Key moments

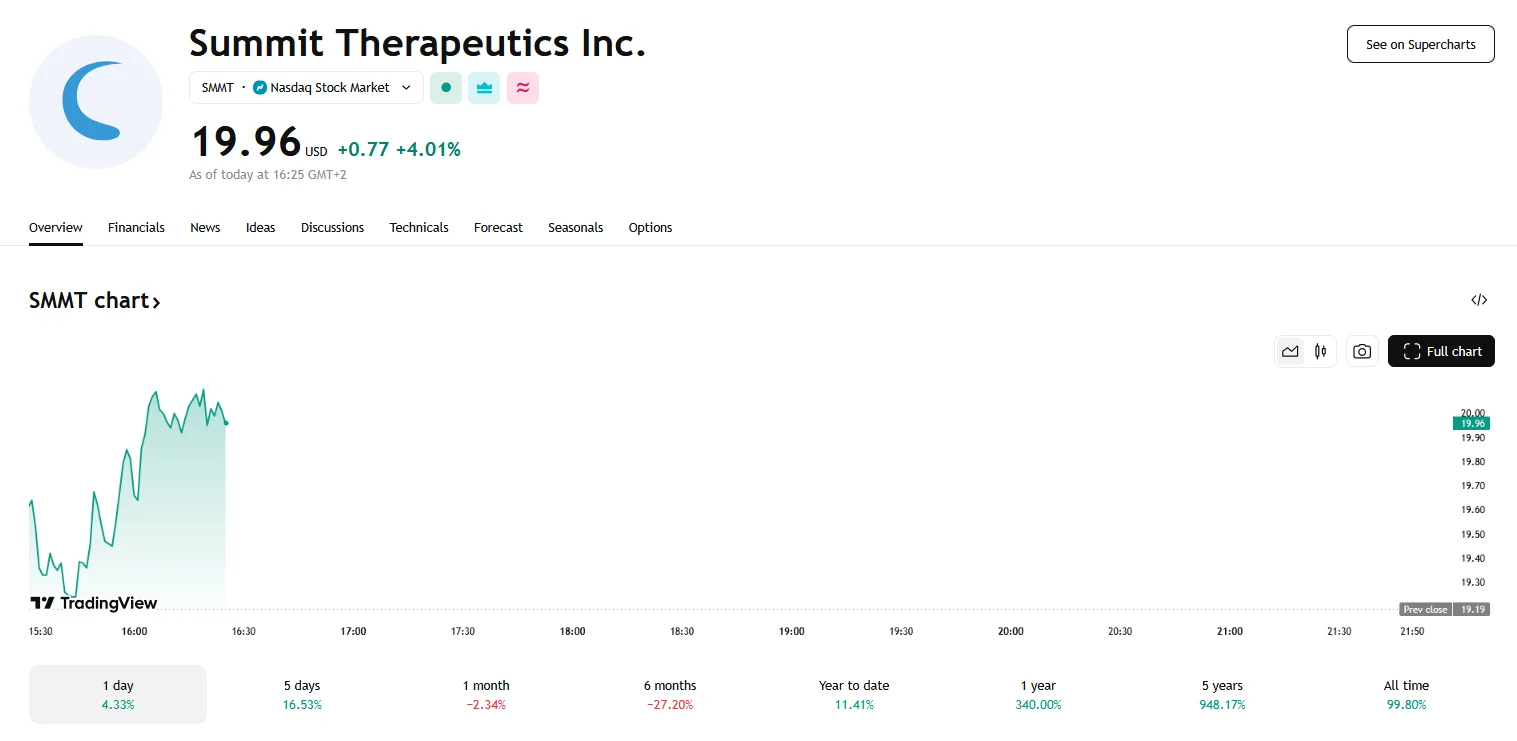

- SMMT stock rose 4.01% to nearly $20 on Friday.

- Investor confidence was bolstered by Evercore ISI’s “outperform” rating ($30 price target) as well as the “buy” rating given by HC Wainwright.

- The company’s valuation has skyrocketed 300% in the past year, attracting significant institutional investment.

Summit Therapeutics’ Stock Rally Continues

Summit Therapeutics Inc. (NASDAQ: SMMT) has once again captured investor attention, with its stock price experiencing a 4.01% surge on Friday, reaching $19.96. This latest climb contributes to an impressive five-day performance, culminating in a 16.53% increase. At the time of writing, the company’s market capitalization stands at a substantial $14.37 billion.

The primary catalyst propelling Summit Therapeutics’ ongoing stock surge is the escalating anticipation surrounding its investigational cancer therapy, ivonescimab. It has ignited considerable market interest following its superior performance compared to Merck’s well-known Keytruda in advanced trials for non-small cell lung cancer. Such promising results have ignited widespread speculation that ivonescimab possesses the potential to emerge as a dominant force within the oncology landscape, potentially unlocking substantial revenue streams in the billions.

Recent analyst actions have significantly bolstered the already positive market perception of Summit Therapeutics. Specifically, Evercore ISI’s initiation of coverage on Wednesday, with an “outperform” rating and a $30 price target, signaled strong confidence. This optimistic assessment, which points to substantial investor gains, further propelled the stock’s upward movement. Adding to this positive momentum, HC Wainwright reiterated its “buy” rating earlier in the week, setting an even more ambitious $44 price target, highlighting their robust belief in the company’s future.

A clear indicator of Summit Therapeutics’ impressive trajectory is its valuation, which has surged by an astounding 300% over the past 12 months. This remarkable growth has attracted significant attention from institutional investors. Notably, SVB Wealth LLC established a new position in the company during the fourth quarter, acquiring 15,350 shares valued at roughly $274,000. Coupled with increased holdings by firms such as Baker BROS. Advisors LP and FMR LLC, these actions demonstrate a growing conviction in Summit’s long-term prospects. Currently, institutional investors and hedge funds collectively own 4.61% of the company’s shares.

Analysts widely maintain a favorable view of Summit Therapeutics, demonstrated by a consensus “moderate buy” rating and an average price target of $34.11. This optimistic assessment is reinforced by a consistent stream of “buy” recommendations from notable firms such as Goldman Sachs, Wells Fargo, Jefferies Financial Group, and Truist Financial.

While the stock has recently experienced a significant upswing, some analysts express concern that Summit Therapeutics’ valuation may be inflated, especially considering the absence of consistent revenue streams. Nevertheless, the transformative potential of ivonescimab in cancer treatment continues to fuel substantial investor interest. As the company advances through clinical trials and works toward market approval, its stock price is expected to remain under close observation.