During yesterday’s trading session EUR/SEK traded within the range of 9.0262-9.0639 and closed at 9.0387.

At 6:35 GMT today EUR/SEK was gaining 0.08% for the day to trade at 9.0435. The pair touched a daily high at 9.0492 at 6:27 GMT.

Fundamental view

Swedens Trade Balance probably widened to 5.5 billion SEK in April, according to the median analysts forecast. In March, the nations trade balance came in at 2.6 billion SEK.

The indicator measures the difference between imports and exports in billion SEK. Imports of goods reflects the prices of goods as they enter the territory of the country, regardless of their final destination. Exports of goods measure the prices at which the goods leave the territory, regardless of the place of production (in or outside the country). Data is based on information from the customs documents for the goods customs officers cleared with countries that are not members of the EU and Intrastat data for intra-community trade.

Statistics Sweden is scheduled to release official data at 7:30 GMT. In case, the nations trade balance widened more-than-projected, this would bolster demand for the Swedish krona.

Technical view

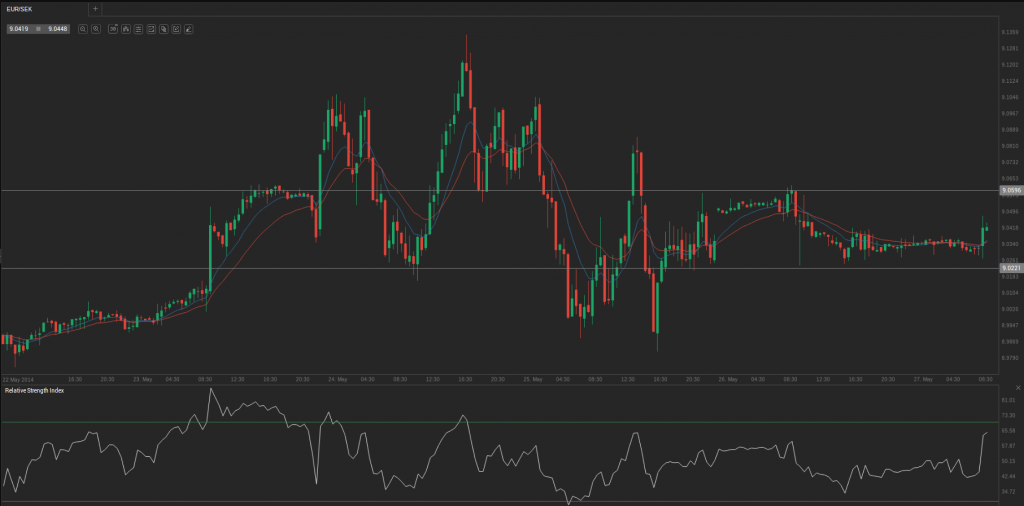

According to Binary Tribune’s daily analysis, in case EUR/SEK manages to breach the first resistance level at 9.0596, it will probably continue up to test 9.0806. In case the second key resistance is broken, the pair will probably attempt to advance to 9.0974.

If EUR/SEK manages to breach the first key support at 9.0221, it will probably continue to slide and test 9.0052. With this second key support broken, the movement to the downside will probably continue to 8.9843.