Hello there, this is tradingpedia.com and this video deals with safe haven currencies, what they are and why such a notion exists in the first place.

United States Dollar (USD)

We start with the USD, the ultimate safe haven currency because it is the world’s reserve currency. Safe haven means that when something goes wrong, politically, economically, etc., when there is a recession, investors will search for safety. The USD is such an asset. Because most of the world’s debt is denominated in USD, in order to pay for it, someone has to buy the USD. Therefore, there is a strong demand.

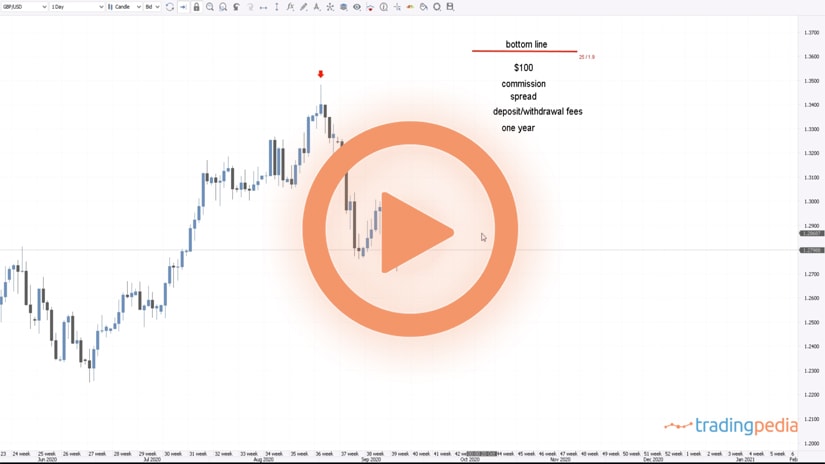

In 2008-2009 (this is the EURUSD on the monthly chart) the pair formed a double top. What happened? The housing market in the U.S. imploded, the derivatives markets created a financial crisis that quickly spread across the globe, as when the U.S. sneezes, the entire world catches a cold. This is the largest economy in the world in charge of the world’s reserve currency.

But the logic would tell you that if the American economy enters a recession, the logical thing to do is to short that currency, because the economy is in a recession. A stronger economy reflects a stronger currency and a weaker economy reflects a weaker currency.

Well, exactly the opposite happened. This was during the prior expansion and, when the crisis started, people flocked to buy the USD, not the other way around. The EURUSD moved lower, while the USD gained against almost all currencies. It is viewed as a safe haven currency.

When liquidity is shrinking in the international arena, more people buy or try to buy the same asset, the USD. The first thing to note at the start of a crisis, before central banks intervene, is a higher USD.

The same thing happened in 2020 with the coronavirus crisis. This is the monthly chart, but if you go on the 4h chart, the first reaction in March was the EURUSD to drop from 1.14 to 1.06, almost a thousand pips lower, before central banks reacted. The move lower happened when the stock market in the United States and the entire world collapsed. Then the central banks intervened, the Fed eased the liquidity shrinkage in the international financial markets by opening swap lines, basically flooding the market with new USD and the USD lost its strength. So, when you think of a safe haven currency, think of the USD first.

Swiss Franc (CHF)

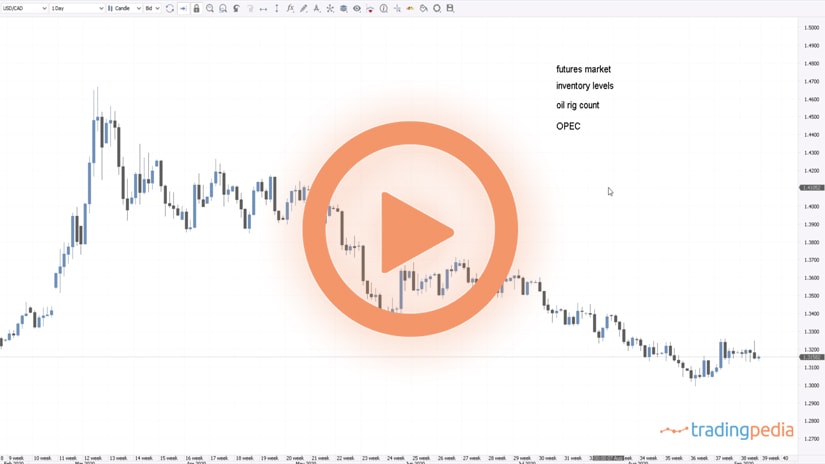

Another safe haven currency is the Swiss Franc (CHF). For those that traded the 2015 January period when the Swiss National Bank (SNB) dropped the EURCHF peg from 1.20, should now that one of the reasons for the peg in the first place was it could not stop the CHF appreciation.

The market viewed the Swiss economy as neutral, one of the most developed in the world, and buying and owning the CHF in times of a crisis is one of the safest bets you may have. Therefore, the CHF is set to appreciate also in times of an economic crisis or recession. This is a reason why the SNB often intervenes in the market, and that floor was one way to intervene.

Another way is to own foreign assets. The SNB owns foreign assets, owning shares in American companies like Amazon or Microsoft. To buy those shares, you need to pay for them in USD, so you must sell the CHF, therefore offsetting the appreciation of the CHF.

Look here, the USDCHF during the coronavirus crisis – it dropped from 0.99 to 0.90. People tried to buy the CHF despite the fact that it is an expensive currency, but it provides the safe haven benefit.

Another thing to consider is the cost. The SNB keeps the interest rate at -0.75%, meaning that if you own a long position on the CHF you will end up paying swaps every trading day.

Related Videos

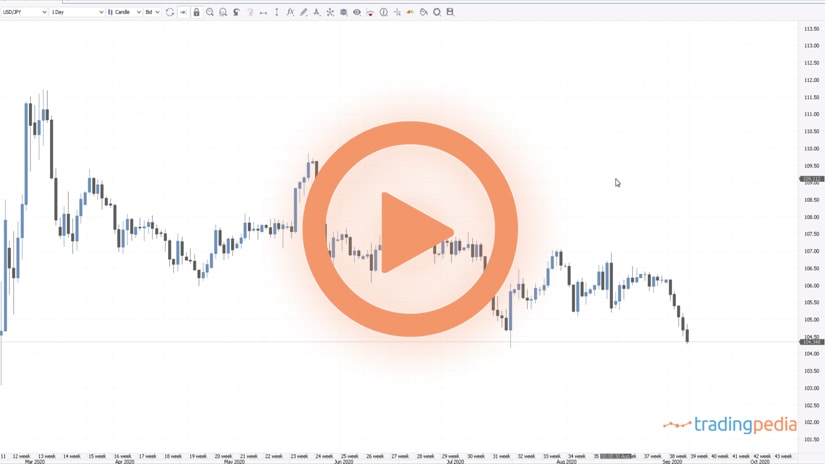

Japanese Yen (JPY)

Last but not least, the JPY. This is a traditional safe haven currency. If you remember in 2017 when North Korea used to make nuclear tests, every time the JPY strengthened, a risk off move in the United States started, and so on.

If I were to list the three in a priority order, I will start with the USD, then the CHF, and finally the JPY. Safe haven means protection, but it comes with additional costs. Bye, bye.