Why You Might Not Be Achieving the Trading Results You’d Like

New traders enter the financial markets with high hopes and expectations. They learn to read a price quote, how to make an entry order, and begin to learn about some of the monster trends in the market.

They finally find a trend, but decide not to trade it. Where do I enter? Where do I place a stop loss? How big of a trade size should I make?

They finally find a trend, but decide not to trade it. Where do I enter? Where do I place a stop loss? How big of a trade size should I make?

This new trader didn’t feel confident they knew what they were doing. Now, with the benefit of hindsight, they watch that same trend develop in the direction they suspected. “Next time, I’ll enter into the trade and figure out where to exit later,” they say to themselves. This new trader now believes they have what it takes to succeed.

The First Few Trades

After jumping into a handful of trades, our new trader is below water, currently running at a loss. What happened?

Our new trader is now confused…the trends no longer make sense.

Our new trader is angry…”if that broker hadn’t run my stop loss then I would be profitable”, they think to themselves.

The answer to their confusion and anger is not always simple. The simplest answer I can share is to take a look at a 3-legged stool. Let me tell you a quick story about this stool (it’ll take 5 minutes).

This 3-legged stool pictured above summarizes a lot of truths about trading the markets.

Let me ask you…let’s say one of the legs of the stool broke. It needs fixed so you run out to your garage in search of a replacement leg. There in the corner, you find a replacement piece of wood and attached it to the stool in place of the broken leg.

Oh no! The replacement leg of the stool was too long compared to the other two remaining legs.

Oh no! The replacement leg of the stool was too long compared to the other two remaining legs.

What happens to that stool when you sit on it?

You’ll fall over as the stool cannot stay upright when one of the legs is too long and the other two legs are the same size. The stool falls over and you fall over with it.

Ok, so you go back to your garage, take out a saw and cut down the replacement leg.

Ah, there we go. Back to the stool we go and attach the new leg, this time shorter.

Oh no! The replacement leg of the stool is now too short compared to the other two remaining legs!

What happens to that stool when you sit on it?

You will fall over as the stool cannot stay upright when two legs are similar sized and one of the legs is too short. The stool falls over and you fall over with it.

Trading Lessons a 3-Legged Stool Teaches

There are a lot of lessons to be taught about this 3-legged stool.

First, each of the legs represents a trading leg. Here are the 3 legs to the trading stool.

- Entry

- Exit

- Trade Size

Too often, traders are hyper-focused on one leg…the entry leg. Traders keep seeking out signals.

Who has the best signals?

Who’s signals can win 80% of the time?

You see, by spending all of their time on signals, their “entry” leg of the stool is too large and they experience severe losses because there is no exit plan. The stool falls over.

An Exit Plan

Other traders will not only consider the entry, but stick to the exit plan for the trade. At a certain price they’ll exit the trade at a loss. At a certain price, the trader closes the position at a profit.

For this scenario, the “entry” and “exit” legs are the same size, but the “trade size” leg of the stool is too short. Guess what, they might experience large gains but one large loss will wipe them out. The stool eventually falls over.

Ok, so by now you may have figured…I get it! You might be thinking “I’ll be conservative on my trade size, I’ll stick to my entry and exit signals, then I will be profitable.”

I wish it were that easy.

Matching Market Conditions to Your Strategy

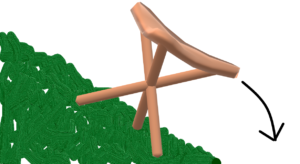

What if you placed that stool on the side of a steep hill, then sat on it. You would fall over. You see, that stool was not made for hills. It was made for flat ground.

What if you placed that stool on the side of a steep hill, then sat on it. You would fall over. You see, that stool was not made for hills. It was made for flat ground.

Similarly, we have to keep the “terrain” of the markets in mind.

Sometimes markets are flat.

Sometimes markets are trending upward or downward (like the side of a hill).

The strategy we use will vary based on the market’s conditions. We can’t use the same strategy all of the time and expect consistent results.

We need to learn how to read the mood of the market. In essence, find the right terrain for our strategy, then trade that strategy on that given market.

Conclusion

Use the 3-legged stool as a visual aid reminder to guide your trading. Then, when you dig into the price charts to learn how to read price action and make forecasts, your analysis will be grounded by market’s terrain.

First, assess the mood of the market. Is the market trading sideways? Is the market in a trend? There are a couple of tools we will look at that can help us determine if the market is sideways (rangebound) or in a trend. We will look at tools like the average directional index (ADX), average true range (ATR) and Bollinger band width (BBW).

Second, if the market is rangebound, then buy low and sell high. If the market is trending, then trade ONLY in the direction of the trend using breakouts, throwbacks and pullbacks. For example, if the market is trending higher, then buy breakouts and buy dips. If the market is trending lower, then sell breakdowns and sell rallies.

Thirdly, manage an exit plan such that you are risking less than your potential reward. We will dive deeper into this on a mini-course. Too often I have seen traders risk a lot to make a little. That type of a strategy might offer short-term rewards but it is a recipe to lose in the long run.

Lastly, make sure your trade size is appropriate for your account size. Leverage acts like a dual edged sword. As quick as you can gain is as quick as you can lose. Therefore, if you decide to use leverage for margin trading, VERY conservative amounts.