Key moments

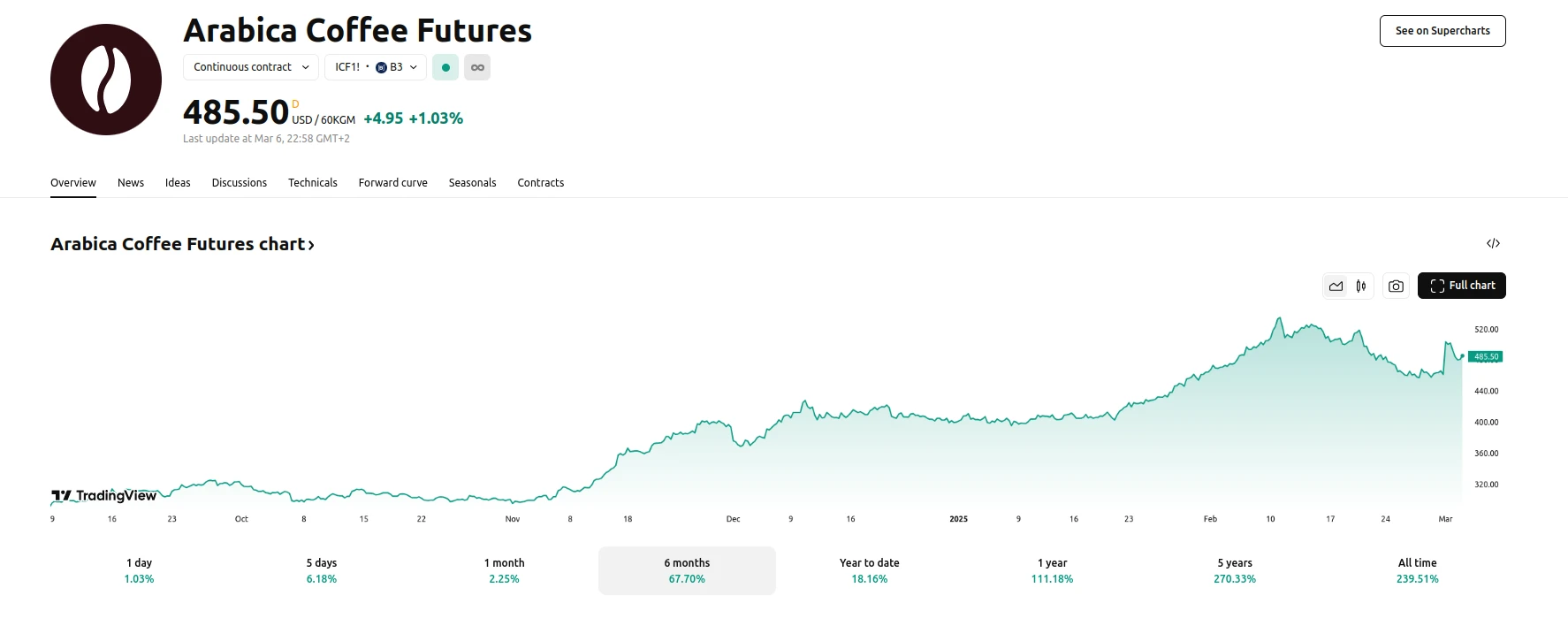

- Sharp Price Increase: Arabica coffee futures, serving as a primary reference point for setting prices in the global coffee trade, experience an almost 70% surge since November, impacting global trade.

- Reduced Purchasing: Traders and roasters minimize purchases due to price volatility and retail resistance.

- Inventory Decline: Coffee warehouses report significantly reduced stock levels, indicating a slowdown in trade.

Global Coffee Market Grapples with Price Surge and Reduced Demand

The global coffee market is experiencing significant disruption as a steep increase in Arabica coffee prices prompts traders and roasters to drastically reduce their purchasing activities. This market response stems from a combination of reduced supply in key growing regions, particularly Brazil, and resistance from retail outlets to accept the higher prices being passed along by suppliers. The resulting market instability is causing significant concern throughout the industry.

The surge in coffee futures has led to a cautious approach among traders, who are now primarily focusing on immediate needs rather than building stockpiles. This conservative trading strategy is evident in Brazil, where deals are being conducted with rapid quality checks and immediate payments. The reluctance to commit to future deliveries reflects the high degree of uncertainty surrounding price stability. The lack of acceptance from retail stores is resulting in slow negotiations, and in some cases, empty shelves. This is causing a large amount of stress on roasters, and some are questioning their ability to stay in business.

The impact of the price surge extends to coffee storage facilities, with warehouses near U.S. ports reporting significantly lower inventory levels. The reduction in storage demand has even led to some storage companies returning silos to owners and canceling leasing contracts. This contraction in storage capacity underscores the overall slowdown in coffee trade. Industry experts anticipate potential market consolidation, with larger companies leveraging their capital to increase trading volumes while smaller players face financial strain. Despite predictions of a potential price drop due to increased planting areas and a possible bumper crop in Brazil, the immediate future of the coffee market remains uncertain, with many participants facing significant challenges.