Key moments

- Nasdaq 100 futures fell 1.6% while S&P 500 futures dropped 1.2%, indicating a weaker Wall Street open.

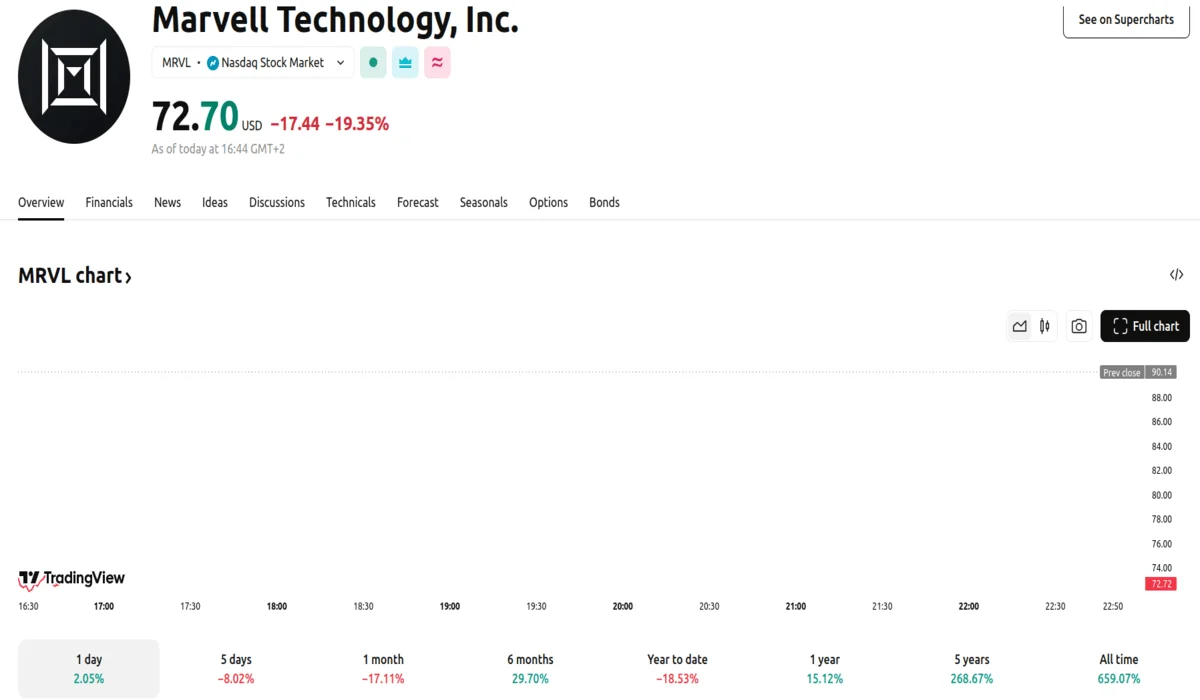

- Marvell Technology shares plunged about 15% premarket, following disappointing earnings and revenue forecasts.

- Europe’s Stoxx 600 index declined as much as 0.9%, adding to bond yield pressures.

Tech Earnings Miss and AI Competition Drive Market Decline

Wall Street futures suffered a sharp decline at the opening bell, with tech stocks bearing the brunt of investor pessimism. Specifically, contracts tied to the Nasdaq 100 index experienced a 1.6% decrease, while those tracking the S&P 500 saw a 1.2% reduction, foreshadowing a less than optimistic start to the trading day. A series of disappointing earnings reports and forecasts, coupled with growing concerns about competition in the artificial intelligence sector, contributed to the negative sentiment.

Marvell Technology Inc. shares were among the most significant premarket losers, experiencing a roughly 15% drop. The chip maker’s financial results and revenue projections failed to meet the high expectations of investors. Similarly, cybersecurity company CrowdStrike Holding Inc. and database software provider MongoDB Inc. both saw their stock values tumble by 7.09% and 1.79% after issuing weaker-than-anticipated earnings outlooks.

Adding to the pressure on chip stocks was the announcement by Alibaba Group Holding Ltd. of its Qwen platform, an AI model that the company claims matches the performance of DeepSeek, a Chinese start-up, but with significantly less data. This development raised concerns about the potential erosion of U.S. companies’ dominance in the AI space.

The combination of underwhelming earnings reports and increased competition from Chinese AI innovation negatively impacted U.S. stocks, according to market analysts. The tech sector, already weakened by recent trends, faced further pressure from these developments.

Conversely, the euro saw a brief increase of 0.5% against the dollar following the European Central Bank’s (ECB) decision to implement a 25 basis-point interest rate cut. However, the ECB’s indication that its policy-easing phase was nearing completion contributed to further market volatility.

Europe’s Stoxx 600 index extended its losses to 0.9% after the ECB’s statement. This decline was exacerbated by the sharp rise in bond yields across the continent, which followed Germany’s announcement of a substantial spending package. The German spending plan, which triggered a historic bond market sell-off, continued to weigh on European markets.

US jobless claims data, which came in lower than expected at 221,000, provided a slight counterbalance to the negative sentiment. However, it was not enough to offset the overall market downturn. Treasury yields remained relatively steady, and the dollar experienced a slight decline of 0.2%.