Key moments

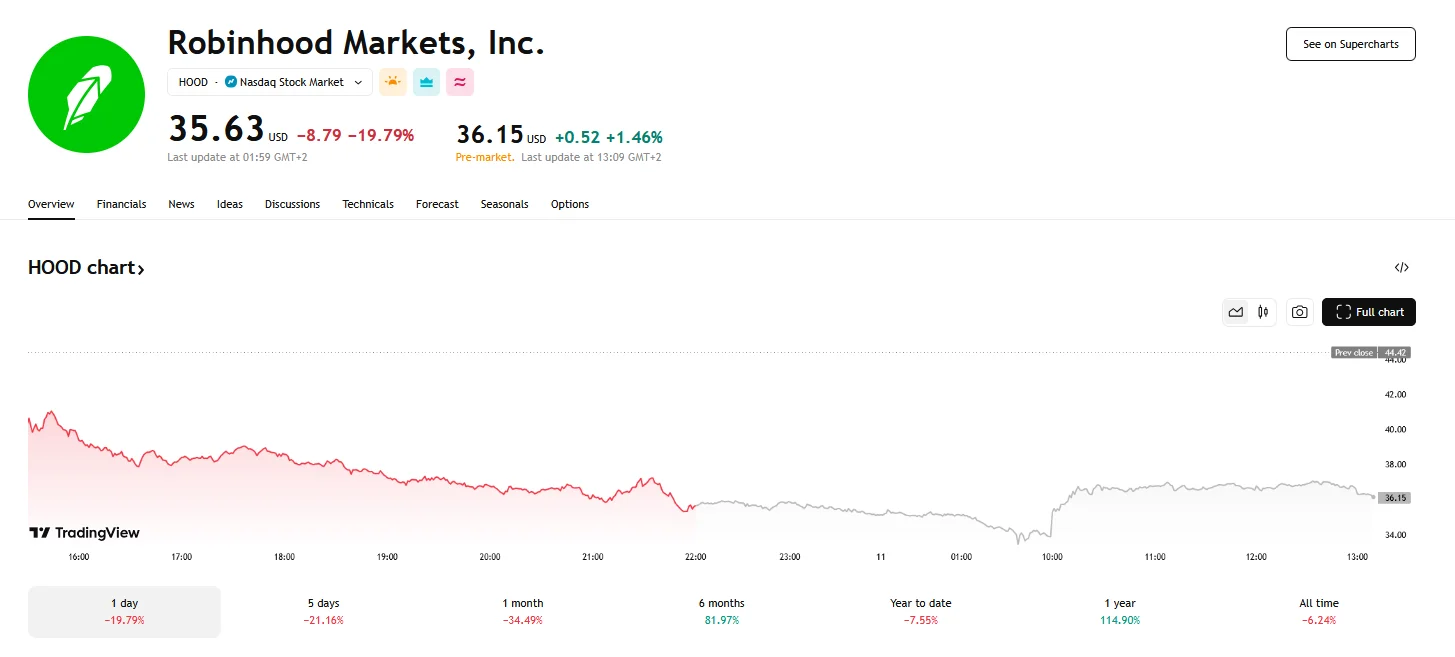

- Robinhood’s stock experienced a significant decline, reaching a multi-month low of $35.63 after a 20% drop.

- Tuesday saw the share price briefly fall to $33.46, reflecting heightened volatility and investor concern.

- Demonstrating confidence in Robinhood’s future, SPX Gestao de Recursos Ltda. acquired 64,500 shares.

A Sharp 20% Decline Sent Robinhood’s Stock Reeling

Robinhood’s recent market performance has been marked by a significant downturn, with the stock price plummeting to levels not seen since late 2024. Monday’s trading session proved particularly challenging, witnessing a dramatic 20% drop that pushed the stock below the $40 threshold it maintained during earlier Monday trading hours, ultimately closing at $35.63. At one point on Tuesday, the stock even dipped to $33.46.

Regulatory scrutiny has played a pivotal role in Robinhood’s recent struggles, as a substantial fine of $26 million levied by the Financial Industry Regulatory Authority (FINRA) significantly impacted investor confidence. Adding to the company’s challenges is the prevailing economic climate. Concerns about a potential recession, fueled by political pronouncements and trade policy uncertainties, have created an environment of market unease in the broader tech sector.

Despite these challenges, institutional investors have shown continued interest in Robinhood. SPX Gestao de Recursos Ltda., for instance, acquired 64,500 shares (around $2,403,000 in value) in the fourth quarter, demonstrating a belief in the company’s long-term potential. Similarly, Metis Global Partners LLC added 7,408 shares to its portfolio, and Toronto Dominion Bank expanded its holdings by 31.1% in the third quarter, bringing its total to 68,408 shares. These investments suggest that while the stock faces short-term pressures, some institutions see value in Robinhood’s future prospects. However, company executives have engaged in substantial share sales, raising questions about internal confidence.

Analysts’ perspectives on Robinhood’s future remain mixed. While some firms have raised their price targets, indicating a bullish outlook, others maintain a more neutral stance. For example, MarketBeat has given Robinhood a “Moderate Buy” rating. The stock’s performance in relation to its moving averages and 1-year trading range further underscores the volatility and uncertainty surrounding its near-term trajectory.