Gann HiLo Activator

This lesson will cover the following

- Definition

- Interpretation

Developed by Robert Krausz, the Gann HiLo Activator is a trend-following technical indicator used to help determine the trends direction and to generate with-trend entry signals. It is best combined with the Gann Swing Indicator and the Gann Trend Indicator (will be reviewed in the following articles) as part of a trading system, commonly known as the “New Gann Swing Chartist Plan”.

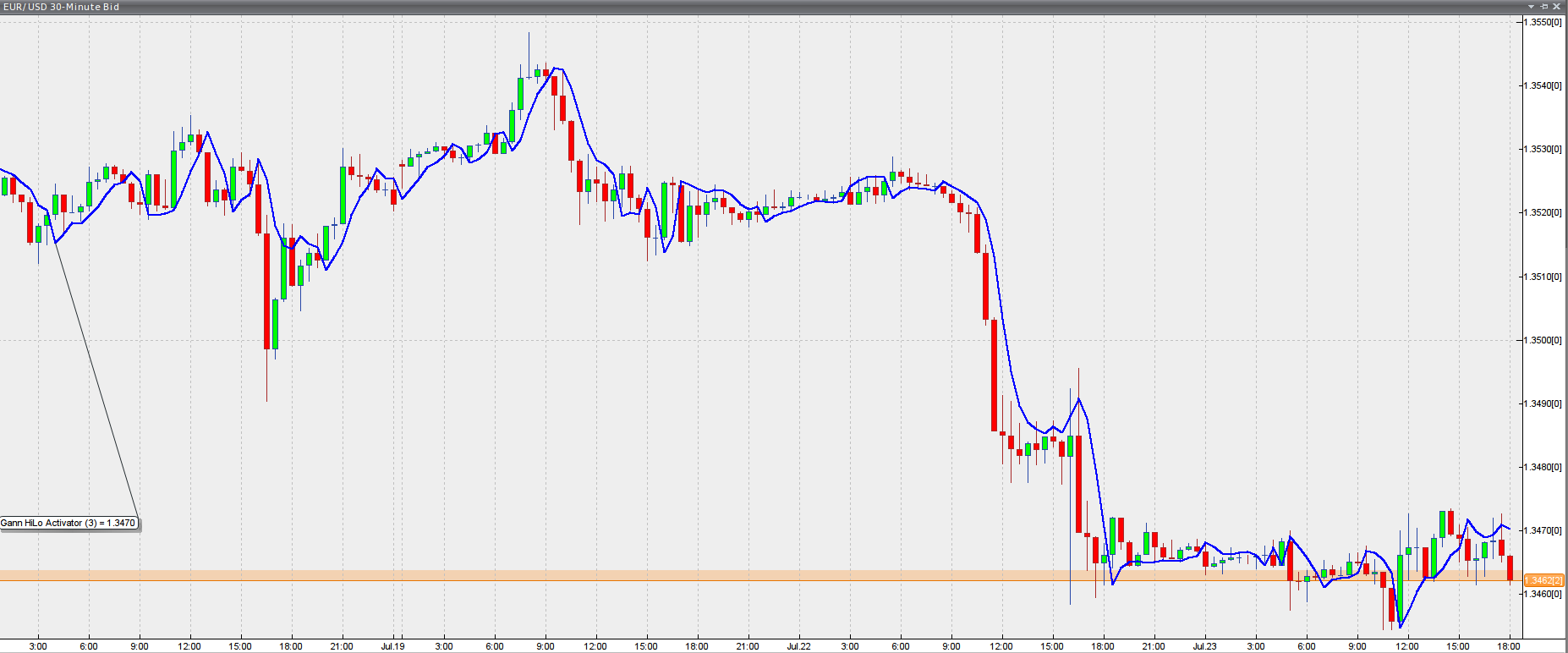

The Gann HiLo Activator is a simple moving average of the previous three periods highs or lows. Based on the moving averages logic, it is a trend-following indicator used to reflect the markets direction of movement. Within the trading system we mentioned earlier, the Gann HiLo activator is responsible for generating entry signals, but also helps determine stop-loss levels. Here is how it looks in a trading platform.

Chart source: VT Trader

Its readings can be interpreted the following way. A bull trend is in force when the price action is above the Gann Activator, thus implying that only long entries should be entered. During an uptrend, the indicator is calculated based on the previous three periods lows.

Conversely, if the indicator is being plotted above the price, it suggests that the market is in a bear trend, thus you should restrict your trades only to short positions. During a downtrend, the Activators calculations are made using the previous periods highs. Read through the next two articles to get the full picture of this trading system.