Chandes Dynamic Momentum Index

This lesson will cover the following

- Definition

- Interpretation

Developed by Tushar Chande and Stanley Kroll, the Dynamic Momentum Index is an indicator gauging momentum in a similar matter to the Relative Strength Index.

However, its method of calculation bears one key significance which makes it a unique trading tool – unlike most other momentum indicators that use a static lookback period, the Dynamic Momentum Index automatically adjusts the number of periods tracked according to changes in volatility.

Thus, as market volatility spikes, the number of DMI trackback periods is decreased so that the indicator can more accurately respond to the most recent price changes. Conversely, as volatility declines, additional data is encompassed for a better assessment of earlier market developments.

http://forums.tradingpedia.com/forum/education/trading-strategies/45-fast-moving-average-crossovers

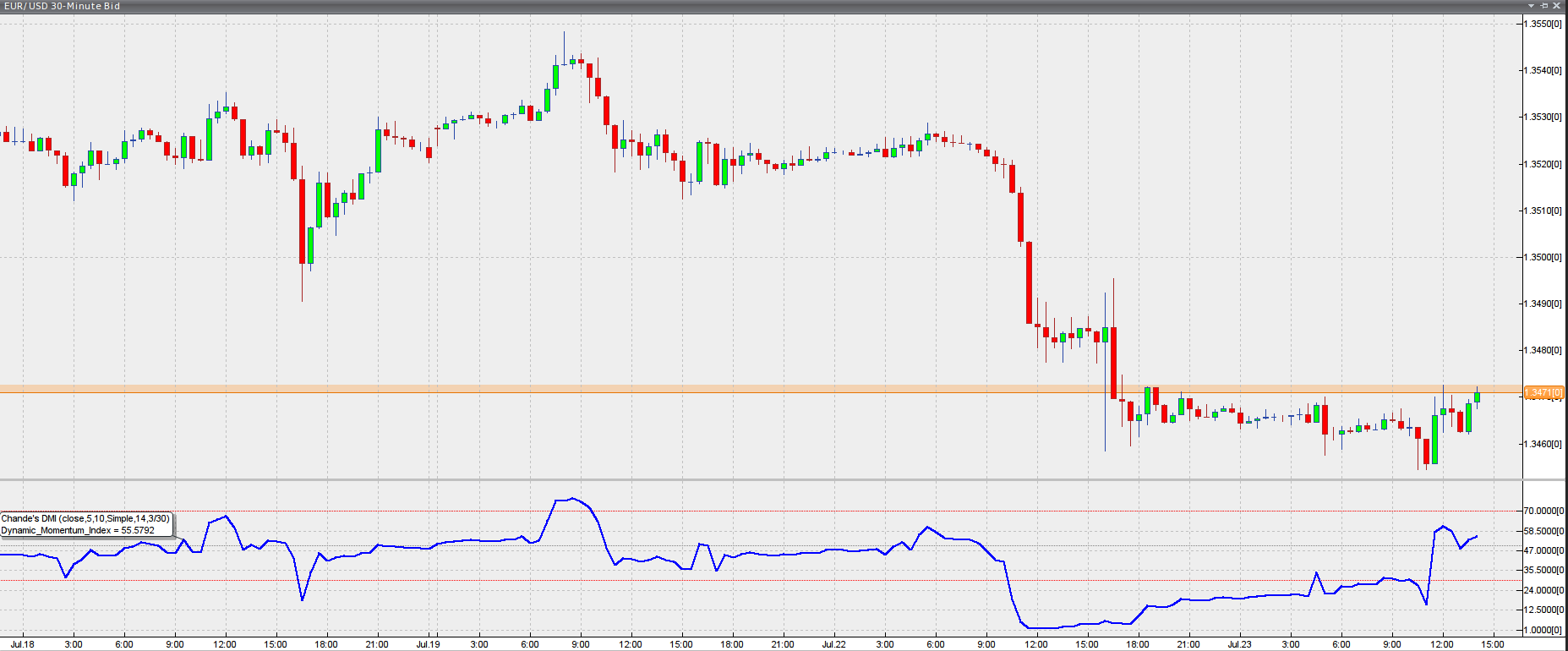

The DMI is interpreted generally in an analogous manner to the more widely used Relative Strength Index. Readings exceeding the level of 70 on its scale are regarded as overbought and imply, but not always, that the price might reverse or at at least retrace soon, while values below 30 suggest the market is oversold and a bullish reversal or retracement might be at hand. The screenshot below shows how the indicator is visualized in a trading software.

Chart source: VT Trader

Apart from trading the overbought/oversold signals, of course in conjunction with a confirmation from other trading tools, we can use the Dynamic Momentum Index to enter the market on divergences with the financial instruments price. This is done following the same principle of trading RSI divergences.