During yesterday’s trading session USD/CAD traded within the range of 1.0630-1.0678 and closed at 1.0636.

At 11:37 GMT today USD/CAD was losing 0.01% for the day to trade at 1.0631. The pair touched a daily low at 1.0627 at 10:20 GMT.

Fundamental view

United States

Employers in the US non-farm private sector probably added 205 000 new jobs during June, according to the median estimate by experts, following 179 000 new positions added in May. The employment report by Automated Data Processing Inc. (ADP) is based on data that encompasses 400 000 – 500 000 companies employing over 24 million people, working in the 19 major sectors of the economy. The ADP employment change indicator is calculated in accordance with the same methodology, which the Bureau of Labor Statistics (BLS) uses. Published two days ahead of governments employment statistics, this report is used by traders as a reliable predictor of the official non-farm payrolls data. Creation of jobs is considered of utmost importance for consumer spending, while the latter is a major driving force behind economic growth. In case expectations were exceeded, this would bolster demand for the dollar. The official figure is scheduled to be published at 12:15 GMT.

Factory orders in the United States probably dropped 0.3% in May compared to April, following an increase by 0.7% in the prior month. This indicator presents the total value of new purchase orders, placed at manufacturers for durable and non-durable goods, and can provide insight into inflation and growth in US manufacturing sector. In case orders dropped more than anticipated, this would have a bearish effect on the greenback. US Census Bureau will release the official data at 14:00 GMT.

At 15:00 GMT Fed Chair Janet Yellen is to take a statement. Yellen took office as Chair of the Board of Governors of the Federal Reserve System on February 3rd 2014 for a four-year mandate ending on February 3rd 2018.

Technical view

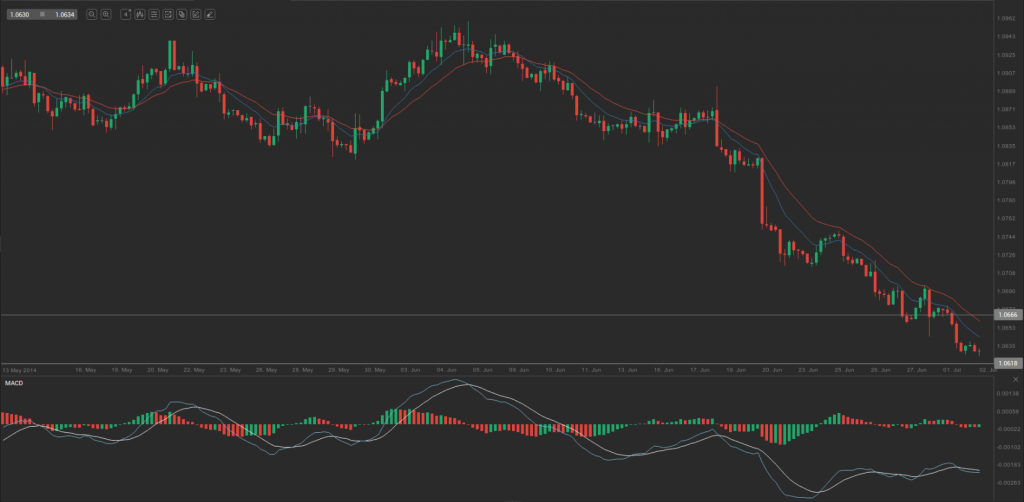

According to Binary Tribune’s daily analysis, in case USD/CAD manages to breach the first resistance level at 1.0666, it will probably continue up to test 1.0696. In case the second key resistance is broken, the pair will probably attempt to advance to 1.0714.

If USD/CAD manages to breach the first key support at 1.0618, it will probably continue to slide and test 1.0600. With this second key support broken, the movement to the downside will probably continue to 1.0570.