For this strategy we will utilize only one of the vast set of tools the famous Ichimoku Kinko Hyo indicator has to offer – the Chinkou Span line (white on the charts below). What we should note here is that it appears a specific number of candles late on the chart. If using the default settings of the Ichimoku indicator, that specific number of candles is 26. It is not 100% necessary for one to use the default settings. He/she is able to modify the periods of the Ichimoku tools in accordance with his/her own preferences. For a detailed overview of the Ichimoku, you can check this article out.

Trading signals are generated when the Chinkou Span crosses the price of the trading instrument. However, in order to identify the spot where one can make an entry, he/she needs to count 26 candles ahead of the Chinkou Span line, because of the shift we mentioned above. For this strategy one may use time frames such as 1 hour, while the option expiry time may be set to the end of the session he/she is trading (Asian, European or American).

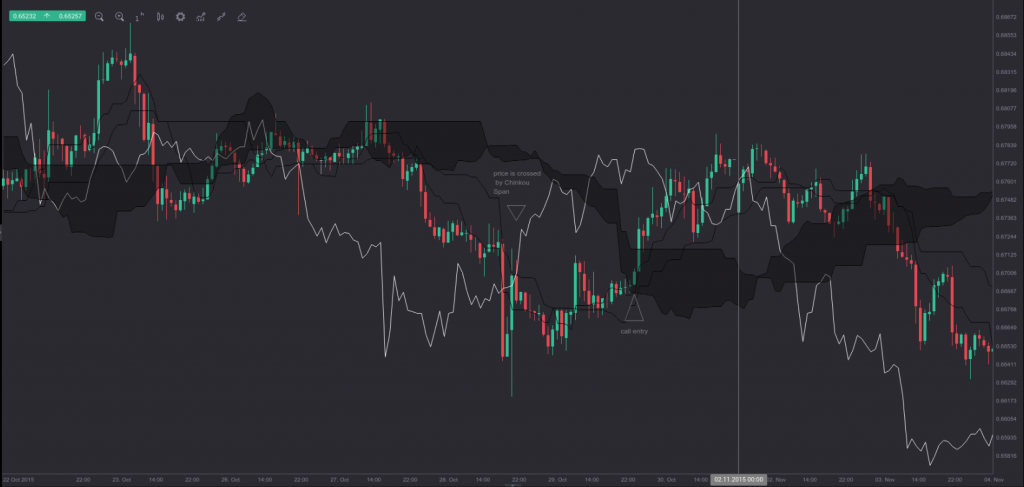

In order to buy a call option, a trader needs to detect where the Chinkou Span crosses the price in a bottom-up manner. The chart below visualizes the spot where the price is pierced by the Chinkou Span line, the spot where a call entry should be made as well as the option expiry (vertical line).

In order to buy a put option, a trader needs to detect where the Chinkou Span crosses the price in a top-down manner. The chart below visualizes the spot where the price is penetrated by the Chinkou Span line, the spot where a put entry should be made as well as the option expiry (vertical line).