Hello there, this is tradingpedia.com and we continue our series dedicated to the price of oil or to what to know regarding the oil market. This is a basic series that wants to highlight the importance of oil for the trading community.

Overview

We left at the oil-producing countries and the importance of oil for many economies, giving the example of the Canadian economy. But you will see a similar impact on other economies. For example, Norway. Known in the world as one of the most developed countries having high standards for social protection, for the salmon industry, etc., but also for the oil industry. Norway, like other oil-reach countries, it established sovereign funds and the proceeds from the oil industry are invested throughout the world.

Therefore, these sovereign funds are responsible for transactions in various markets, mergers and acquisitions, real estate transactions, stocks, you name it. And it is all because of oil.

Can you imagine the world without oil? You could not.

Oil Industry in United States

The U.S. oil industry is one of the beneficiaries of the advancing in the oil industry. For instance, shale oil or fracking, means that this technology allows to reach for oil not only on the vertical, but fracking horizontally as well. The problem with it is that it is controversial due to negative environmental impact. Some say that it is responsible for all kind of disasters, earthquakes, and so on.

Nevertheless, fracking and the shale oil industry in the United States reached such a level lately that it challenged the traditional oil-producing countries in the Middle East when it comes to costs. Therefore, while the costs in the United States decreased, in the Middle East they remained at a higher level. So, the United States became competitive on the international arena.

If we look at what it means throughout the years, we see the changes. Here, the United States was a net importer because it consumed more than it produced, and suddenly here it became a net exporter, because of the advances in oil-extracting technology.

This is important because it shows the dependency of one economy on another. For instance, an oil importer will depend on what the OPEC rules are. Therefore, energy supremacy or independence is a key issue for a country.

This table here shows why oil is important from a geopolitical point of view as well, not only from an economic point of view. 2020 turned out to be very difficult because of the coronavirus crisis and a challenge for oil-producing countries.

Oil Rig Counts and Oil Inventories

Oil rig counts and the US oil inventories are two of the most important pieces of data any trader must consider. If the oil inventories in the US are rising, it means that there is not enough demand for the oil. Hence, with too much oil, the price of oil will adjust at lower levels. As such, you will have a lower CAD, lower RUB, and so on. The price of oil will move in anticipation to what the United States economy, the largest in the world, will do.

The oil rig counts is a number calculated in the US and internationally. It shows the number of producing rigs around the world and the lower the number, the weaker the demand for oil is.

Related Videos

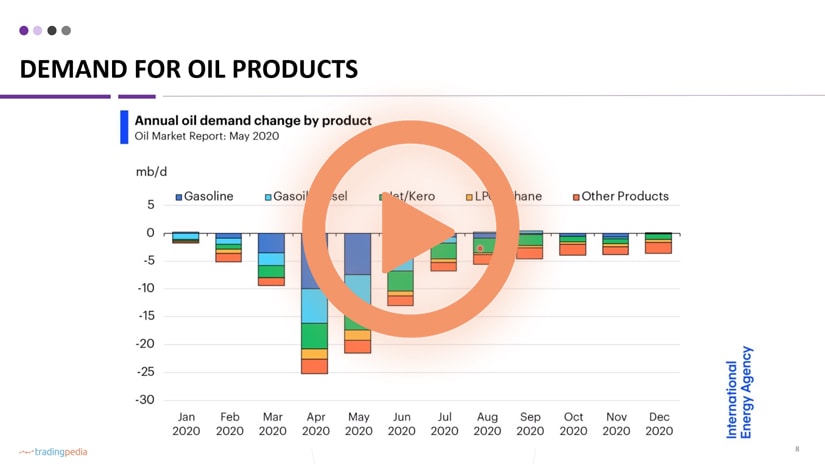

World Oil Demand Changes in 2020

Perhaps this is the most important chart in the last couple of decades showing how the power shifts in the world. I will end this video with a view of how the world oil demand changed in 2020. This is the Q4 of 2020 and it represents nothing but a projection. It is important to look at the breakdown between OPEC and the other producing countries. It ended up with the price of oil collapsing well below the zero level.

This is another interesting chart showing the importance of a $30/barrel oil price and the impact on different countries around the world. We will start the next video with this chart – bye, bye.