Advantages of Using a Demo Account

This lesson will cover the following

- Why should you use a demo account?

- What is a lot?

- Why reliable support is important?

- Why trading on demo accounts should be kept close to trading on live accounts?

In this chapter and the next one we will talk about the different platforms brokers provide and why it is so important to take your time and choose the most suitable for you. And what better way to make that decision than to test it for as long as you like for free using a demo account.

Why should you use a demo account?

Trading is not a childs play. While it does provide unlimited possibilities for profiting, it also involves a large amount of risk and as brokers typically warn almost everywhere when it comes to leveraged products, losses may exceed your deposited money. That is why traders who are new to Forex must take advantage when brokers offer them to test their platforms and practice for free through demo accounts.

There are many different brokers and as we already said in article 8 “Forex Brokers and Where They Fit in the Market“, they are the link between the users in the Forex market and the liquidity providers, facilitating the trade via their trading platforms.

The trading platform is what the user sees and experiences during his everyday trading sessions. Some brokers have the capital to be able to afford making their own, proprietary, trading platforms, while some use white-labeled products which they customize and others just buy a license for using a platform as it is, like MetaTrader by MetaQuotes Software Corp.

Given the great variety of brokers and the even greater number of platforms there are, it is strongly recommended to learn the features and quality of each platform by trading with play money before committing real funds.

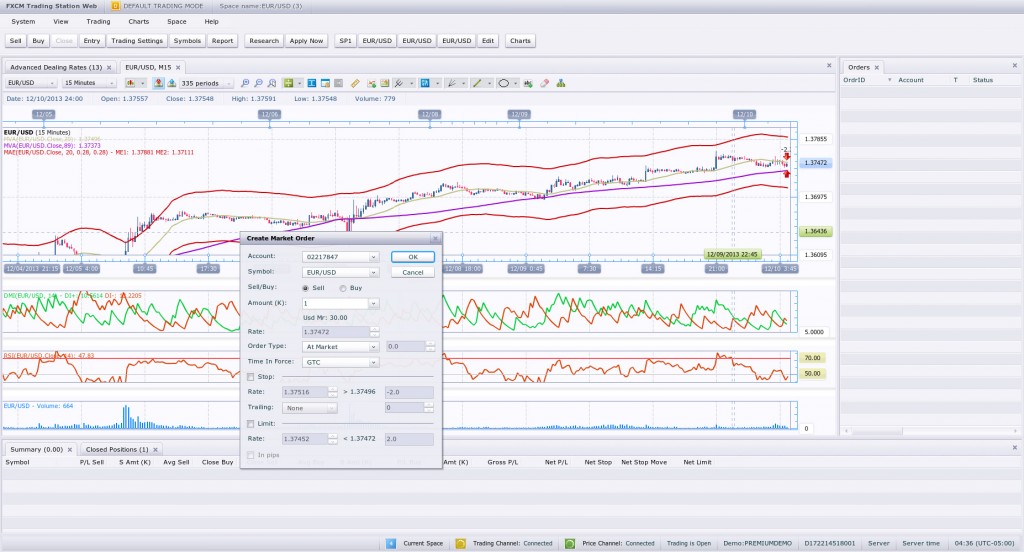

First and foremost, each trader must make himself familiar with how an order is placed within the new platform. In most cases, users enter a long position on a currency by clicking on the “ask” quote, or buy button, on a pop-up window, while placing a short order is done by hitting the “bid” quote, or sell button. This method is illustrated on the following snapshot of FXCMs web trading station.

Some platforms, however, also allow you to place orders directly by clicking on the chart. In FXCMs web-based platform, this is done by clicking the right mouse button and selecting the type of order you want to place.

Meanwhile, some offer you the possibility to choose whether you want to place a limit or a market order after the quote ticket pops up, while others require you to do that in advance.

Other key points, one should consider becoming familiar with, are the spreads, the lot size you can trade and how to set a stop. Spreads can be fixed or variable. In article 8 “Forex Brokers and Where They Fit in the Market”, we described the types of brokers and how they define whether spreads remain constant or fluctuating.

Lot size

Determining the lot sizes you can trade is also very important, especially for beginner traders. A lot represents the minimum quantity of an asset that may be traded in a single order, which means that the bigger the lot size, the larger the risk exposure is.

The lot system is used to standardize price quotes. This standardization allows every investor to easily determine exactly how many units he is buying with each contract and assess what the price per unit is.

In stock trading for example, each contract, or lot, consists of 100 shares, also known as a “round lot”. Any number of shares less than 100, or 1-99, is called an “odd lot” and is not posted on the bid/ask data on exchanges.

Any number of shares that is greater than 100, but not a multiple of 100, i.e. 334, 876, 475, is called a “mixed lot”. Mixed lots are generally traded by round lots and the remaining odd-lot portion of the order is cancelled.

In Forex, currency pairs are usually traded in standard lots, mini lots and micro lots. Standard lots consist of 100 000 currency units, while mini lots are made of 10 000 and micro – of 1 000 units. This means that if you go long with 1 lot (standard) on EUR/USD at $1.3000 ask price, you will purchase €100 000, while paying $130 000 in exchange.

In each pair where the U.S. Dollar is the counter currency, one pip of price movement will equal $10 in a standard lot, $1 in a mini lot and $0.10 in a micro lot. This is why beginner traders are generally advised to trade using mini or micro lots as a losing position will generate a lesser loss. This of course means that platforms which allow traders to switch and mix lots have a competitive edge as they are more flexible and overall suitable for beginners.

Reliable support

Another feature of significant importance a newcomer should test is how responsive and helpful the support is. As in any other business, the support office is one of the most important departments and will assist you with lost passwords, technical issues, problems with depositing or withdrawing money. And since the Forex market is decentralized and goes around the clock except for the weekends, it is vital that your broker provides support in accordance.

Apart from some brokers offering you the possibility to start a chat and ask questions within the platform, most of the reputable Forex dealers also maintain call centers, where operators can help you, if for example your internet connection goes down during a trading session.

Keep it close to real

And last but not least, when trading with a demo account, a beginner trader should always try to act like it is a real account so that the transition to real funds goes easier later. You should always keep the risk at levels you think you can manage, as if your hard-earned money was at stake.

You should also start a demo account with relatively the same amount of funds you would deposit in a real account. Some platforms allow you to operate with as much as 100 000 demo US dollars, which can lead to orders of millions of currency units when you add leverage. If a beginner trader gets used to such huge numbers on a demo account, this could lead to excessive risk taking when scaled down to a $5 000 or $10 000 live account, as he would have lost his sense of proportion.

You must also have in mind that although peoples risk appetite varies and everyone accepts losses in a different way, each person hates to lose money. This means that someone might feel relatively okay when losing $100 000 in a demo account, but might become highly agitated when losing as much as $50 of his real money.

After doing the initial 30-40 trades in order to get used to the user interface, a trader should then focus on finding the strategy which suits him best. Through practice with play money you can decide whether you are an aggressive short-term trader who uses high leverage and enters many intra-day positions, or you prefer using smaller lots and hold long-term positions, aiming for big price movements over the next month.

However, no matter how good results your strategy yields, you must always bare in mind that trading with a demo account is much different than trading real money. This means that even if you achieve success when practicing, this doesnt ensure you profits after switching to a live account. Nevertheless, professional traders agree that if you cant be successful with demo money, you will certainly not make it on the real scene.