Recursive Moving Trend Average

This lesson will cover the following

- Explanation and calculation

- How to interpret this indicator

- Trading signals, generated by the indicator

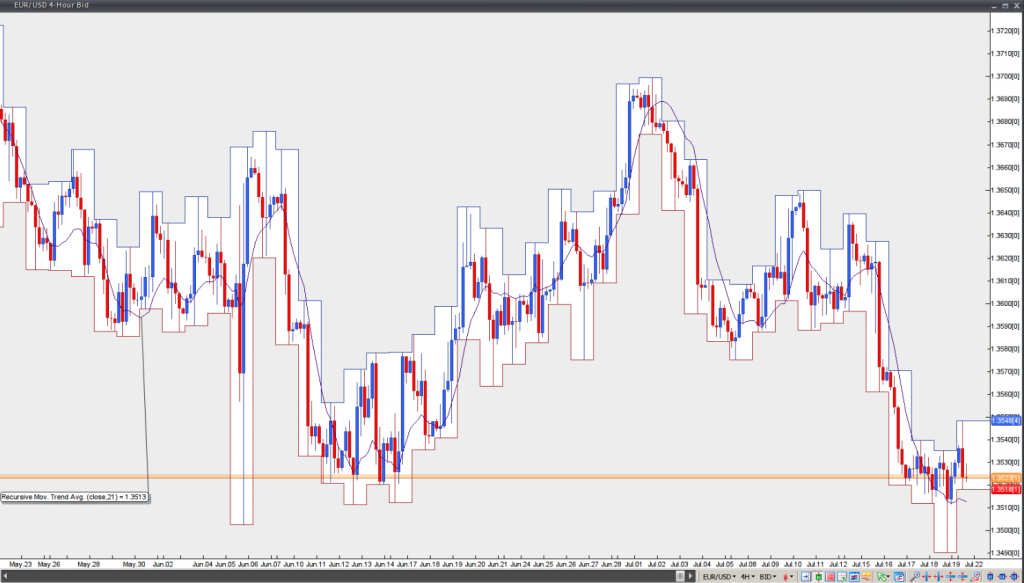

This indicator was developed by Dennis Meyers and introduced in his article “The Japanese Yen, Recursed”, published in the December 1998 issue of Technical Analysis of Stocks and Commodities magazine. According to Meyers, this method requires a small number of historical data of the estimated price and the price at present (today) in order to forecast the price in the future (tomorrow).

Dennis Meyers suggests creating a simple trend oscillator (the ”tosc”), that represents the difference between the Recursive Moving Trend Average and an Exponential Moving Average (EMA), both using one and the same period. He suggests examining the price series and searching for changes, which exceed the normal noise fluctuations. This signals the beginning of a potential bull or bear trend.

A potential signal to buy is generated, when the tosc’s reading crosses above the “dup” level. A potential signal to sell is generated, when the tosc’s reading crosses below the “-ddn” level.