How Does Copy Trading Work?

This lesson will cover the following

- Copy trading mechanism

- Adding and removing funds

- Individual traders

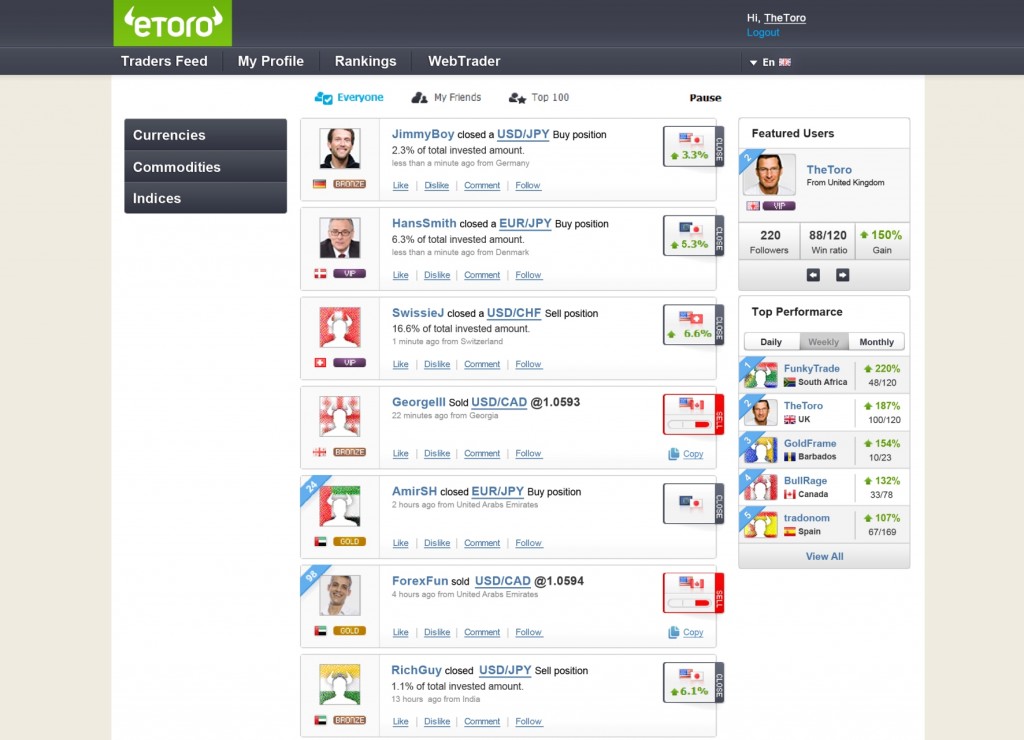

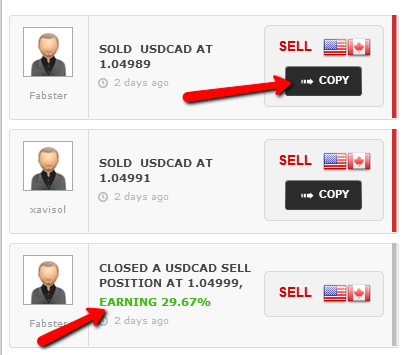

Unlike social trading, copy trading isnt as reliant on the information provided by other traders as it is reliant on their actions. In other words, copy trading allows you to copy the actions done by other traders. In order for the process to be considered copy trading and not social trading, you have to copy a trader using the automatic system provided by the platform youre using.

Copy Trading Mechanics

Copy trading connects a part of your portfolio with the portfolio of a trader of your choosing. Once you copy a trader, all of their opened trades are copied to your account. Furthermore, all of their actions in the future are automatically copied to your account, as well. You are prompted to choose a sum to invest in a certain trader. In most cases the sum cannot be more than 20% of your portfolio. The sums used the trades are a calculated percentage of the traders portfolio based on how much you decided to invest. Imagine your accounts balance is currently USD 1000. You dont have any open trades but youve decided that you want to copy a trader. His stats look promising but since this is your first time trying something like this, you dont want to invest too much. Thats why you invest USD 100 (or 10% of your funds). The trader has one open trade which is copied to your account.

The sum of USD 100 youve invested is a percentage of the traders portfolio. If his portfolio is USD 1000 (and lets say it is its more easy to calculate), then your investment is 10% of his portfolio. If he makes a trade for USD 100, then you will make the same trade, but the money that will be invested from your account are going to be 10% of the money hes invested, or in other words USD 10 if hes invested USD 100. The mechanics are automated so dont worry about the calculations – you wont have to even lift a finger because the system does everything automatically.

Note: Some sites use an automated system where a certain percentage of your portfolio is invested. Check the sites policy before you begin trading with real money.

Adding and Removing Funds

If you like how the trader is handling your investment, you can seamlessly increase the funds. This way you will invest more when a trade is copied to your account which increase your profits if the trade is successful. However, this also increase the risks because you in case its a losing trade, your losses will also be bigger. Its a good idea to keep your portfolio diversified and not invest too much in single trader. You can still increase or reduce the investment based on the traders performance. If youre especially satisfied with the results, you can try to increase your profits by investing more. You should always keep in mind that investing more is a risky move, though.

Note: Some platforms allow more control than others. Some sites use a fixed system. You will have to check with the provider. We will talk more about this in future sections.

Individual Trades

Once you begin copying a trader, you can have different scales of control depending on the platform youve chosen. Some sites use a fixed system, which means that once you begin following a trader, the only course of action you can take in general to stop copying them. On the other hand, there are also more liberal platforms that allow you to control your funds manually.

For example, if there is a trade you dont like or you think that if it remains opened for longer you will end up losing from it (or lose more), then you can manually close it. Once again, we will talk more about the different platforms in future sections of the guide.

Why is Copy Trading Beneficial?

Trading in general can be intimidating. Its not easy to begin with, and once you throw charts and patterns into the mix, it becomes confusing enough to throw even the most enthusiastic newbie trader in panic mode. Copy trading helps you get rid of that fear. It allows you to begin trading without knowing anything about trading. This way you can see what experienced and successful traders do and you can figure out why. If they are more talkative, they can even directly show you and give you a few tips. This is a mutually beneficial relationship.

Also, smart is he who learns from his own mistakes, but wise wise is he who learns from the mistakes of others. Sure, you might not have taken a trade in your life. But that wont stop you from seeing what works and what doesnt based on the successes and failures of others. In time you will learn to see everything you need in order to become a trader, yourself. All you need is time.

Final Words

Copy trading is the perfect start for a newbie trader. It allows you to experience the successes a and failures of others and learn directly from their mistakes. Its a nice way to being making money on the market but its not without risk.

You should be really careful in your choice of platform depending on how much control you want to have over the operations. You should also be careful which trader you choose – at the end of the day, you are entrusting a part of your portfolio to a total stranger.