How to Copy a Forex Trader

This lesson will cover the following

- What does it mean to copy a trader

- Why is this beneficial

- Possible downsides

Copying a Forex or stock trader may very well be the best way to learn how to trade in the beginning. Of course, different people have different learning styles so this might not be for everyone. Nonetheless, its really beneficial for new traders to try this and see how things are done.

What is Copying a Trader?

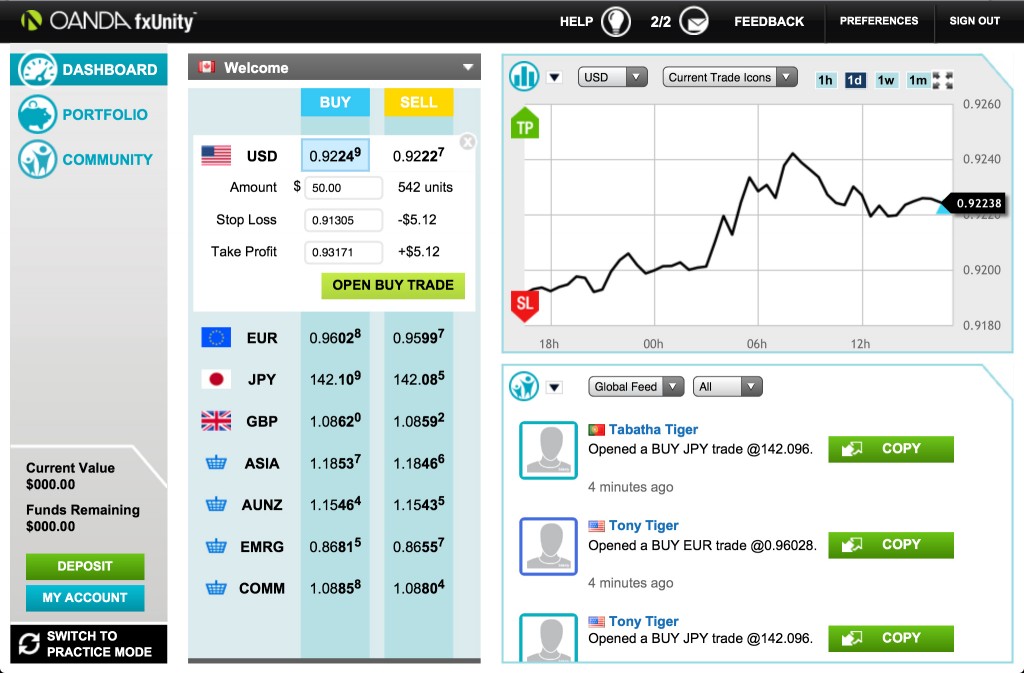

Weve already covered this, but in case youve forgotten, heres a brief overview – copying a trader is a way of directly opening all current and future operations of the said trader. Once you decide to copy a trader, you open all his current trades. If he opens a new one, so do you and that will continue until you decide that you dont want to follow him anymore.

In a sense, copying a trader means investing a part of your portfolio in that person. When they open a trade, so do you, and the amount you invest is a percentage of the amount youve invested as compared to their entire portfolio. This means that if their portfolio is, say USD 1000, and you invest USD 100, then for every trade he opens, you will automatically invest 10% of what he invests. If he loses, you lose, and if he wins, so do you. The profits and losses are calculated in a accordance.

Different platforms allow this option in a different manner. Some allow you to have more control while others restrict your movements. Usually, you cant invest your entire portfolio in a single trader.

Why is This Beneficial?

If youve learned how to properly pick a trader, then we shouldnt have to explain why this is beneficial. If the trader wins, you win. If youve picked a good, experienced or talented trader, you can make a lot based on their trades. However, the wrong choice might cause significant losses. Also, there is always a risk. Sadly, its not as simple as copying a trader and waiting for your bank to call and tell you youve just become a millionaire. If it were that easy, everybody would be doing it, dont you think? That being said, there are still many benefits. First of all, if youre good at reading the profiles, you can become one of the many traders who have created people-based portfolios.

If youve learned how to properly pick a trader, then we shouldnt have to explain why this is beneficial. If the trader wins, you win. If youve picked a good, experienced or talented trader, you can make a lot based on their trades. However, the wrong choice might cause significant losses. Also, there is always a risk. Sadly, its not as simple as copying a trader and waiting for your bank to call and tell you youve just become a millionaire. If it were that easy, everybody would be doing it, dont you think? That being said, there are still many benefits. First of all, if youre good at reading the profiles, you can become one of the many traders who have created people-based portfolios.

This means that you wont invest in stocks or Forex, but in people. If all the traders youve picked are good and consistently make a profit, then you will be doing the same. The problem with this is that its hard to establish. Not only that, but its also the sort of investment that will require your constant attention. Some traders will be on losing streaks and making bad trades, and sometimes its better to just shut the whole thing down before it get out of control. On the bright side, you wont have to study technical or fundamental analysis. If youre good at reading profiles, then its quite possible to make money this way.

But you dont have to necessarily count on those traders to make you money. You can also learn from them. Follow their steps, try to predict their moves, use them in an educational way. You can even do it using your demo account until the time comes for you start trading with real money. Learn as much as you can if you want to become a good trader. Copying someone can really help you with that (if theyre good, of course).

Possible Downsides

Copying a trader, even if theyre good, can have some negative effects, as well. First of all, it might create unrealistic expectations. Many of the platforms have a Top X (where X is a number) section where you can see the top traders. New traders might think that just because these people are in the top list, they will definitely make considerable profits in days. This is not how it works, sadly, and many novice traders are left disappointed (if theyre lucky) or even broke. Dont fall into the mental trap of creating unrealistic expectations. Always remember that a good risk management is always a benefit.

Other problems might also occur, aside from the unrealistic expectations. If you start copying traders, you might get lazy and think that its good to just sit back and relax. This is a really bad attitude you can never allow in trading. The field is constantly changing, and you need to change with it. Todays winners are tomorrows losers, so you need to make sure that youre not stuck with them because you were too lazy and laid back to notice they were losing you money.

Also, making the wrong choice can you lose you lots of money so dont simply trust the stats – test the trader through your demo account first.

Final Words

Copying a trader can be both profitable and educational. How ever, it can also be detrimental to your own development as a trader, if you let it. It can also harm your bank account if youre not careful. Never rely too much on someone. Always remember the risks and that no matter how good a trader is, hes bound to make a mistake. You need to notice when things are going down and jump ship.