Key moments

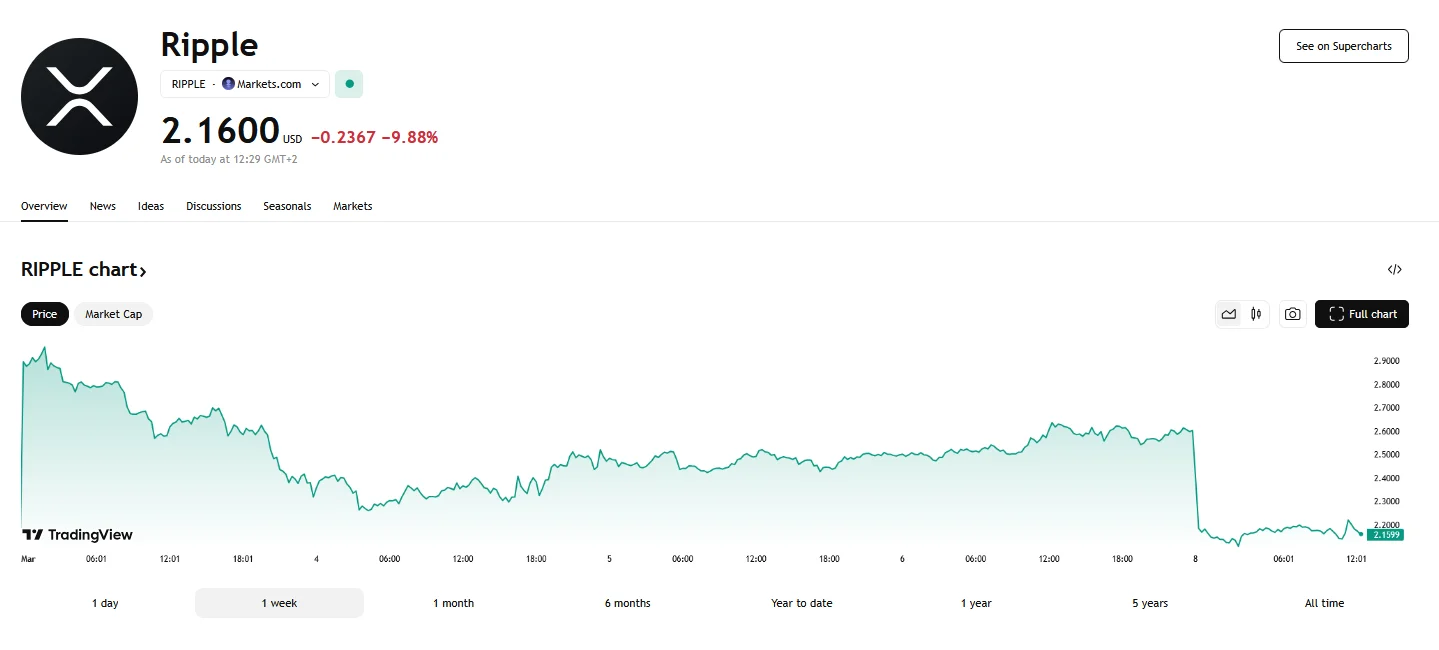

- XRP experienced a sharp decline, with its value falling by 7% and dipping below the $2.20 mark. Market anxieties, compounded by wider crypto market downturns and global economic uncertainties, contributed to the significant price reduction.

- During Monday’s trading session, XRP’s price reached a low of $2.0887.

- A substantial $730 million outflow from XRP’s payment volume signals a decline in user engagement and confidence.

XRP’s Network Data Raises Red Flags

A significant downturn struck the XRP market, with its value plummeting by 7% as it fell below the $2.20 mark, a stark contrast to its recent highs. This decline wasn’t merely a minor fluctuation; it represented a substantial shift in investor sentiment, underscored by a massive $730 million outflow of XRP from its transactional volume. Furthermore, the cryptocurrency’s price descended to $2.0887 earlier today.

The broader crypto landscape also experienced a downturn, contributing to XRP’s woes. However, specific on-chain metrics painted a troubling picture for XRP, with declines in payment activity, active accounts, and overall transaction volume. These indicators suggested a diminishing interest in the Ripple ecosystem, potentially signaling reduced adoption and waning user engagement.

Prior to this slump, XRP had seen a period of notable growth, reaching over $3. However, this surge proved short-lived, as the token succumbed to market pressures. Despite the current bearish trend, some analysts remain optimistic about XRP’s long-term potential. They suggest that if XRP can maintain support above the $2 threshold, it might invalidate bearish patterns and even trigger a rally toward $5.

A deeper analysis of the market revealed a confluence of factors contributing to XRP’s decline. The crypto fear and greed index, a measure of investor sentiment, hit a multi-year low, indicating “extreme fear” among traders. This fear was exacerbated by global economic uncertainties, including ongoing tariff wars and a lack of significant announcements from key regulatory bodies.

The substantial $730 million XRP outflow further compounded the token’s problems. This reduction in payment volume signaled a serious lack of confidence among investors and users, raising concerns about the fundamental health of the XRP network. Historically, robust network activity has been a crucial driver of cryptocurrency price rallies. The current decline, therefore, represented a significant red flag.

Technical indicators also painted a bearish picture, with the emergence of a “death cross” pattern signaling potential further downward pressure. This pattern, combined with the lack of sustained upward momentum, suggested that XRP faced significant challenges in regaining its previous highs.