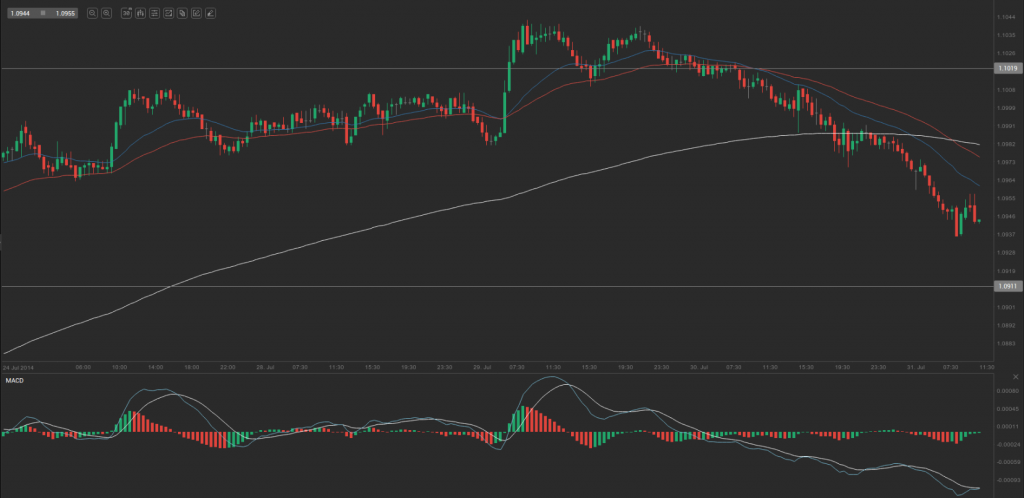

During yesterday’s trading session AUD/NZD traded within the range of 1.0978-1.1032 and closed at 1.0986, falling 0.39% on a daily basis.

At 8:27 GMT today AUD/NZD was down 0.34% for the day to trade at 1.0952. The pair broke the first and the second key support levels and touched a daily low at 1.0943 at 6:30 GMT.

Fundamental view

Australia

At 23:30 GMT the Australian Industry Group (AIG) is expected to announce the results from its survey on short-term and intermediate-term conditions in the sector of manufacturing in Australia during July. 200 manufacturers provide their assessment of overall business situation in the sector in terms of employment, new orders, output, prices and inventories. The seasonally adjusted Performance of Manufacturing Index (PMI) for Australia came in at a reading of 48.9 in June. Values below the key level of 50.0 are indicative of contraction in activity. An improvement in the value of this indicator would provide certain support to Australian dollar.

Technical view

According to Binary Tribune’s daily analysis, the central pivot point for the pair is at 1.0999. In case AUD/NZD manages to breach the first resistance level at 1.1019, it will probably continue up to test 1.1053. In case the second key resistance is broken, the pair will probably attempt to advance to 1.1073.

If AUD/NZD manages to breach the first key support at 1.0965, it will probably continue to slide and test 1.0945. With this second key support broken, the movement to the downside will probably continue to 1.0911.

The mid-Pivot levels for today are as follows: M1 – 1.0928, M2 – 1.0955, M3 – 1.0982, M4 – 1.1009, M5 – 1.1036, M6 – 1.1063.

In weekly terms, the central pivot point is at 1.0924. The three key resistance levels are as follows: R1 – 1.1073, R2 – 1.1165, R3 – 1.1314. The three key support levels are: S1 – 1.0832, S2 – 1.0683, S3 – 1.0591.