In the week 18th – 22nd October stocks hit an all-time hi after the S&P 500 completed a seven-day winning streak, backed up by the earnings release. Factors such as the surrounding troubles with the constantly high “temporary inflation”, the pending tapering, the supply shocks, the high energy prices and the pandemics restrictions were largely ignored. The third earnings quarter season is a continuous proof of the resilience of the US economy. Equities have gained almost 6% this month, fully recovering from last month’s losses and bonds have been pressured by the rising yields. For the 42nd week of the year DJIA gained 1.1%, and YTD 16.6%, the S&P 1.6% with 21% YTD, and the Nasdaq 1.3% with 17.1% YTD. Oil as measured by the WTI, gained 2.3% for the week and the impressive 73.5% YTD! Despite the interruption of the winning streak of the indices on Friday, due in part of the Powell expected but unfavorable comments, and in part to the Snapchat drama, oil continued on the green territory with a number of fundamental and structural factors backing its gains, as discussed in my previous articles.

The Fed Chairman Jarome Powell on Friday reiterated the tapering polemics but with slightly more bitter concern over the persistently high inflation. In previous officials’ comments back in the beginning of October, the US Financial Minister and former Fed Chairman Janet Yellen was the only one to directly speak the truth – that “supply chain bottlenecks may last longer than previously expected and likely well in to the next year, more or less H1 2022”. Back then Fed officials whose words are the driving force of market prices engaged in a much softer tone calming the markets about the “temporary inflation”, the slow and precarious removal of financial support and the long lasting zero-interest rate environment. On Friday markets already plummeting by the tech sector selloff, further deepened losses discovering the difference in the tone of Powell when speaking on inflation. Considering that there is also arising critics that US inflation may go out of control, and the Fed should reassure this is not happening, the focus of the Central bank will be shifted from healing up the post pandemics damages on the economy to fighting post pandemic inflation, a scenario definitely disrupting the stock market and supporting the bond market.

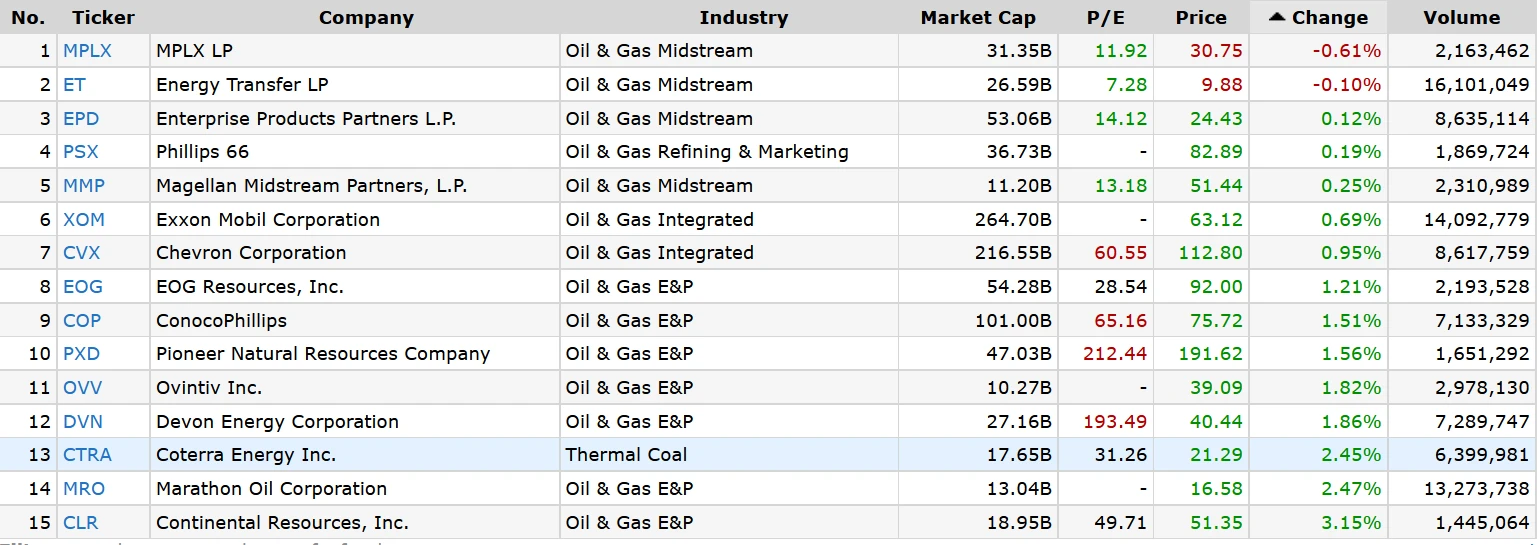

The Oil and Gas industry of the Energy sector still held gains on Friday despite the total worsened picture on the stock market. Oil and gas companies are highly correlated with the price of the commodity itself, which used to move in a demand-defined positive correlation with the stock market and consumer sentiment. Right now, however considering the energy sector as an asset with inverse correlation with the stock market and more related with world fundamental and structural industry specifics, provides a good escape from the off and on stock market volatility, subject to so many counter-interactive factors. Provided below is a list of NYSE listed mid cap+ US-based Oil and Gas companies with P/E stated as the forward P/E. On the first glance, companies in the E&P /exploration and production/ sector are most favored in the segment, regardless of how high their forward P/E has reached.

When the COVID came into the world a lot of oil and gas drilling facilities were closed and projects for future expansion terminated – the prospects for recovering demand were still very blurred, the vaccines were not invented yet. As the world economics started recovering, the oil production capacities recovered too but they are still 20% off pre-pandemics time. On one hand we have world politicians stimulating and asking companies and OPEC to increase production and to pile up inventories, in order to prevent an ever rising, energy price-driven inflation, and on the other hand we have a cautions producer investment in new drilling facilities. Companies prefer to be on the safe side, with restricted production capacity, as they are worried of the unsustainability of the high oil prices, and so are their project financers. Moreover, the world is switching to alternative energy, and this high oil and thermal coal demand is only temporary, as are the government officials’ requests to boost production. Considering the above reasoning we could assume that the relatively restricted supply of oil world-wide would persist on a structural level, as no one could pour money into unsafe projects. This will provide a solid base for the commodity price in the mid-term, together with demand from the world economic recovery.

Considering the US shale oil industry – it is one of the most expensive methods for drilling oil in the world. In last week some big creditors stated that they will restrict providing finances for this type of drilling industry. Just for a simple comparison – a barrel of oil costs USD 9.9 to produce in Saudi Arabia, and USD 36.2 in the US! When the US based EOG stated its plans to boost production in February, its stocks faced the biggest dropdown, since the company S&P500 listing.

According to City’s group analyst a price per barrel below USD30 and above USD60 is unsustainable in the long term. In the first case a lot of world producers would not be able to cover direct and operational expenses, and supply restriction measures would be taken to increase the oil price again. In the second case, regulatory measures and competitive forces would drive prices back to balance levels, as there are a lot of poor oil-producing countries, able to drill cheap and sustaining themselves almost purely on the commodity export.

Provided above is a general fundamental coverage of the industry, market dynamics of the commodity price, together with a list of US producers, subject to the overall analysis. The point of the coverage is what should be taken into consideration when making trading decisions. However, insights for shorting or taking long positions are not provided – it is a trader’s responsibility to make a market sentiment, fundamental and technical analysis for a list of correlated companies/asset classes and for a single stock to trade.