Key moments

- Positive Phase 3 Data: TNX-102 SL demonstrates statistically significant pain reduction in fibromyalgia studies.

- Novel Treatment Approach: Sublingual formulation targets non-restorative sleep, a key factor in fibromyalgia pain.

- Anticipated FDA Decision: PDUFA goal date set for August 15, 2025, fueling investor optimism.

Positive Phase 3 Trial Results Fuel Investor Confidence and Anticipation for Tonix Pharmaceuticals’ Breakthrough in Chronic Pain Management

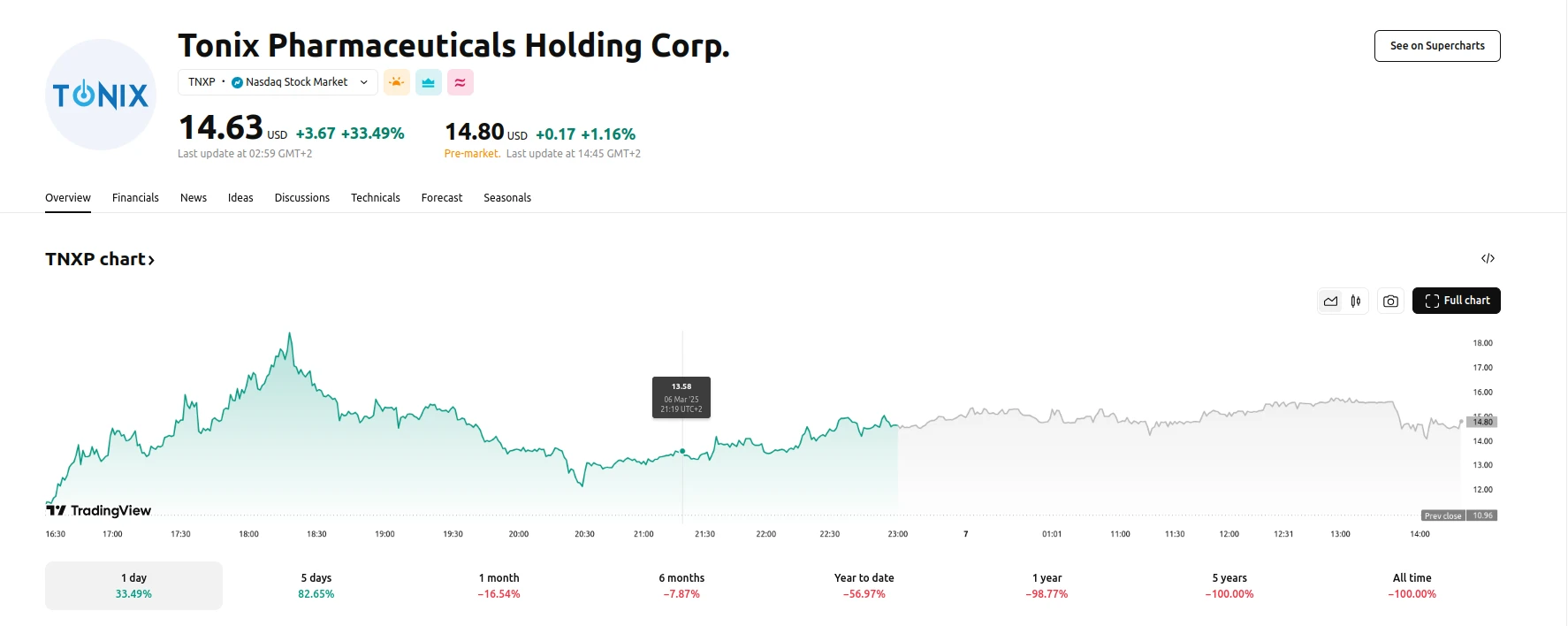

Tonix Pharmaceuticals Holding Corp. (TNXP), a clinical-stage biopharmaceutical company, experienced a dramatic surge in its stock value following the release of positive Phase 3 trial data for its fibromyalgia treatment, TNX-102 SL. The company’s shares climbed by 33.49%, as of March 07, 2025, reflecting strong investor confidence in the potential of this novel therapy. What propelled this upward market activity was the announcement of statistically significant pain reduction observed in two late-stage studies of TNX-102 SL, a sublingual formulation designed to address non-restorative sleep, a critical factor in fibromyalgia pain.

TNX-102 SL’s distinct approach sets it apart from traditional oral fibromyalgia treatments. By utilizing a sublingual delivery method, the drug bypasses first-pass metabolism, which enhances bioavailability and minimizes adverse side effects. This innovative approach has demonstrated the ability to provide durable pain relief lasting three months, a significant advancement compared to existing oral formulations. If approved by the Food and Drug Administration (FDA), TNX-102 SL would represent a new class of non-opioid fibromyalgia treatments, addressing a substantial unmet medical need and potentially reducing reliance on opioid medications.

The market’s positive response to the trial data underscores the growing demand for effective non-opioid pain management solutions. With the FDA setting a Prescription Drug User Fee Act (PDUFA) goal date of August 15, 2025, Tonix Pharmaceuticals is poised to potentially deliver a significant breakthrough in chronic pain management. The company’s receipt of Fast Track designation for TNX-102 SL further reinforces its potential to capture a substantial share of the market. Investors are now closely monitoring Tonix Pharmaceuticals as it progresses toward the FDA’s final decision.