Key moments

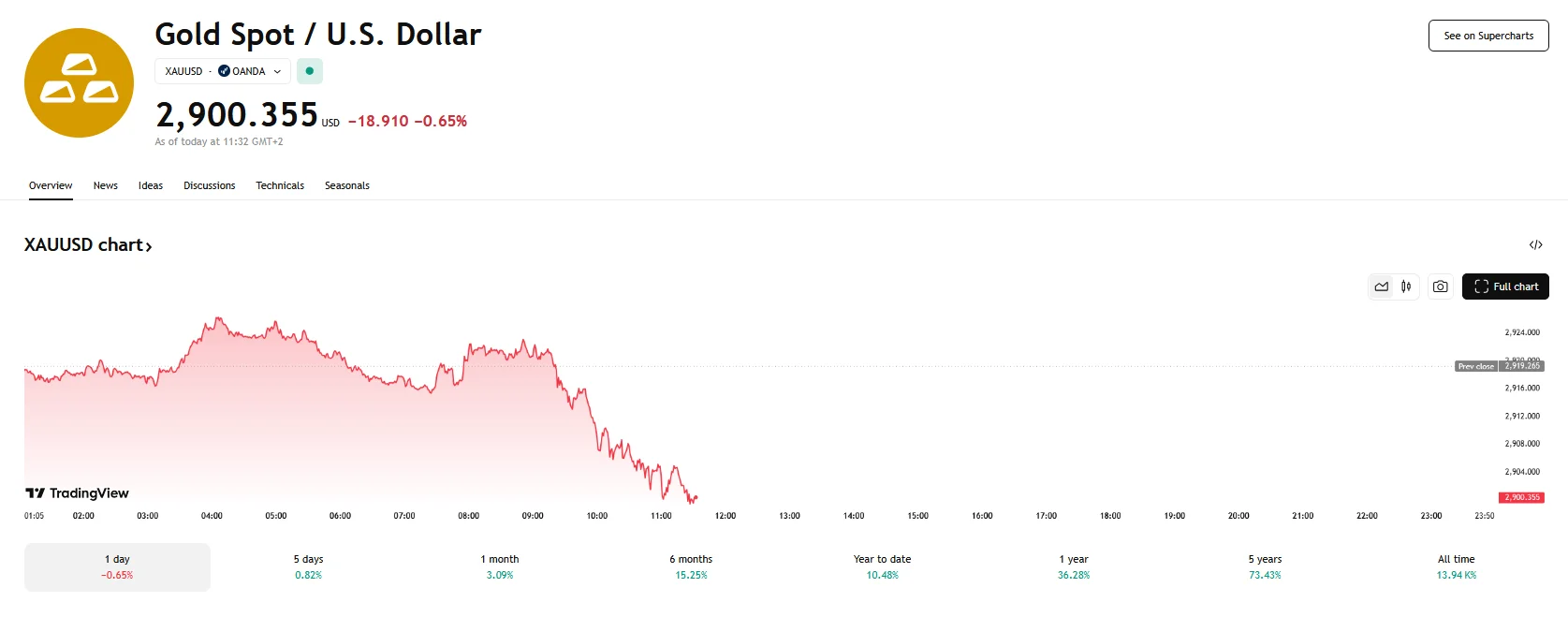

- While Gold’s value fell from its Thursday peak of over $2,926, the precious metal continues to hover around $2,900.

- President Trump’s imposition of tariffs on major trading partners has fueled anxieties about a potential global trade war, prompting investors to seek the stability of gold.

- Market speculation regarding upcoming Fed interest rate cuts has weakened the U.S. dollar, making gold more attractive to international buyers.

Gold Maintains Its Value Over in a Turbulent Market

Thursday presented a dynamic portrait of gold’s market behavior, with the precious metal’s value surging to approximately $2,926, only to subsequently recede, finding a relatively stable footing just above the $2,900 threshold. Drops below $2,900 have been relatively minor.

The initial ascent and subsequent stability can be attributed to a confluence of factors, foremost among them being the enduring anxieties surrounding international trade. Uncertainty surrounding President Trump’s implementation of tariffs on imports from key trading partners, including Canada, Mexico, and China, has generated significant market unease. The retaliatory measures enacted by these nations have further intensified concerns about a potential global trade conflict, prompting investors to seek the perceived safety of gold.

Moreover, the anticipation of monetary policy adjustments by the Federal Reserve has played a crucial role in gold’s price dynamics. The market’s expectation that the Fed will initiate interest rate reductions has weakened the U.S. dollar, thereby enhancing gold’s attractiveness. A depreciating dollar renders gold, which is denominated in dollars, more affordable for investors holding other currencies, resulting in increased demand and upward price pressure.

However, the subsequent decline from the peak of $2,926 reflects the market’s sensitivity to evolving economic data and investor sentiment. The release of certain economic indicators, such as the ADP employment report, which revealed lower-than-expected private sector job growth, has reinforced expectations of Fed rate cuts. Conversely, the announcement of a temporary delay in certain tariffs under the USMCA agreement has provided a degree of relief, contributing to a shift in investor focus towards riskier assets.

Gold’s ability to maintain its position above $2,900 suggests a degree of market confidence in its long-term value. Despite the intraday volatility, the metal’s fundamental drivers remain intact. The ongoing trade disputes, coupled with the potential for further Fed rate cuts, provide a solid foundation for gold’s continued appeal as a safe-haven asset. The market remains vigilant, closely monitoring upcoming economic releases, such as the Nonfarm Payrolls report, which are expected to provide further insights into the health of the U.S. economy and influence the Fed’s decision-making process.