Gold and silver futures were steady during midday trade in Europe today, ahead crucial economic data later this week. Previously, stocks reached record highs on Monday, driven by improving outlooks for the US. Meanwhile, copper futures fell, pressured by HSBCs manufacturing data for China.

Gold and silver futures were steady during midday trade in Europe today, ahead crucial economic data later this week. Previously, stocks reached record highs on Monday, driven by improving outlooks for the US. Meanwhile, copper futures fell, pressured by HSBCs manufacturing data for China.

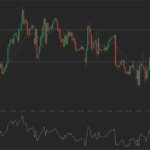

Gold futures for delivery in August traded for $1 243.4 per troy ounce at 13:31 GMT on the COMEX in New York today, down 0.05%. Daily high and low stood at $1 247.9 and $1 241.7 per troy ounce, respectively. Yesterday the precious metal dropped 0.16%, reaching the lowest level in four months at $1 241.1 per troy ounce. Previously, on Friday the contract closed for a 3.69% weekly loss, following a rally for US stocks in light of positive economic data.

Meanwhile, silver contracts for July stood at $18.790 per troy ounce, for an increase of 0.86%. Daily high and low were at $18.920 and $18.735 per troy ounce, respectively. On Monday silver closed for a 0.31% gain, after last week the contract dropped 3.84%, pushing a four-year low at $18.615 per ounce.

Economic reports

The EU posted CPI and employment figures earlier today. The unemployment rate for April was reported at 11.7% to mark a minor improvement on the 11.8% for March. The preliminary figure for May CPI in the Eurozone was logged to have declined to 0.5%, falling short of expectations and recording the lowest level in 5 years. Meanwhile, core CPI was also lower, at 0.7%, after 1.0% in April.

“It’s a surprise, but not enough of a surprise to change materially the global economic outlook that the ECB will release on Thursday,” said for Bloomberg Michel Martinez, economist at Societe Generale SA in Paris, in address to EUs CPI. “What seems highly likely is that the ECB will cut key rates and probably also inject further liquidity.”

Also today, The US reported factory orders for April today. The figure exceeded expectations to record a gain of 0.7% on a monthly basis, after an upward-revised 1.5% growth in March.

Later this week, on Wednesday the EU will report on services PMI for May and Q1 GDP, while the US will post services PMI and a nonfarm employment report. On Thursday, HSBC will post services PMI for China, while the EU will reveal retail sales and a crucial ECB interest rate decision. Friday will close the week with reports for industrial production in Germany, and key data on payrolls in the US.

Previously

Yesterday ISM reported quicker expansion of manufacturing activities in the US for May, in accordance with expectations. Earlier in the day, the institute had reported a weaker standing, but corrected its reading twice, for a sizable increase in expansion. Also on Monday, the EU too revealed factory PMI, which was slightly worse than expected, though growth was maintained at a stable rate.

Last week a number of reports on the US economy boosted sentiment, as durable goods orders, consumer sentiment and services PMI were all shown to stand much better than expected. However, a sizable gain for oil supplies in the States was reported, which pressured crude contracts lower for the week.

Stocks, dollar, SPDR

US stocks opened bearishly on Tuesday on Wall Street, after the reported slowdown for factory orders. By 14:25 GMT Dow 30 was down 0.17%, S&P 500 fell by 0.11%, while Nasdaq 100 was up 0.03%. US stocks continued to gain, strengthened by the reported larger expansion in manufacturing activities. S&P 500 added 0.07% as trading ended on Wall Street on Monday, to stand at the all-time high of 1924.97. Dow 30 Industrial closed for a 0.16% gain, at the record-high level of 16 743.63. Nasdaq 100, which excludes financial institutions, was the only major index to score lower, closing for a 0.10% decline, after the highest level was reached the previous session.

Elsewhere, EU stocks dropped on EUs CPI report. Dow Jones Euro Stoxx 50 was down 0.43% by 13:19 GMT. Previously, the index shrugged off weak factory data to close Monday’s session for the all-time high of 3249.90, with a daily gain of 0.16%.

Meanwhile, assets at the SPDR Gold Trust – the largest gold-backed exchange-traded fund, remained unchanged for a fourth session on Monday, after regaining some 9 tons to stand at 785.28 last Tuesday. Previously, holdings were at 776.89 tons, the lowest level since December 2008. The fund had lost over 30 tons in the last month, until Tuesday, as investor interest in havens diminishes, pressured by the growing US economy.

Copper

Copper futures for settlement in July fell by 1.12% to trade at $3.1350 per pound at 13:32 GMT today on the COMEX in New York. Prices shifted in a daily range between $3.1275 and $3.1690 per pound. Yesterday the contract gained 1.50%, as . Last week the contract the metal lost 1.39%, though it reached the highest level in almost three months at $3.1925 per pound.

Earlier today, HSBC and Markit reported their May reading on Chinese manufacturing for a PMI of 49.4, falling short of expectations and retreating from April’s 49.7. Meanwhile, services PMI was logged at 55.5, improving on April’s 54.8. Any reading below the boundary of “50″ means contraction in activities, and anything above it means expansion. The bigger the distance from 50, the greater the pace of expansion or contraction. HSBC’s figure comes after the Chinese government reported an expansion in the sector on Sunday.

On Sunday the Chinese government posted the official manufacturing PMI for May, beating forecasts for a reading of a slight expansion, in contrast with HSBC’s figure.

China accounts for more than 40% of total copper consumption.

“The conflicting PMI data out of China looks like it has played its part,” said for Bloomberg Ole Hansen, head of commodity strategy at Saxo Bank A/S in Copenhagen. “There are some concerns that the dollar could rise further, thereby eroding support.”

Previously, major exchanges recorded multi-year lows of tracked copper volumes, which alongside peak construction demand in China bumped up the red metal.