Key moments

- The AUD/USD has risen for five of the past six weeks, demonstrating a clear upward trend.

- US trade policy uncertainties contribute to a weakened US dollar.

- Australian employment data and central bank meetings are anticipated as key market drivers.

AUD/USD Sees Gains Amid Trade Policy Uncertainty and Anticipation of Key Economic Data

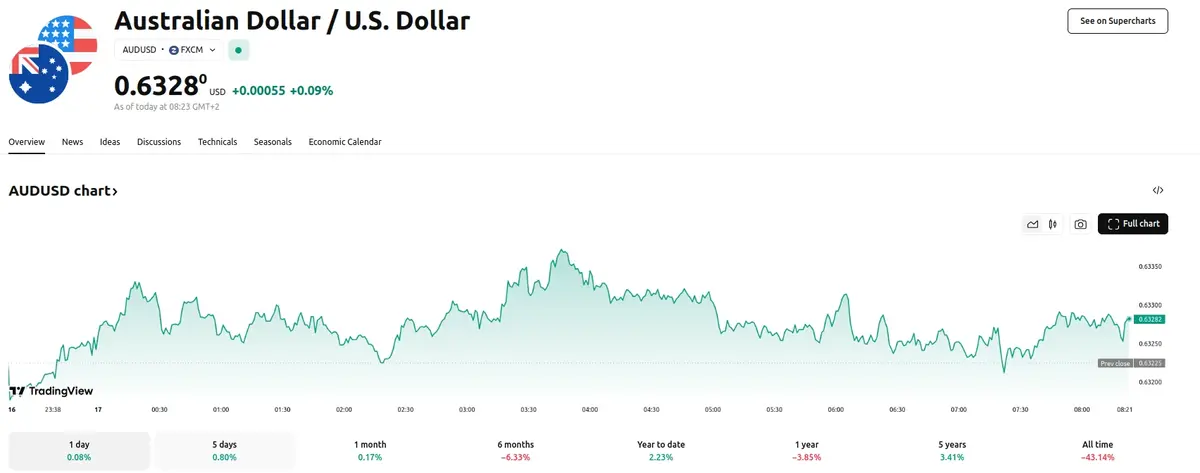

The AUD/USD currency pair has demonstrated a consistent upward trend, concluding the previous week at 0.6326, a 0.32% increase. As of March 17, 2025 the pair’s open price was 0.6319 USD. This marks the fifth week of gains within the last six weeks, showcasing a notable appreciation period. The pair has become a significant beneficiary of the fluctuating tariff announcements from the US administration. These policies have generated apprehension among traders, leading to a decline in the US dollar’s value due to concerns about potential inflation and a US economic recession. Notably, the Australian dollar’s rise persisted despite implementing a 25% US tariff on steel and aluminum imports, which impacts approximately $1 billion of Australian exports.

Further bolstering the AUD/USD’s performance was an improvement in risk sentiment observed towards the end of the week. This positive shift was driven by several factors, including bipartisan support for a funding bill in the US Senate, China’s announcement of measures aimed at stimulating consumption, and an agreement among German political parties to increase defense spending and promote economic growth. These international developments have contributed to a more favorable environment for the Australian dollar.

Looking ahead, the AUD/USD’s trajectory will likely be influenced by a combination of external and domestic factors. External factors include global risk sentiment, the evolving US trade policy landscape, and the interest rate decisions of the Bank of Japan and the Federal Reserve. Domestically, the Australian employment report for February is anticipated to be a crucial determinant. The upcoming employment report is projected to show an increase of 20,000 jobs, with the unemployment rate remaining steady at 4.1%. This data will be critical in assessing the Reserve Bank of Australia’s (RBA) future monetary policy decisions.