By using this strategy a trader is able to achieve profit even when his/her positions expire out of the money. The trader will begin with a predetermined amount and if his/her first trade is a success, he/she will continue making entries on the market with that same amount of funds. In case the first trade leads to a loss, the trader will move on to the next ”investment size”.

The standard payout, which binary option brokers will usually offer for 60-second binaries, is 70% of the amount invested (though there are exceptions). Let us have an example with a starting amount of $20.00. We begin trading by placing a stake of $20.00 that EUR/USD will drop within the next 1 minute. If the pair indeed does so, we will gain $14.00 of profit (70%). Our first trade was a success, so we place another stake of $20.00, buying a put option again.

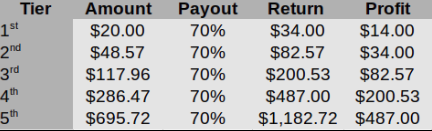

In case, however, our first trade led to a loss (EUR/USD did not depreciate within the next 1 minute), we need to move on to a larger stake (investment size). We will make an entry by putting $48.57 at risk. Why that much? Take a look at the following table.

After we have made a decision to begin with $20.00, our potential return would be $34.00 (the initial amount plus profit). It is calculated by multiplying the amount of the first investment ($20.00) by 1.7. In order to estimate the amount for our second investment, we need to divide the potential return on our first investment by 0.7. Or $34.00 / 0.7 will give us $48.57. The latter would produce a potential return of $82.57 ($48.57*1.7). By dividing the potential return for our second investment by 0.7, we are able to estimate the amount for our third investment and so on.

Now let us presume that our first three trades produced losses. As we invested $20.00 on the first position, $48.57 on the second and $117.96 on the third, the total loss is $186.53. We will move to the fourth amount in the table, thus, we will next invest $286.47. In case it is successful, it will generate $200.53 of profit. The latter would be enough to cover the loss from the first three positions and it will provide $14.00 on top.

In case our first four trades led to losses, a successful fifth trade would cover them and would provide $14.00 of profit.

An important moment to note is that this strategy should be used within trading ranges, not in a trending environment (more than 10 consecutive bullish/bearish bars). So, a trader needs to look for ranges to make his/her entry and exit the market after his/her third consecutive successful trade. This rule applies especially when the trader has reached his/her 3rd or 4th level (investment size). Otherwise, he would risk too much.