Chandes Range Action Verification Index

This lesson will cover the following

- Explanation and calculation

- How to interpret this indicator

- Trading signals, generated by the indicator

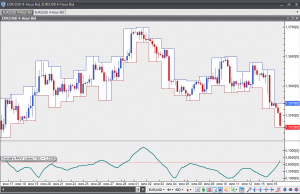

Developed by Tushar Chande, the Range Action Verification Index (RAVI) is used in order to help identify if the market is in a trend. The indicator shows the difference (in percentage) between the current prices and the past prices. Two key lines are recommended by Chande for the RAVI – 3% or 1% in dependence on the market.

A bull trend begins, when the RAVI crosses the 3% key line from bottom-up. The bull trend is considered as active as long as the indicator line moves up.

A bear trend begins, when the RAVI crosses the 1% key line from top to the downside. The bear trend is considered as active as long as the indicator line moves down.

In case the RAVI line turns back to zero, this is an indication that the trend has come to an end and the market is now in a trading range.

In case the RAVI line turns back again, but does not enter the area between the two key lines, this is an indication that the trend has resumed.