Key moments

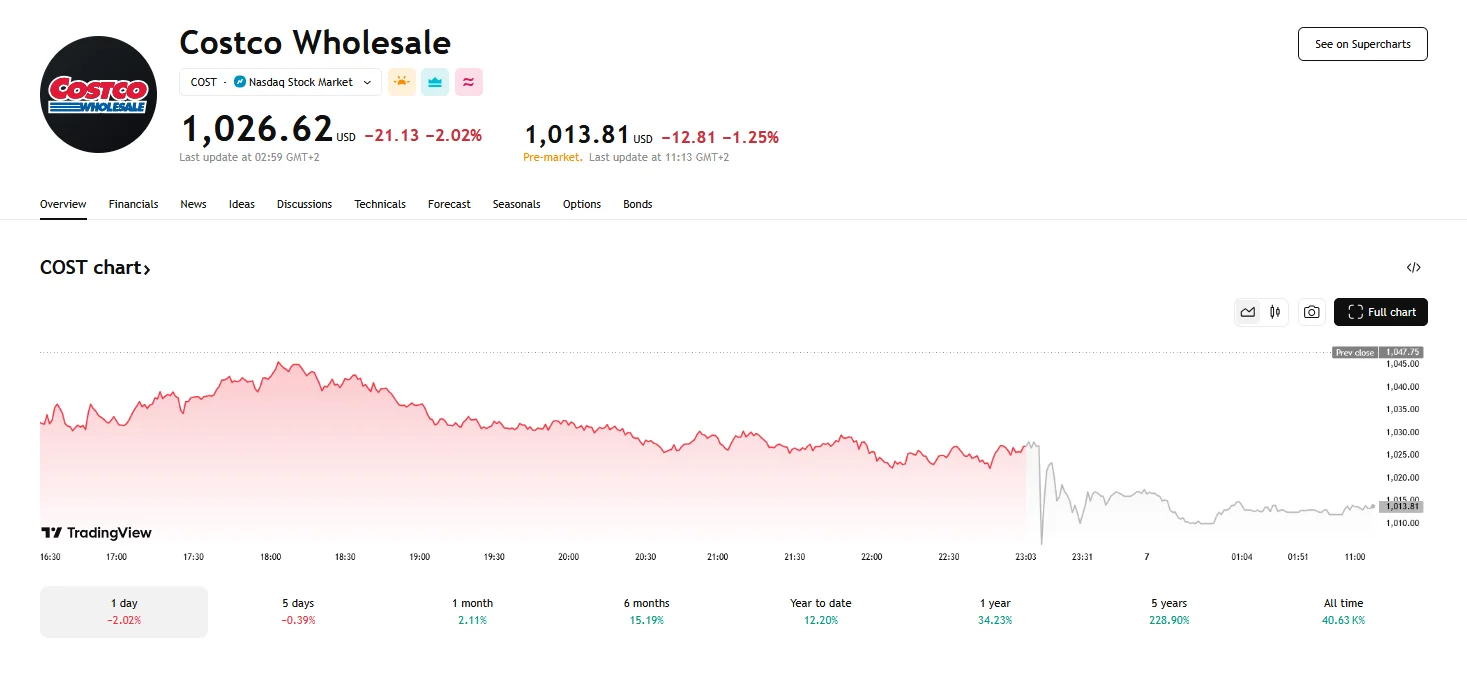

- Costco’s stock experienced a 2% drop to $1,026.62 following its Q2 FY2025 earnings release.

- The market’s reaction was primarily due to an EPS miss, with $4.02 falling short of the anticipated $4.11.

- Costco’s net sales soared to $62.53 billion, marking a 9.1% year-over-year increase. Revenue exceeded forecasts at $63.7 billion, and comparable sales rose 6.8%.

Costco Stock Reacts to Earnings Per Share Shortfall

Despite reporting a robust surge in revenue, Costco Wholesale Corporation witnessed a slight decline in its share value following the release of its second-quarter fiscal year 2025 earnings. This market reaction, with shares dropping over 2% to roughly $1,026, stemmed primarily from the company’s earnings per share (EPS) falling short of analysts’ predictions. During post-market hours, the stock briefly plunged to $1,005.45 before recovering to figures of over $1,010.

While the overall financial picture presented a narrative of growth, with net sales reaching $62.53 billion—a 9.1% increase compared to the previous year—the EPS figure of $4.02 failed to meet the anticipated $4.11. This minor discrepancy, largely attributed to the impact of unfavorable foreign exchange rates, sparked concern among investors.

Despite the EPS miss, Costco demonstrated strong performance in other key areas. Notably, the company’s revenue for the quarter totaled $63.7 billion, marginally exceeding forecasts. Furthermore, comparable sales, a crucial metric for retail businesses, rose by 6.8% year-over-year.

A significant driver of Costco’s growth was its e-commerce division. The company’s strategic investments in digital platforms, including the “Costco Next” initiative and its mobile application, have yielded impressive results. E-commerce comparable sales experienced a substantial 20.9% increase, showcasing the effectiveness of Costco’s efforts to enhance its online presence.

In the face of potential economic headwinds, such as tariffs and fluctuating consumer spending, Costco’s management remains optimistic. CEO Ron Vachris emphasized the company’s commitment to providing value to its members, stating that Costco will strive to minimize price increases. He highlighted the company’s global buying power and strong supplier relationships as key factors in navigating these challenges. Costco’s financial health remains solid, with strong cash flow generation supporting its growth initiatives. The company plans to continue its expansion, with 28 new warehouse openings projected for the fiscal year. Moreover, the company’s membership model continues to be a reliable source of revenue, as shown by a 7.4% increase in membership fee income ($1.193 billion).