Ehlers MESA Adaptive Moving Average

This lesson will cover the following

- Definition

- Interpretation

Developed by John Ehlers, the MESA Adaptive Moving Average is a technical trend-following indicator which, according to its creator, adapts to price movement “based on the rate change of phase as measured by the Hilbert Transform Discriminator”. This method of adaptation features a fast and a slow moving average so that the composite moving average swiftly responds to price changes and holds the average value until the next bars close. Ehlers states that because the averages fallback is slow, you can create trading systems with almost whipsaw-free trades.

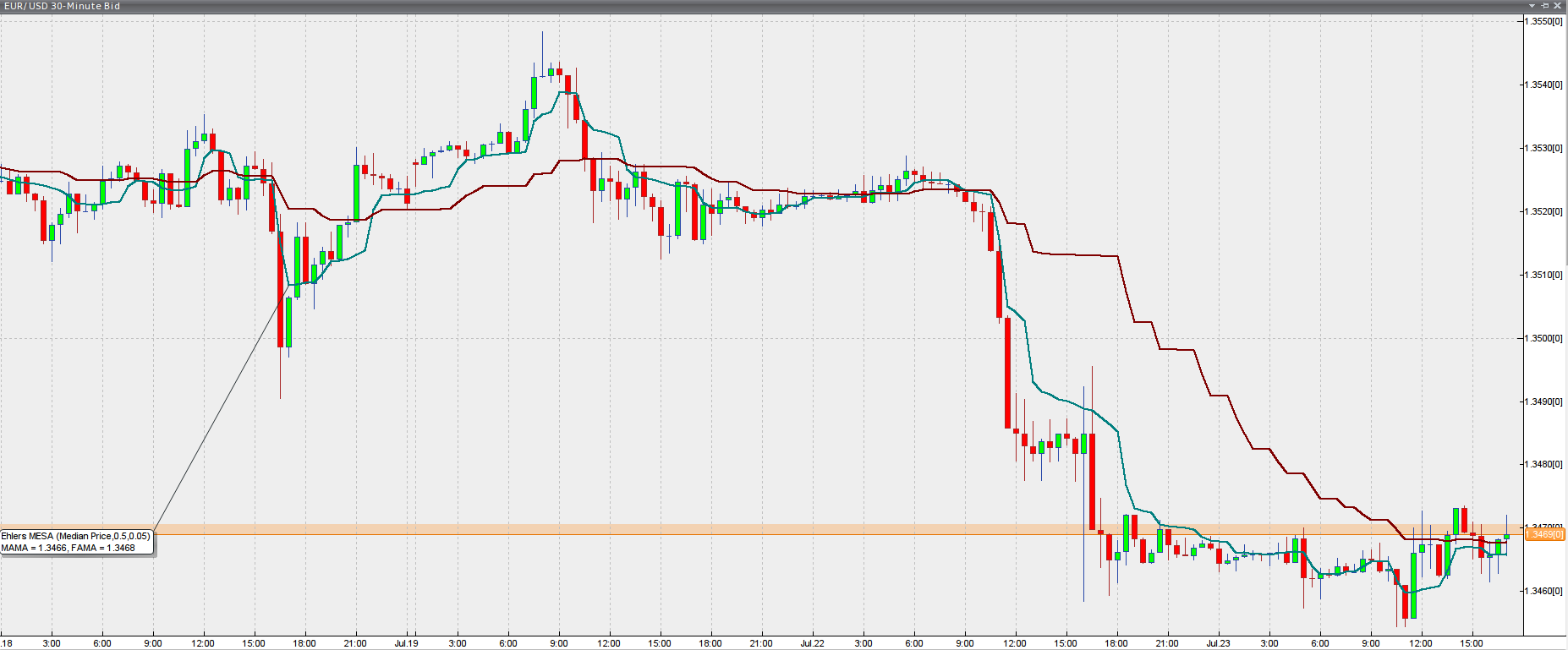

Below you can see the indicator plotted in a trading platform.

Chart source: VT Trader

Basically the indicator looks like two moving averages, but instead of curving around the price action, the MESA Adaptive MA moves in a staircase manner as the price ratchets. It produces two outputs, MAMA and FAMA. FAMA (Following Adaptive Moving Average) is a result of MAMA being applied to the first MAMA line. The FAMA is synchronized in time with MAMA, but its vertical movement comes with a lag. Thus, the two dont cross unless a major change in market direction occurs, resulting in a moving average crossover system which is “virtually free of whipsaw trades”, according to Ehlers.

The MESA Adaptive Moving Average is used as a replacement of traditional moving averages. As such, the MAMA and FAMA can be traded just like ordinary moving averages.

First, they act as strong support and resistance areas and the price will tend to rebound from them upon contact. This makes pullbacks to the MAMA and FAMA suitable with-trend entry areas.

Second, crossovers between the MAMA and FAMA, resembling a golden or death cross, are also widely traded. When the MAMA crosses the FAMA from below and edges higher, this means that the market will likely continue to move up, generating a buy signal. Conversely, when the MAMA crosses the FAMA from above and edges lower, it implies the market is edging lower and will most likely continue to do so, thus generating a short entry signal.

The MESA Adaptive Moving Average, just like traditional moving averages, can be used as a stand-alone indicator, but also in conjunction with other indicators, which are typically combined with SMA and EMAs in order to improve your decision-making.