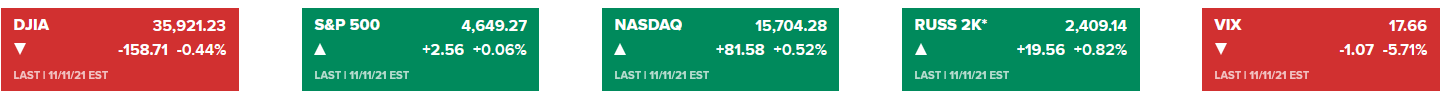

The US indices finished the session on Thursday sideways, with persisting confusion on the rising consumer and producer prices. The blue chips recovered a major downfall on Wednesday, as fears arose on the sooner than expected rising of the base interest rate and larger-scaled than expected tapering of the USD150B monthly QE by the Fed. It is interesting to note that the VIX /Bats: VXX/ is falling, indicating that investor sentiment is cooling down, processing all the available macro and corporate information. Today at 12:10 pm EST, the FOMC member William speaks, perhaps with more insight as weather the Fed is viewing the hot inflation figures as temporary or long-prevailing, considering the driving factors behind it.

The trend this week is paying more attention to macroeconomic data or events, something which was widely neglected during the euphoria at the start and extension of the earnings season. A hot topic right now is the Russian stationing of troops along the Ukraine border – again, which self-will could turn into a cornerstone for a short-term broader market correction. According to Skynews, “The United States’ Secretary of State Antony Blinken is concerned Russia may be attempting to rehash its 2014 invasion of Ukraine…the Ukraine’s Defense Ministry says about 90,000 Russian troops are stationed there. In 2014, Russian troops annexed the Crimean Peninsula and supported a pro-Russian separatist insurgency in eastern Ukraine”, with the broad-based disapproval and sanctions imposed from most of the G8 leaders.

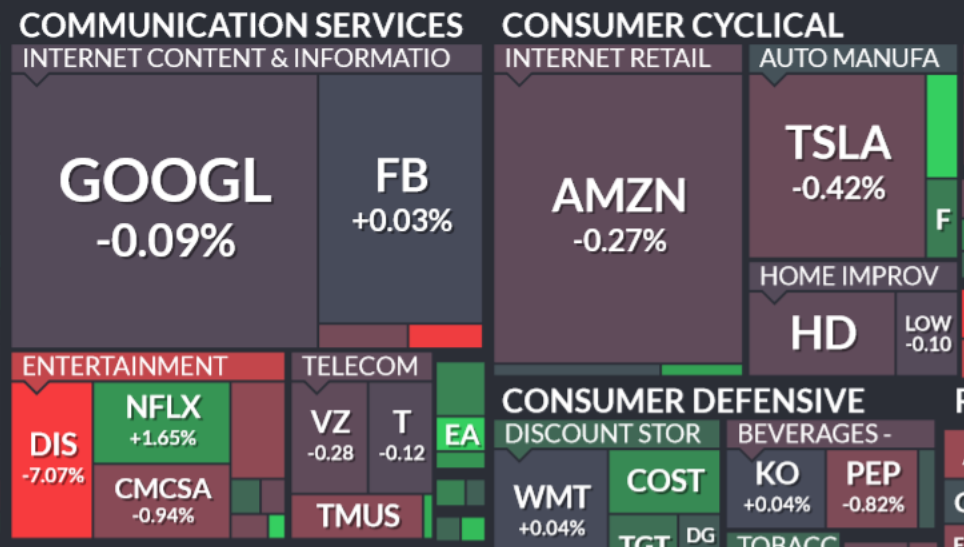

Considering market movers, the consumer cyclicals are shedding off market value in times of economic uncertainty, while consumer defensives are logically favored by investors:

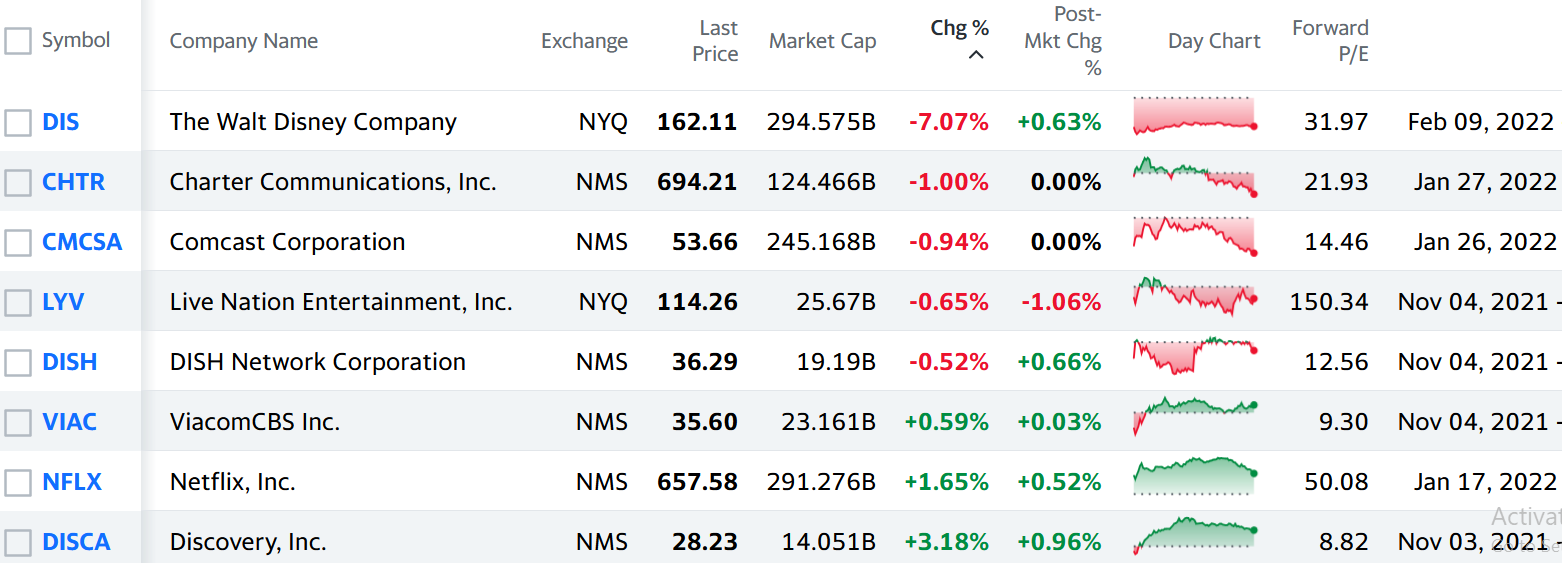

A big market mover was the Walt Disney Company /NYSE: DIS/, drawing attention to the Communication Services – Entertainment sector:

The entertainment giant shed off some 7% from its market cap, after posting disappointing figures on its streaming Disney+ subscription service. Wall Street analysts’ estimates were set for a growth of 9.3M subscribers, while Disney reported a 2.1M only. The costing base of entertainment companies and content producers is composed of fixed costs mostly, so the most important figure watched by analysts is the growth rate of subscribers. In this way the sector is relatively easy to analyze even by nonprofessionals. As it could be seen from the list of peers above, all of the major companies of the sector have reported so far. Netflix on the other hand, surprised with an extremely positive growth rate in almost all of its segments, and the company continues to reap rewards even long after the financial reports release date. Logically, the sector in general is favored in covid-pandemics times, and it depends on inter-competitive results on whether the company is suitable for a short or a long position.

Successful trading!