PepsiCo Inc (PEP) said on Thursday that it would consider a move into alcoholic beverage business, two days after its competitor Coca-Cola Co announced plans to introduce an alcoholic sparkling water on the US market in 2021.

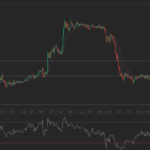

PepsiCo shares closed higher for a second consecutive trading session on NASDAQ on Thursday. The stock went up 1.59% ($2.20) to $140.80, after touching an intraday high at $140.85, or a price level not seen since September 3rd ($144.03).

Shares of PepsiCo Inc have risen 3.02% so far in 2020 compared with a 4.64% gain for the benchmark index, S&P 500 (SPX).

In 2019, PepsiCo’s stock went up 23.71%, thus, it again underperformed the S&P 500, which registered a 28.88% gain.

Earlier this week Coca-Cola Co and Molson Coors Beverage Co announced a partnership aimed at production and sale of an alcoholic version of the Topo Chico sparkling water.

“We will make decisions in the coming quarters – whether this is an area where PepsiCo wants to play,” PepsiCo’s Chief Executive Officer Ramon Laguarta was quoted as saying in a reference to PepsiCo following the example of rival Coca-Cola.

Analyst stock price forecast and recommendation

According to CNN Money, the 19 analysts, offering 12-month forecasts regarding PepsiCo Inc’s stock price, have a median target of $148.00, with a high estimate of $162.00 and a low estimate of $135.00. The median estimate represents a 5.11% upside compared to the closing price of $140.80 on October 1st.

The same media also reported that at least 10 out of 20 surveyed investment analysts had rated PepsiCo Inc’s stock as “Buy”, while 9 – as “Hold”.