- Jump to:

- Main features of the best DMA Forex brokers

- Direct Market Access

- How Does It Works

- Direct Market Access CFDs

- Key Features

- Advantages and Disadvantages

DMA stands for direct market access and refers to a type of trading that allows clients to trade directly with large banks, market-makers and liquidity providers. Trading in this manner allows getting the best possible prices on the market without the need to use the services of a dealing desk.

Fusion Markets74-89% of retail's CFD accounts lose money

Fusion Markets74-89% of retail's CFD accounts lose money FP Markets73.85% of retail investor accounts lose money

FP Markets73.85% of retail investor accounts lose money ActivTrades73% of retail investor accounts lose money

ActivTrades73% of retail investor accounts lose money BlackBull MarketsTrading leveraged products is risky

BlackBull MarketsTrading leveraged products is risky Global Prime74-89% of retail CFD accounts lose money

Global Prime74-89% of retail CFD accounts lose money Pepperstone75.5% of retail investor accounts lose money

Pepperstone75.5% of retail investor accounts lose money

Below you can find a comparison table of forex brokers that offer Direct Market Access (DMA) trading. We rank them based on several factors including: regulation, spreads and commissions, Trustpilot rating, trading instruments, trading platforms, deposit and withdrawal methods.

Our team has thoroughly evaluated all brokers listed below using TradingPedia’s exclusive methodology.

Main features of the best DMA Forex brokers

- Brand

- Trading platforms

- Minimum deposit

- Regulations

- Trading instruments

- Spreads

- Leverage for Forex CFDs

- Leverage for Crypto CFDs

- Leverage for Indices CFDs

- Deposit methods

- Withdrawal Methods

- Commission per Lot

- Contact details

Normally, Forex and stock brokers offer DMA accounts only to institutional, professional or VIP clients. Many Forex brokers do not provide DMA order execution at all and instead, they operate through a dealing desk and are also known as market makers. However, an increasing number of brokerages decide to offer retail traders direct market access and work directly with the major banks that operate in the interbank market. This is how they ensure their clients can get the best prices possible.

What Is Direct Market Access?

Direct market access, or DMA, is a term you will often encounter in trading and financial markets. It is used to describe a method for electronically trading securities used by investors who want to trade with financial instruments and interact directly with the list of orders and prices, i.e. the order book, of an exchange or another market without any intermediaries.

Usually, this type of trading – on the order book – is restricted to members of the exchange, including market makers, sell-side firms, and broker-dealers. However, by using DMA, investment companies (or buy-side firms) and private traders can utilize the sophisticated technology infrastructure of sell-side firms like investment banks and the market access that such firms have.

This may sound too complicated but the emergence of fully digital, Internet-based trading systems has made DMA more accessible than ever. Direct market access is also used in Forex trading and it is a type of order execution in which traders are offered direct access to the market. This automatically enables them to place trading offers with liquidity providers such as other brokers, leading foreign exchange banks and market makers.

How Does Direct Market Access Work?

In Forex trading, direct market access works through a sophisticated technology infrastructure, usually owned by sell-side firms. DMA brokers deal directly with the banking institutions trading on the interbank market – these banks provide liquidity and deal in huge volumes of foreign currencies. Brokers aggregate bid-ask prices from these liquidity providers and transmit them to their clients. This is how traders can see the actual market prices rather than receive quotes from their broker.

Traditionally, brokers would make the market for their clients, i.e. they would take the other side of a trade, practically trading against the client. They provide both a buy and a sell quote, making a profit from the spreads – the difference between the buy and sell price. This structure of operations is called a dealing desk and it is the most common brokerage model. DMA brokers, on the other hand, do not pass their clients’ orders through a dealing desk, which is why they are also known as No Dealing Desk (NDD) brokers, a term that has already been discussed in this guide.

When clients work with DMA brokers, they receive several quotes and choose a particular bid-ask price from one of the liquidity providers. The broker then sends the order directly to the interbank market for execution. The transaction is immediate. Along with the bid and ask prices, clients can also see the so-called market depth – who is buying or selling at a particular price and how much trading volume the other party is looking to trade at that price.

Since DMA brokers are also NDD brokers, some traders believe that DMA is the same as STP or ECN, the two types of NDD models. They refer to Electronic Communication Network (ECN) and Straight Through Processing (STP). However, ECN brokers are not the same as DMA brokers – although both display the market depth and show prices from the interbank market, ECN or ECN+STP brokers may send their clients’ orders to prime brokers rather than to liquidity providers. Typical for the true DMA is that there are only market executions (in comparison to instant executions), only variable spreads, only 5-digit pricing, and there is optional access to the depth of market.

Direct Market Access CFDs

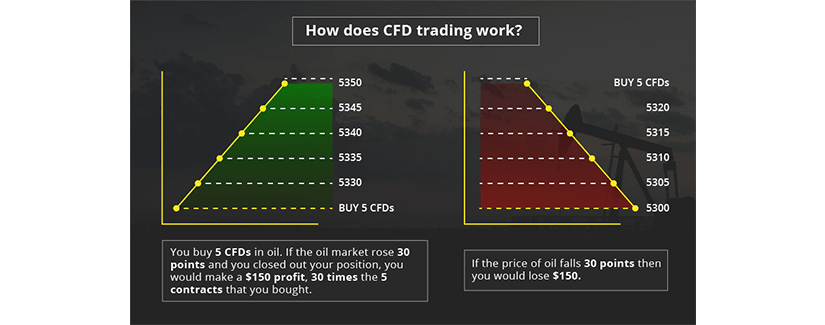

It is also important for traders to understand the concept of DMA contracts for difference (CFDs). Many DMA brokers offer CFD trading, a type of derivative trading where traders speculate on the rising or falling prices of fast-moving markets and instruments such as foreign currencies. In most countries, CFDs are an over-the-counter (OTC) product and they are usually traded using the direct market access model.

The idea is slightly confusing, though, since OTC means that there is no actual market to have direct access to. Traders may see a DMA offering for a CFD instrument on their computer but when they trade it, they do not buy or sell the actual currency or another type of CFD. Instead, they enter into a contract for difference or CFD with the price provider at the price rate shown. Then, the provider hedges the price by placing a cash order into the order book on its own behalf.

Many traders prefer this type of trading because the CFD price is based on the underlying market price for the instrument rather than one quoted by the provider. There are often higher fees for this service compared to non-DMA CFD trading services but the overall costs for traders remain lower due to the tighter spreads.

Key Features of DMA Forex Brokers

As we have mentioned above, DMA Forex brokers usually work directly with liquidity providers and manage to offer their clients faster execution of orders and better prices. These brokerages are usually larger firms with years of experience in financial markets, properly obtained licenses, and an overall good reputation in this business. There are many other key features of DMA Forex brokers and DMA trading as a whole every trader should be aware of:

- DMA offers lower transaction costs because traders pay only for the technology of the process. Fees are either a fixed markup to the client’s dealing price or a small commission.

- The orders are handled straight by the provider of the price but are facilitated by agency brokers. DMA brokers are not market makers or liquidity providers on the DMA platform they offer their clients.

- There is no information leakage at all.

- DMA allows the trader to “trade the spread” of the stock.

- DMA Forex brokers offer market execution with no re-quotes.

- DMA Forex brokers provide a trading environment where the traders can privately execute trades on neutral prices that influenced solely by the global Forex market conditions, most notably the supply and demand forces. Market volume and volatility also affect prices.

- There is no conflict of interest in DMA trading mostly because of the lack of a dealing desk and intermediaries in the trade. DMA brokers are not market makers.

- With this type of trading, retail clients access the true market depth and have equal access to the order book.

- Forex DMA market structures display variable spreads rather than fixed spreads, which are indicative of dealer platforms.

Advantages and Disadvantages of DMA in Forex

Using DMA in Forex trading comes with a lot of positive aspects but there are also certain risks that should be taken into account. Traders who are new to this type of trading or are just entering the world of Forex need to keep in mind that any type of investment brings a certain level of risk when real money is involved. The type of execution and the specific access to the market are irrelevant in this sense. Still, there are a few advantages and disadvantages of using direct market access in Forex trading.

The price rates shown in DMA structures are streamed straight from the liquidity providers, which are committed to their ask/bid offers. This means that there will be no rate rejections, re-quotes or partial fills. However, most DMA brokers add a small fixed mark-up on their spreads. The good news is there is no additional commission.

Another obvious advantage of using DMA over market makers is that orders are executed more quickly because they do not have to go through an intermediary. Of course, traders are offered full market transparency since they can see the actual orders and prices in the interbank market. In traditional trading, clients simply receive quotes from their brokers without any information on how these prices have been formed (supply and demand, traded volumes, economic news, etc).

Direct market access comes with a few drawbacks, as well. First of all, prices are not necessarily better than what is offered on the over-the-counter market. Since there are no fixed spreads in DMA trading, clients may end up paying more with dynamic spreads. Forex brokers usually charge substantial fees if a DMA account stays inactive for a long time.

Second, the minimum deposit requirements for registering a DMA account are often higher since these accounts are typically designed for institutional and professional traders. Moreover, some brokers levy penalties for clients who do not trade often enough.

In case you are interested and you want to try brokers that use DMA, then below, you will find a list of some of the largest and most respected firms on the Internet. Since these brokers have years of experience, they are trustworthy and provide professional services to their clients:

- Hot Forex

- FXOpen

- FX Pro

- FXCC

- NORD FX