Reserve Bank of Australia did not introduce any change in its base interest rate, as inflation prospects remained calm and Australian dollar was still at high levels against peers. RBA left base interest rate at the record low 2.75% level. Experts from the bank assured that its current monetary policy course was appropriate. They also announced that according to their latest estimate, inflation prospects make way for additional policy easing, if that will be necessary in the future to bolster demand.

Reserve Bank of Australia did not introduce any change in its base interest rate, as inflation prospects remained calm and Australian dollar was still at high levels against peers. RBA left base interest rate at the record low 2.75% level. Experts from the bank assured that its current monetary policy course was appropriate. They also announced that according to their latest estimate, inflation prospects make way for additional policy easing, if that will be necessary in the future to bolster demand.

RBA also said that Australian dollar was still overvalued, given the fact export prices were constantly dropping during the last two years. Base interest rate was decreased by 0.25% during May, as this was the last act by RBA during its easing cycle, which started in November 2011.

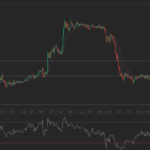

Aussie hit session low versus its US counterpart during Asian session, with AUD/USD down to 0.9691. Additional report showed that Australias Current Account deficit decreased more than expected during the first quarter of 2013 to 8.510 billion AUD, as the deficit was 14.759 billion AUD during the previous quarter. Analysts had projected that the Current Account deficit would narrow to 9 billion AUD during Q1. Deficit was diminished due to better goods and services trade results, as the latter were expected to contribute to Australian growth with 1% during the first three months of this year, surpassing analysts projections.