remains under significant pressure, with investors closely monitoring developments that could influence future price movements.