Aroon Oscillator

This lesson will cover the following

- Explanation and calculation

- How to interpret this indicator

- Trading signals, generated by the indicator

Aroon Oscillator represents the difference between Aroon (Up) and Aroon (Down) indicators. It oscillates between -100 and +100, while zero is the centerline. The oscillator shows a reading of +100, when Aroon (Up) is 100 and Aroon (Down) is 0. The oscillator shows a reading of -100, when Aroon (Up) equals 0 and Aroon (Down) equals 100.

A resilient price movement to the upside will drive the Aroon Oscillator to +100, while a strong price movement to the downside will drive the oscillator to -100. A relatively high positive oscillator reading comes as a result of Aroon (Up) being relatively high and a relatively low negative oscillator reading comes as a result of Aroon (Down) being relatively high.

If the oscillator reading is above zero, this implies that Aroon (Up) is larger than Aroon (Down), or the market is setting new highs more recently than new lows. If the oscillator reading is below zero, this implies that Aroon (Down) is larger than Aroon (Up), or the market is setting new lows more recently than new highs.

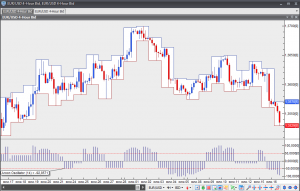

Aroon Oscillator can be used in order to determine the general trend bias. The oscillator tends to remain above zero during a strong bull trend and below zero during a strong bear trend.

Some technical analysts may manipulate the extreme parameters in order to achieve a better filtration of signals. If they widen the two extremes, this will provide them with signals with more lag and a larger time horizon. The bullish extreme can be set to +85, while the bearish extreme can be set to -85. An oscillator reading of +85 would signify that Aroon (Up) is between 85 and 100, while Aroon (Down) is between 0 and 15. The opposite is valid for an oscillator reading of -85. A move above +85 can be considered as strong enough to signal the beginning of an extended rally until disproved by a move below -85. The latter can absorb the majority of pullbacks, occurring during the bull trend. A move below -85 can be considered as strong enough to signal the beginning of an extended decrease. The signal will not be reversed until a move above +85, a level high enough to absorb the majority of bounces off the oversold level.