Ehlers Relative Vigor Index

This lesson will cover the following

- Explanation and calculation

- How to interpret this indicator

- Trading signals, generated by the indicator

The Relative Vigor Index (RVI) was introduced in the January 2002 edition of Technical Analysis of Stocks and Commodities magazine by John Ehlers. The idea behind this indicator is that prices tend to close at higher levels than they open during bull trends and close at lower levels than they open during bear trends. Therefore, the vigor (energy) of the move is established by where prices end up at the close.

In order to normalize the RVI to the daily trading range, one needs to divide the price change by the maximum price range during the day. Or,

Relative Vigor Index (1) = (Close-Open) / (High-Low)

In order to smooth the resulting value, one may use a Simple Moving Average (SMA) with a period of 10. Or,

Relative Vigor Index (10) = 10-period SMA of Relative Vigor Index (1)

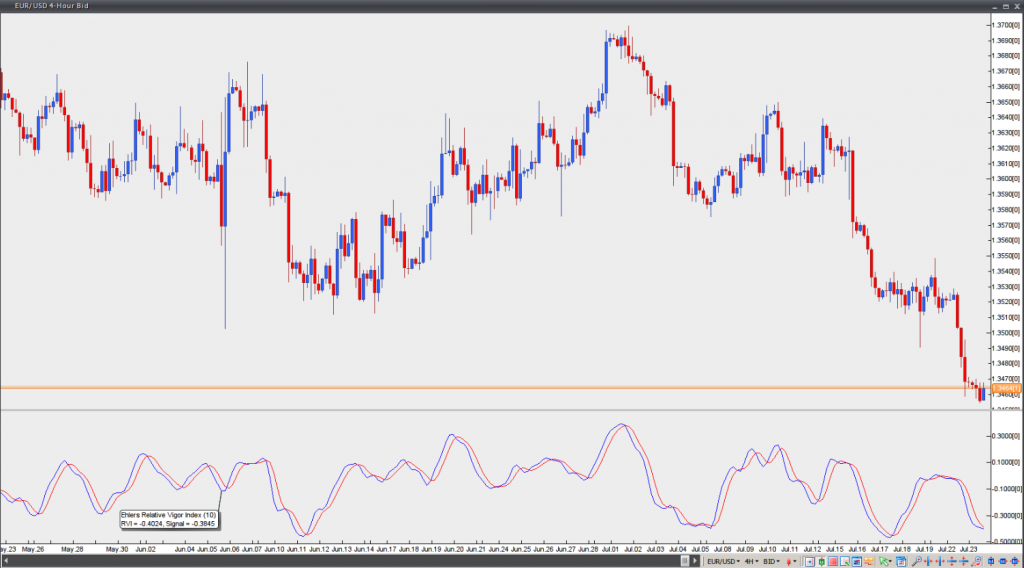

The RVI generate trading signals, when the RVI SMA (blue line on the chart below) and the RVI signal line (red line on the chart below) cross. A signal to buy is produced, when the RVI SMA crosses above the RVI signal line. A signal to sell is produced, when the RVI SMA crosses below the RVI signal line.

The RVI does not identify overbought and oversold conditions.