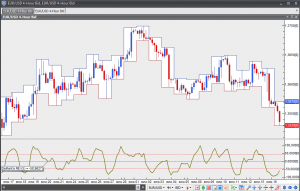

DeMarks Range Expansion Index

This lesson will cover the following

- Explanation and calculation

- How to interpret this indicator

- Trading signals, generated by the indicator

Developed and introduced by Thomas DeMark in the book “DeMark on Day Trading Options”, the Range Expansion Index (REI) is a market-timing oscillator, meant to cope with problems, which exponentially calculated oscillators, such as the Moving Average Convergence Divergence, encountered. The REI is arithmetically calculated.

The oscillator fluctuates between -100 and +100. Its default setting includes a period of 8. If a trader is willing to be provided with less but more reliable signals, he/she may use a larger period. If a trader is willing to be provided with more but less reliable signals, he/she may use a smaller period. Thomas DeMark recommends using the default setting.

If the indicator value exceeds the +60 level and then falls below it, a signal to sell is generated. If the indicator value moves below the -60 level and then surges above it, a signal to buy is generated.

Thomas DeMark does not recommend trading in extreme overbought or oversold conditions, indicated by six or more bars above or below the two thresholds.