The US indices ended its first session for the week on negative territory, dragged down mainly by techs, and other growth-driven stocks, as investors continue divesting in a rising yields’ environment. The Dow, S&P and Nasdaq deleted respectively .94, 1.3 and 2.14 from their market value. The 10 yr and 30 yr Treasuries ended with 1.494 and 2.07% respectively, as the 10 yrs reached 1.56% last week – the highest performance since June 2021. As mentioned in previous articles, growth is usually financed by debt, and future cash flows for market estimates are discounted at the prevailing risk-free rate as a base, no company could escape from these aspects. Companies with extremely high P/Es, both trailing and estimated, like the tech giants are now logically subject to a downside revision of future cash flows. The firm and stable Treasuries’ rates’ figures is the main attributable factor for the general red market picture, and is set to continue until higher than expected and prolonged in time inflation does not get normalized, together with monetary policy. In the near future most probably we’ll see companies financing their projects with more equity raising – private or public, which on the other side leads to a dilution of EPS.

MSFT /-2.07%/, AAPL /-2.46%/, GOOGL /-2.11%/, FB and AMZN /-2.85%/ all ended down with considerable losses with FB being the biggest looser, deleting 4.89% from its market cap. As mentioned before, FB is facing a number of regulatory and technical-protocol challenges for its operations, but yesterday another drama was added to its market woes. There was a 6-hour worldwide collapse in its services, covering the Facebook social network, Whatsapp and Instagram and preventing its 3.5B users worldwide from communication and other services on its platforms. FB blamed a “faulty configuration change” for this disaster, attributable to DNS protocol, according to specialists. Also, on Sunday an ex-employee of FB spoke publicly against the consumer-misleading policy of the giant, regularly feeding the Wall Street Journal with spicy information.

AMZN is already on a negative territory for the year – this was an investors’ favorite in the previous interest-rate friendly environment and now that things have changed, the price has to be paid. It could be clearly concluded that there’s no such thing as an always winning stock, with always boosted estimates, and the market always prices in all the available information, affecting the real economy. The Monday bad market results completed a 6th consecutive negative session for AMZN. Despite the clear negative picture on the tech-sector, it is not recommended to immediately plunge into daily short positions, as a messy correction may occur after such prolonged slumps. The sector will be watched closely for news on the other positive side.

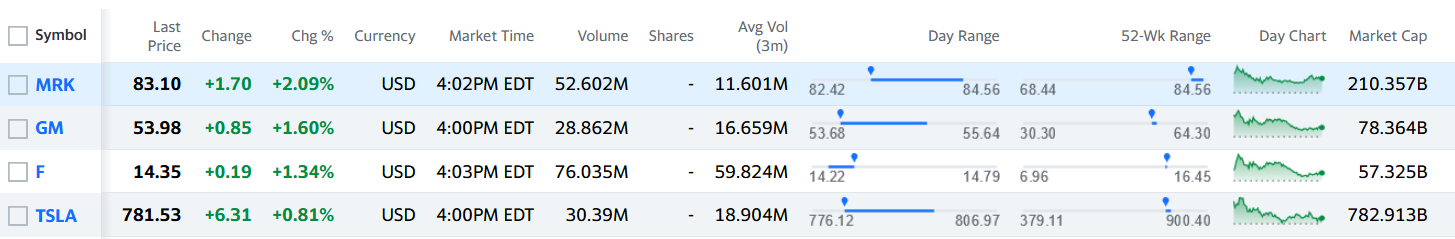

On the other hand, TSLA, F, GM and MRK, all traded at NYSE, ended against the market with the positive sentiment on the automobile companies derived mainly from TSLA. The Elun Musk company presented extremely favorable electric automobiles sales on Sunday, surpassing the estimates. It is no wonder electric automobile production will be favored in an environment of oil boosting prices and energy crises worldwide.

Merck on the other hand attributed its favorable Monday performance on its still experimental antivirus pill, able to confine death or serious complications from the coronavirus for people most vulnerable to the disease. The 2.09% market gain was in continuation to the 8% Friday big-news boost. If approved by authorities, Molnupiravir will be the first pill against coronavirus.

The oil continues to climb higher with Brent and WTI adding 2.77 and 2.61% to USD 81.48 and 77.86 per barrel. Exxon Mobil /XOM/, Chevron /CVX/ and ConocoPhilips /COP/ were positively affected accordingly.

The Asian sessions slumped after the negative US session, additionally bothered by another real estate company: Fantasia Holdings homebuilder. Its dollar-denominated bonds lost nearly half their market value in a massive Monday selloff, after Fantasia failed to make a USD206M international market debt payment on time. Hang Sang deleted 2.44% from its market value. It seems that the Evergrande scandal will not be a one-time event but the early bird of a real estate crisis in Asia, supposed at least to spread world-wide via international securitized debt.

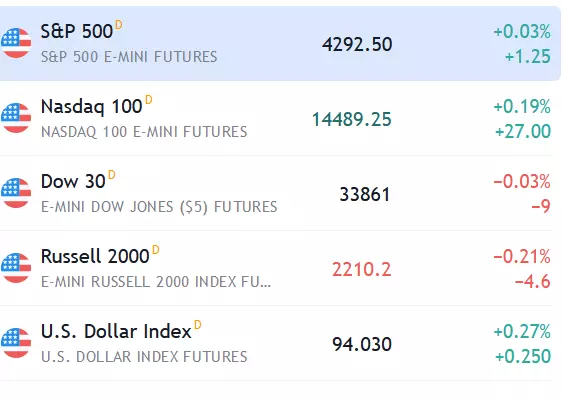

From the premarket picture this morning /around 2am EST/, it looks like the tone for the session is set for a small recovery and dip-buying on fundamentally favorable stocks and sectors:

Special attention should be paid at US ISM Services PMI, coming out at 10 am EST. The 59.9 market consensus level is less than last month’s 61.7 but still quite positive. If the market starts on the green and the Services PMI disappoints, this could affect the rest of the session. The service sector is not affected by world supply shocks and the US economic recovery is heavily reliant on it. At 13:15 EST tentative time an FOMC member speaks.

Successful trading!