Key moments

- Nvidia’s stock fell 5.7%, contributing to a near 18% year-to-date loss, driven by fears about AI demand and competitive pressures.

- Analysts point to increased competition and a change in market sentiment as factors impacting Nvidia’s stock performance.

- Despite the recent downturn, analysts still recognize Nvidia’s strong position in the AI market and its potential for long-term growth.

Despite Continued Leadership in AI, Nvidia Faces Mounting Challenges, as Evidenced by Sharp Stock Decline

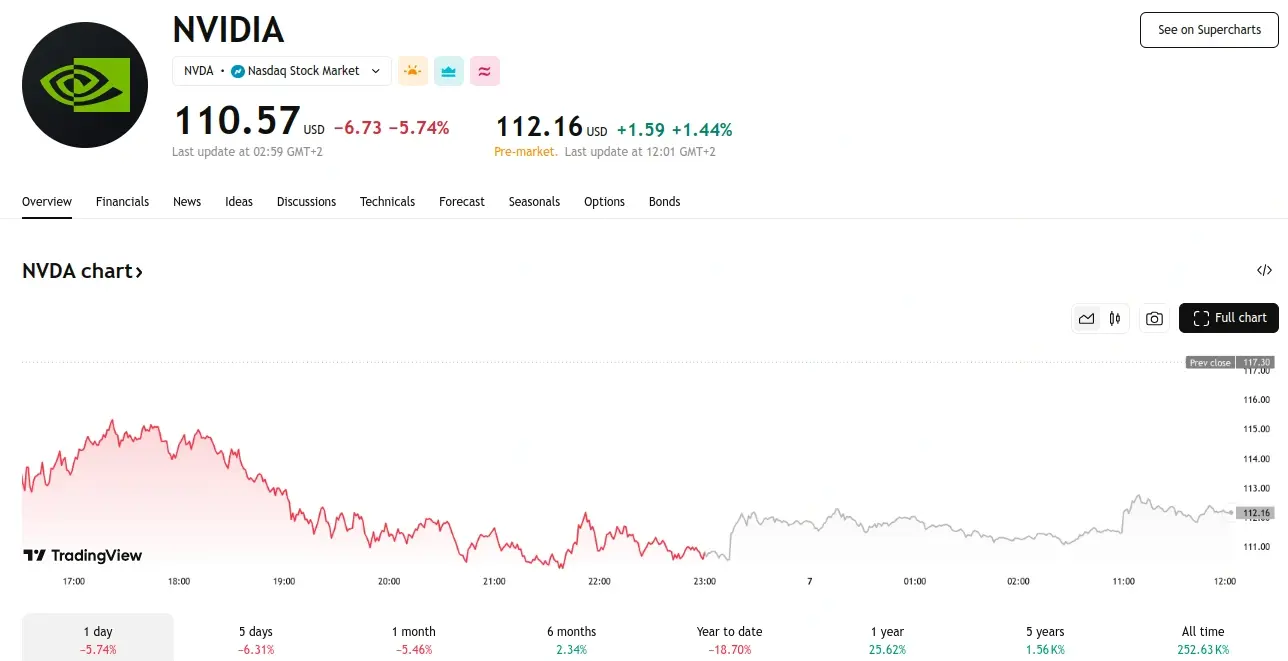

Nvidia (NVDA) shares experienced a 5.7% decline on Thursday, closing at $110.57, contributing to a broader downturn among chip manufacturers as concerns surrounding artificial intelligence demand persisted. This drop has resulted in Nvidia’s stock falling nearly 18% year-to-date, with the company’s February performance marking its most significant monthly decline since June 2022.

Analysts have expressed concerns regarding Nvidia’s recent performance. “It’s been a rough year for NVDA so far,” noted Bernstein analyst Stacy Rasgon, citing “growth fears, supply chain noise, and tariff and regulatory risks” as contributing factors to the stock’s decline. Rasgon also observed a clear shift in market sentiment towards the broader AI semiconductor sector.

Futurum Group analyst David Nicholson further elaborated, suggesting that “Wall Street is catching up to the reality that Nvidia will not create a decades-long dynasty like Intel once did. Competition is hitting them from dozens of directions.” This perspective highlights the increasing competitive pressures facing Nvidia in the AI chip market.

Despite Thursday’s share decline, Nvidia remains a favored pick among analysts who recognize the company’s potential in AI advancements. Analysts at Zacks.com, for instance, position Nvidia as a leader in the AI revolution anticipated in 2025.

Nvidia’s rapid expansion is largely attributed to its dominant position in AI, particularly in the realm of generative AI. As businesses increasingly integrate AI to boost productivity, the demand for Nvidia’s graphic processing units (GPUs), which power these technologies, has surged. According to a Grand View Research report, the global generative AI market was valued at $16.87 billion in 2024 and is projected to experience a compound annual growth rate (CAGR) of 37.6% from 2025 to 2030.

The growing demand for generative AI and large language models, which utilize GPUs based on Nvidia’s Hopper and Blackwell architectures—both designed for high-performance computing, particularly AI—is driving data center revenue growth.

The company, which holds a Zacks Rank #2 (Buy) rating, has a consensus earnings estimate for fiscal 2026 of $4.39 per share, reflecting a 4.28% increase in the last 30-day period.