This spring has brought us a very unstable economic situation, marked by inflation, rising interest rates and stagnant growth for businesses. On top of that, the global economy was threatened by an unprecedented US debt default, adding to the uncertainty. On this background, the crypto markets have brought some stability for investors with crypto prices remaining relatively stable after the big surges in January and March.

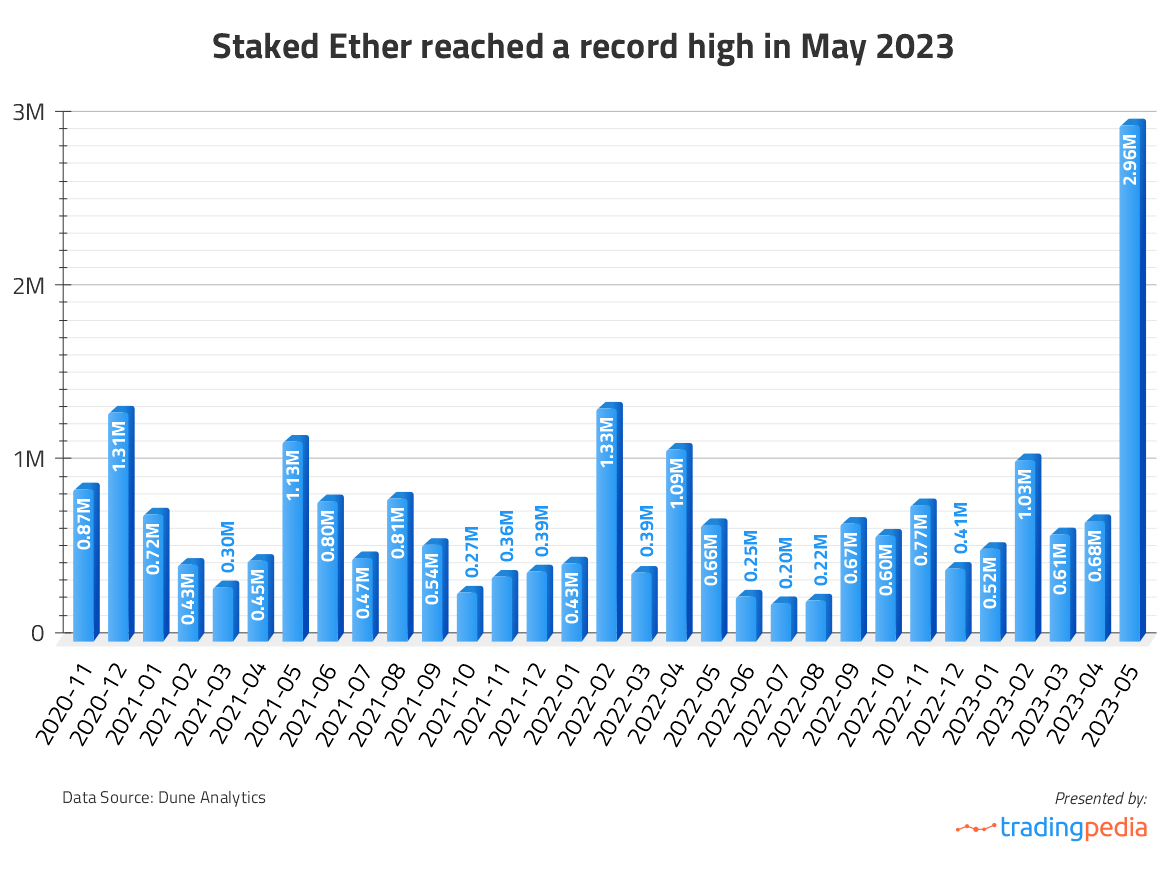

The crypto scene has been eventful recently with one of the main occurrences being Ethereum’s Shanghai Upgrade, which went live on April 12. It finally enabled users to “unstake” staked Ether, aiding the cryptocurrency’s liquidity. This prompted our team at TradingPedia to look into blockchain data and see if and how this upgrade has affected Ethereum’s staking dynamics. We used Dune Analytics to query raw blockchain data for the monthly staked Ether amounts since the very beginning when staking was introduced with the Beacon Chain. We plotted this data on a chart to find that we’ve had record amounts of staked Ether in May 2023:

We can see that in May 2023, there were nearly 2.96M ETH staked. This amount excludes withdrawals and is more than twice as high as the second highest amount of staked ETH, recorded in February 2022.

“Ethereum once again proved to be investors’ favorite and the opportunities which the Shanghai Update provides for liquidity are just another cornerstone. The US Debt ceiling saga and the earlier events with banks going bankrupt surely affected Ether’s popularity and more and more users prefer to stake their money in ETH rather than keep them in the bank. Additionally, the usual crypto volatility in recent months is rather low, which adds some extra safety, having in mind the ever rising inflation for the FIAT.”

-comments Brian Brian McColl, analyst at TradingPedia.

The 2.96M staked in May is approximately 2.46% of the total ETH supply (120.25M as per ycharts data). This is another signal that proves investors trust Ether and find it as an investment tool rather than a speculative asset. Additionally, the current APR is approximately 5.4% which offers better deposit conditions than most of the banks around the world.

At the end of the day, the recent events with the potential default of the US economy and the rising investor interest in ETH staking raise the question whether crypto is not permanently losing its speculative and becoming a rather stable financial instrument. The Shanghai Upgrade seems to definitely be a step in this direction.