Hello there, this is tradingpedia.com and we continue the series dedicated to trading gold. It is just a guide for the retail trader and what to do when the trader looks to gain exposure to the gold market.

Overview

If you want to study more about gold, feel free to do so as this is a fascinated subject. We talked about gold as a commodity but also about Bitcoin as it is viewed now as a digital alternative investment. In 2020, with the collapse in the financial markets, one of the closely watched ratios was gold vs. Bitcoin.

Gold as an Invetment Around the World

But what is means gold as an investment for various people? There is a different meaning to gold in various parts of the world. For instance, gold has a different meaning in Asia, the United States, or the European Union. In Asia and Eastern Europe, gold has been a refuge against devaluation and money debasement.

So you had few options as a simple investor that lived in an authoritarian regime, one that created inflation and did not respect any economy principle (such countries still exist). One is to own jewelry. For instance, in India, gold has a special status. Therefore, the weddings season is a strong determinant for the price of gold. When the weddings seasons starts, the demand for gold rises, and it influences the price.

In the 21st century it is not only about jewelry, but gold as an investment allows us to speculate because nowadays, we have access to financial markets. Gold is not only denominated in USD, but also in EUR, GBP, etc. If you can compare something with all the other fiat currencies, it is a close form to money.

Related Videos

Why to Add Gold to Your Portfolio

Gold is often added to a portfolio so the investor gains diversification benefits. It means that when things go wrong, the price of gold protects the downside. For instance, if you have a portfolio of 60% stocks and 35% bonds, and you add 5% rest of gold. When stocks move to the downside, the gold will react to the upside in such a way that it will offset the exposure on stocks. Therefore, gold as an investment in a portfolio it balances the portfolio.

One can obtain diversification benefits by adding any other uncorrelated asset, not only gold. For instance, if you have a portfolio made of stocks and bonds, if you want to add something else, it must not have a positive or a negative correlation with the other assets in the portfolio. There are various ways to gain exposure to gold and we will cover them all. It is important to understand that most professional portfolios have exposure to gold – bigger and small ones alike.

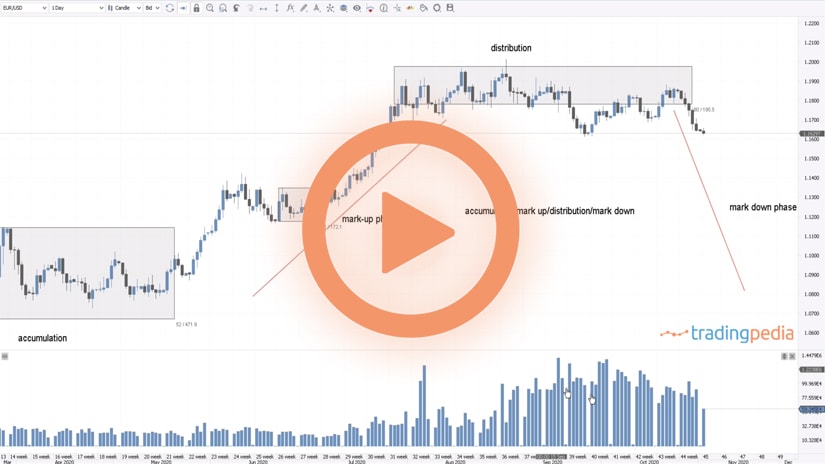

The long-term oriented portfolios like endowments (ran by universities) favor exposure to alternative investments like gold. This chart tells you much why – what was gold’s performance in the last two decades?

On average, gold gained 10.3% against nine different currencies, each and every year. Stay tunned for the next part please.