Balance of Power

This lesson will cover the following

- Explanation and calculation

- How to interpret this indicator

- Trading signals, generated by the indicator

This indicator was first introduced by Igor Livshin in the August 2001 edition of Technical Analysis of Stocks and Commodities magazine. The Balance of Power measures the strength of buyers against sellers in the market by assessing the ability of each side to drive prices to an extreme level. It is calculated as follows:

Balance of Power = (Close price – Open price) / (High price – Low price)

The resulting value is usually smoothed by a moving average.

The Balance of Power (BoP) can be used in three ways in order to provide trading signals:

First, identifying the direction of the trend. When the indicator tends to be rising, this is evident that the market is in a bull trend. When the indicator tends to be decreasing, this is evident that the market is in a bear trend. In addition, crossovers of the zero line provide trading signals. When the BoP crosses above zero, this is considered as a signal to buy. When the BoP crosses below zero, this is considered as a signal to sell.

Second, searching for divergences between the price and the BoP in order to identify a potential trend reversal or trend continuation setup. There are two types of divergences – regular and hidden. Regular divergences signal trend reversals, while hidden divergences signal trend continuation.

A regular bullish divergence is a situation, when the market forms lower lows, while the BoP forms higher lows.

A regular bearish divergence is a situation, when the market forms higher highs, while the BoP forms lower highs.

A hidden bullish divergence is a situation, when the market forms higher lows, while the BoP forms lower lows.

A hidden bearish divergence is a situation, when the market forms lower highs, while the BoP forms higher highs.

Third, taking advantage of overbought and oversold conditions. These extreme levels provide an early indication that a trend reversal is at hand. Overbought/oversold conditions are present, when the BoP clusters its tops and bottoms. This way it sets up the overbought and oversold levels around those values. There are cases, when the price also tends to remain at these overbought/oversold levels and continue to move in the same direction for a certain period of time. So, in those cases it would be safer, if the trader waits for the BoP to cross over the zero line before placing his/her order.

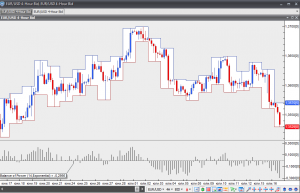

Chart Source: VT Trader