Key points

- USD/INR near fresh three-week peak

- Demand for cash dollars and for future payments weighs on Rupee

- FOMC June minutes in focus

India’s Rupee retreated against the US Dollar on Wednesday, pressured by strong demand for dollars from importers for immediate and future payments.

“Since open, from our side, there has been a demand for cash dollars and for payments that are due one month to three months down the line,” a Forex salesperson at an unidentified private sector bank was quoted as saying by Reuters.

The Rupee was also impacted by a weaker Chinese Yuan, after data showed China’s services sector activity had slowed in June. The Caixin China General Services PMI pointed to an expansion in activity, but at the slowest pace since January as new orders eased to a six-month low.

Investor focus now sets on the minutes of the Federal Reserve’s policy meeting in June. The Fed is likely to hike rates again next month following the latest string of solid US macro data.

Markets are now pricing in an over 80% chance of a 25 basis point interest rate increase at the Fed’s meeting in July, according to CME’s FedWatch tool.

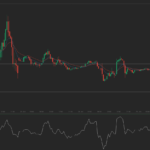

As of 7:39 GMT on Wednesday USD/INR was edging up 0.26% to trade at 82.1400. During the early phase of the European trading session, the exotic Forex pair went up as high as 82.1875. The latter has been the pair’s strongest level since June 15th (82.2525).