Linear Regression and Linear Regression Slope

This lesson will cover the following

- Explanation and calculation

- How to interpret this indicator

- Trading signals, generated by the indicator

Linear Regression Indicator

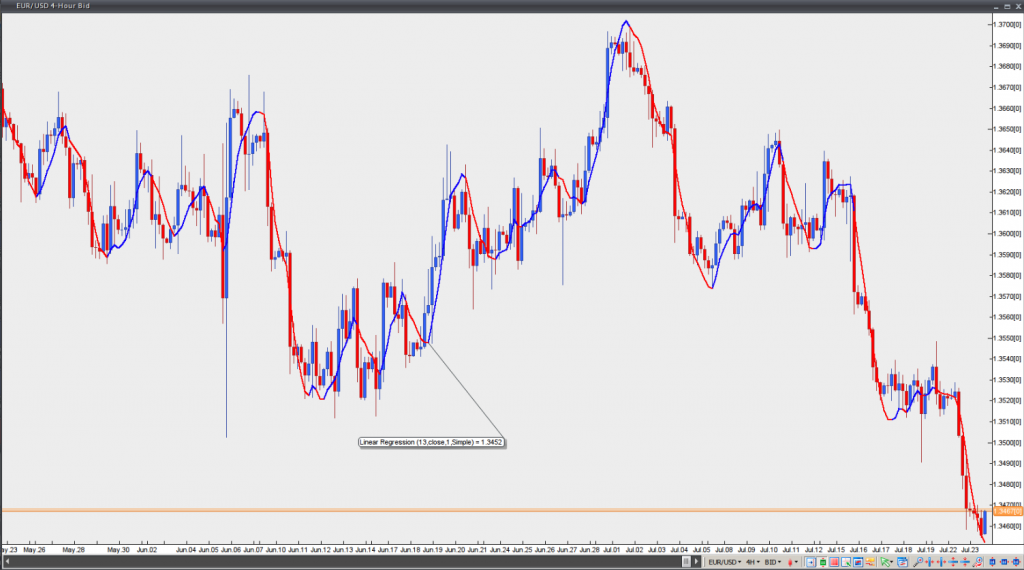

This indicator plots a string of linear regression lines, drawn on successive days. The Linear Regression Indicator has an advantage over a traditional moving average – it has less lag than the moving average and reacts more rapidly to price changes. This is a trend-identifying and trend-following indicator. The major trend is identified by calculating a Linear Regression Trendline with the use of the “least squares fit” method, which helps to minimize the distance between the data points and the Linear Regression Trendline.

The Linear Regression Indicator is actually a projection of tomorrows price, plotted today. If prices are higher or lower compared to the forecast value, one may anticipate that they will eventually return to more realistic levels. The Linear Regression Indicator highlights where the price should be trading on a statistical basis, while a deviation from the regression line will likely not last long.

Trading signals should be taken by using the direction of the Linear Regression Indicator. A trader may additionally use another such indicator with a longer period as a filter. A long entry (or an exit from short position) should be made, when the indicator turns to the upside. A short entry (or an exit from long position) should be made, when the indicator turns to the downside.

Chart Source: VT Trader

Linear Regression Slope

This indicator determines the slope value of theoretical regression lines, which include the current bar and the prior n-1 bars, for every bar loaded in the chart (while ”n” refers to regression periods). The slope value is normalized by multiplying the raw slope value by 100 and then dividing the result by the price.

Slope value = (Raw Slope value x 100) / Price

Normalization of slope values is crucial, if one is to compare markets, which trade within different ranges. The normalized slope value reflects the price change in percent per bar of the regression line. If the normalized slope is 0.25, this means that the regression line is increasing at a rate of 0.25% per bar. A normalized slope of -0.60 would suggest that the regression line is decreasing at a rate of 0.60% per bar.

Chart Source: VT Trader