The Chief Executive Officer of Amazon.com Inc. – Mr. Jeff Bezos – officially revealed the company’s first smartphone, which features some characteristics that undoubtedly distinguish it from other products of such type, at the event on June 18th. Amazon.com Inc. officially announced that its Fire Phone will be released on July 25th and will be sold at 199 to 299 dollars with a two-year contract with AT&T Inc. as the exclusive wireless carrier.

Chief Executive Officer Mr. Bezos shared in an interview, which was cited by the Wall Street Journal: “Were trying to do something different and better. There is a group of customers who will find these features useful and adopt them.” As reported by the Financial Times, Mr. Jeff Bezos described Amazon’s Fire Phone as “a better phone for our most engaged customers” and explained that the retailer has invested a lot of time on the technology used in the device.

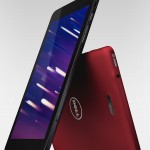

The retailer’s smartphone provides the users with a 3D screen with holographic images, hands-free scrolling, a special technology that recognizes images and audio plus some features that offer Amazon’s customers unlimited storage for photos, as well as one year free membership in the so-called Primer fast-shipping program.

The launch of the company’s smartphone puts Amazon.com Inc. right in the middle of a highly-competitive business environment, turning it from an online book seller to global technology giant. Over the last few years the retailer has been constantly expanding its reach, offering more and more electronic devices in order to make its online store and digital services more popular among clients worldwide.

One of the analysts working at International Strategy & Investment Group in New York – Mr. Oliver Wintermantel commented the release of Amazon’s Fire Phone in a Bloomberg interview: “There’s a place for it,” “The phone will serve to fulfill one thing and that’s having people spend more time and money on Amazon.”

Amazon.com Inc. was 2.69% up to close at 334.38 dollars per share yesterday, marking a one-year change of +18.68%. According to the information published on CNN Money, the 39 analysts offering 12-month price forecasts for Amazon.com Inc. have a median target of 425.00, with a high estimate of 500.00 and a low estimate of 330.00. The median estimate represents a +27.10% increase from the last price of 334.38.