Key moments

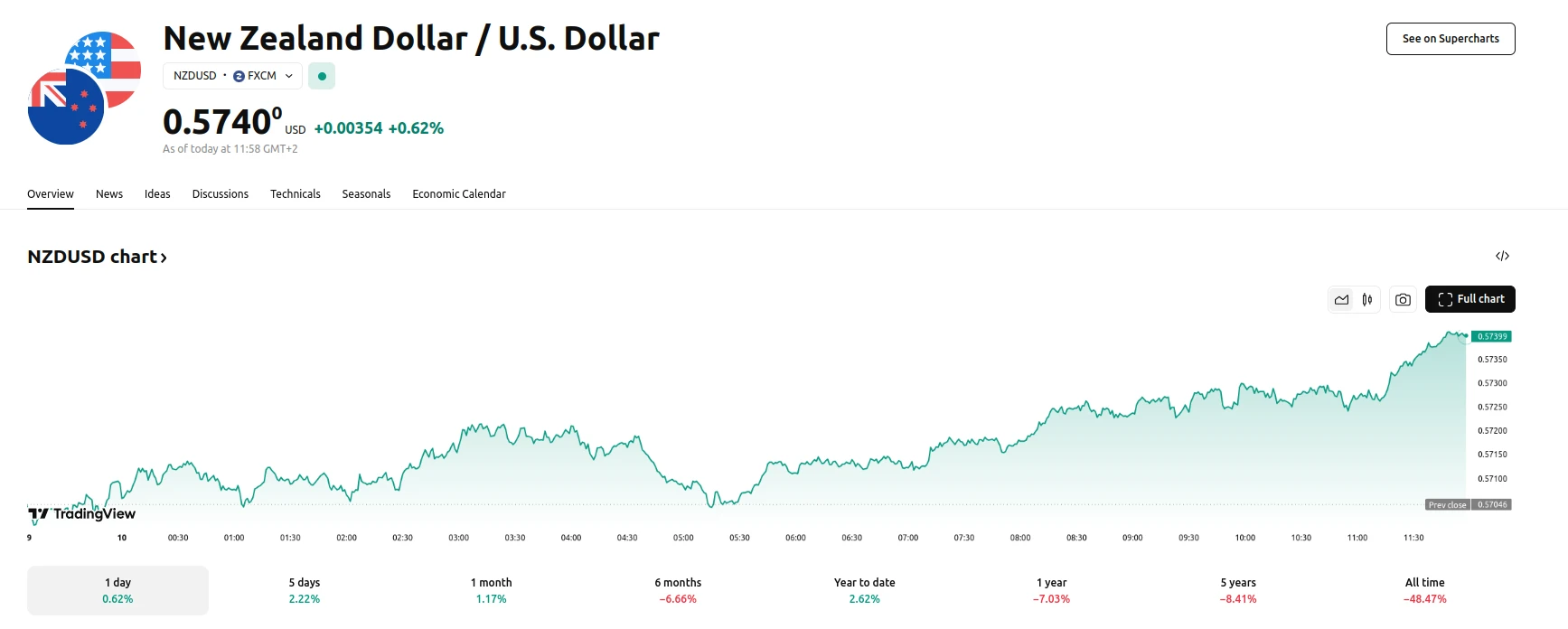

- NZD/USD pair gains ground, reaching approximately $0.5740, driven by a weakening US dollar.

- Escalating trade tensions between the US and China, with retaliatory tariffs taking effect, impact market sentiment.

- US economic uncertainty, highlighted by Federal Reserve concerns and weaker than expected job data, puts pressure on the US dollar.

NZD/USD Climbs 0.63% within the Last Day to $0.5740 as US Dollar Weakens

The New Zealand dollar (NZD) strengthened against the US dollar (USD) on Monday, with the NZD/USD pair rising 0.63% to approximately $0.5740. This upward movement is primarily attributed to a weakening US dollar, which has been influenced by growing concerns about the health of the US economy. However, the potential for further gains in the NZD/USD pair is being tempered by escalating global trade tensions, which are stifling investor risk appetite.

A significant factor contributing to market uncertainty is the ongoing trade dispute between the US and China. China’s implementation of retaliatory tariffs on select US agricultural products, in response to increased US tariffs on Chinese goods, has added to the prevailing sense of unease. Given China’s position as New Zealand’s largest trading partner, these trade tensions have a direct impact on the New Zealand economy. Furthermore, the NZD is experiencing challenges that hinder growth due to disappointing Chinese Consumer Price Index (CPI) data for February, indicating a decline that exceeded market expectations.

Adding to the pressure on the US dollar, recent economic data from the US has been less than robust. The US Bureau of Labor Statistics reported that Nonfarm Payrolls (NFP) for February failed to live up to expectations, and January’s job growth figures were revised downward. San Francisco Fed President Mary Daly’s comments regarding growing business uncertainty and its potential to weaken demand in the US economy have further contributed to concerns about the US economic outlook. These factors have collectively contributed to the weakening of the US dollar and the corresponding rise of the NZD/USD pair.