Key moments

- Foxconn reported a 56.43% YoY increase in February revenue, marking a historical high for the period.

- The Taiwanese company’s revenue for the first two months of 2025 showed a 24.63% spike compared to the same period a year earlier.

- Foxconn anticipates its Q1 2025 performance to align with market expectations and exceed the 5-year average for the same period.

February Revenue Up 2.36% from January’s NT$538.7 Billion

Foxconn, a major electronics manufacturer and key supplier for companies like Apple and Nvidia, has released its revenue figures, revealing significant growth in early 2025. The company’s February revenue reached NT$551.38 billion, representing a substantial 56.43% increase compared to the same month in the preceding year. This figure marks a historical high for Foxconn’s February revenue, surpassing previous records.

Furthermore, Foxconn’s cumulative revenue for the first two months of 2025 totaled NT$1.09 trillion, or approximately $33.5 billion. This figure corresponds to a 24.63% increase compared to the same period in 2024. The growth acceleration, which is a significant increase from the 11% growth pace Foxconn experienced in 2024, is attributed to the ever-increasing demand for AI computing products.

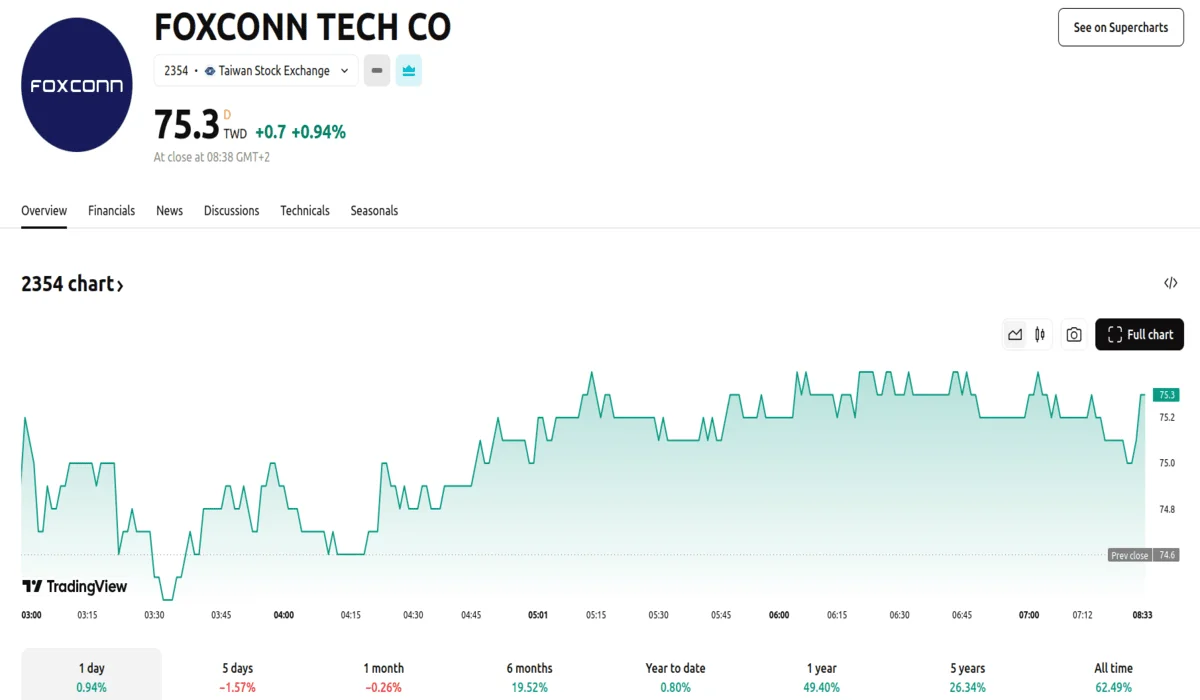

The company’s monthly performance also indicated growth, with February revenue rising 2.36% compared to the NT$538.7 billion generated in January 2025. The sequential increase highlights the company’s sustained momentum. The company’s stock currently trades at NT$75.3, up 0.94% from the previous day.

Foxconn has also provided an outlook for the first quarter of 2025, stating that it anticipates its performance to be roughly in line with market expectations. The company also projects that its sequential performance for the first quarter will be better than the average level of the past five years and will demonstrate strong YoY growth.

The company has witnessed increases across several segments. The Cloud and Networking Products segment showed strong growth YoY due to solid pull-in momentum for AI products. Revenue from Smart Consumer Electronics, Computing Products, and Components and Other Products also showed substantial increases.

Analysts are projecting a 22% revenue increase to NT$1.6 trillion for Q1 of 2025. The acceleration in Foxconn’s growth comes after Nvidia’s announcement last week, when the company disclosed $11 billion in quarterly revenue from its most advanced Blackwell chip. The latter is commonly described as the fastest product ramp in the company’s history. Foxconn, which is formally known as Hon Hai Precision, is slated to report its Q4 2024 results on March 14.