Gold futures advanced to the strongest level in more than six months as worsening tension between Ukraine and Russia spurred demand for haven assets, with prices heading for the best string of weekly gains since September 2012. A weaker US dollar also supported the yellow metal, while assets in the SPDR Gold Trust, the biggest bullion-backed ETF, declined yesterday from the highest level since December 20th, contracting for the first time in almost a month.

On the Comex division of the New York Mercantile Exchange, gold futures for settlement in April rose by 0.11% to trade at $1 372.00 per troy ounce by 07:46 GMT. Prices touched a session high at $1 375.20 per troy ounce, the strongest since September 10, while day’s low was touched at $1 365.30 an ounce.

Bullion advanced 1.4% yesterday, the most since February 14 and headed for a sixth weekly gain, as tension between Russia and Ukraine escalated, spurring demand for haven assets, including gold.

Gold futures are up 14% this year amid concern the economic growth of the largest bullion consumer, China, may slow, while unrest in Ukraine hurt emerging market assets already weakened by reductions in Fed stimulus, boosting demand for the precious metal as a store of value.

At the same time, the parliament of the southern Ukrainian region, Crimea voted on Tuesday that the Black Sea peninsula will declare itself an independent state if its residents approve a March 16 referendum on splitting from Ukraine and joining the Russian Federation as Western leaders threaten sanctions. Yesterday, the US President Barack Obama assured the Ukrainian Prime Minister Arseniy Yatsenyuk that the US will stood with Ukraine to protect its sovereignty and territorial integrity.

“Gold should be supported as long as the situation in Ukraine remains uncertain,” said Zhu Siquan, an analyst at GF Futures Co., a unit of the Guangzhou-based company that bought Natixis Commodity Markets Ltd, cited by Bloomberg. “Technically, gold is starting to look a bit overbought.” Zhu Siquans statement suggested that bullion prices may be set to reverse.

Fed stimulus outlook

Data today may show that retail sales, which account for almost 70% of the US economy, rose 0.2% last month, after contracting 0.4% in the previous month. At the same time, separate data may show the number of people filing for initial jobless benefits in the US rose to 330 000 in the week ended March 8, from 323 000 a week ago.

Bullion prices were pressured earlier in the week after two Fed officials commented that the hurdle rate to alter the pace of Fed stimulus cuts was too high.

Fed President of Philadelphia Charles Plosser, who is a voting member this year, commented on Monaday that the recent batch of strong US economic data wasn’t enough to alter the pace of the central bank asset purchases. His statement was later echoed by Chicago Fed President Charles Evans, who will not vote on policy this year.

“Given the fact that we’ve embarked on measured reductions, it’s important to give some certainty or at least clarity to the markets on what we’re doing,” Plosser said in a Bloomberg interview. “It’s OK to continue at 10 billion. The hurdle rate for change is pretty high in either direction.”

Federal Reserve Chair Janet Yellen said last month that central bank’s officials were “open to reconsidering” the pace of reductions in monthly bond purchase, should the economy falter, in contrast with her comments made earlier in February, that US economy has gained enough strength in order to withstand reduction of monetary stimulus.

At the same time, Fed officials will try to determine whether the weakness economy has recently demonstrated is due to temporary factors, before their next policy meeting scheduled for March 18-19th.

The central bank announced in December that it will pare monthly bond-buying purchases by $10 billion, after which it decided on another reduction of the same size at the meeting on policy in January, underscoring that labor market indicators, which “were mixed but on balance showed further improvement”, while nation’s economic growth has “picked up in recent quarters.”

A weaker dollar also supported the yellow metal. The US dollar index, which measures the greenback’s performance against a basket of six major peers, fell by 0.25% on Thursday to trade at 79.49 by 07:44 GMT. Prices touched a session high at 79.74, while daily low was touched at 79.48, the weakest level since March 7. Weakening of the greenback makes dollar-denominated commodities cheaper for foreign currency holders and boosts their appeal as an alternative investment.

Federal Reserve will probably continue to pare stimulus by $10 billion at each policy meeting before exiting the program in December, according to a Bloomberg News survey of 41 economists, conducted on January 10th.

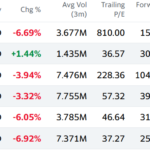

Assets in the SPDR Gold Trust, the biggest bullion-backed ETP, declined to 811.20 tons yesterday from the strongest level since December 20th. Holdings in the fund are 0.9% up this year after it has lost 41% of its assets in 2013, that wiped almost $42 billion in value. A total of 553 tons has been withdrawn last year. Billionaire hedge-fund manager John Paulson who holds the biggest stake in the SPDR Gold Trust told clients at the end of last year that he wouldn’t invest more money in his gold fund because it isn’t clear when inflation will accelerate. However, a government report revealed that the owner of the largest stake in the SPDR Gold Trust, kept his holdings unchanged in the fourth quarter of 2013.