Recognizing Good Traders

This lesson will cover the following

- Community feedback

- Trading history and gains

- Portfolio, profile and risk management

Social trading is based on the premise that you will use the information provided by other traders so you dont have to learn all the required skills, yourself. But how do you know if the information is any good? You cant simply take everything in good faith, right? Of course you cant. However, you are asking the wrong question, here. You cant know if the information is good until you either test the presented data, or you decipher the charts and get all the information, yourself. Even then there is no guarantee that you will get it right.

Sometimes even trends lie. Sometimes the unforeseen occurs. This is why you can never be sure in the information youre provided with, whether you get it through technical analysis or through other traders. A better question here is how can you be sure that a trader is good? Sure, we all make mistakes but a good trader will make a lot less mistakes than a trader who seems confident and knowledgeable but is actually full of himself. In this section, well help you answer that question.

Community Feedback

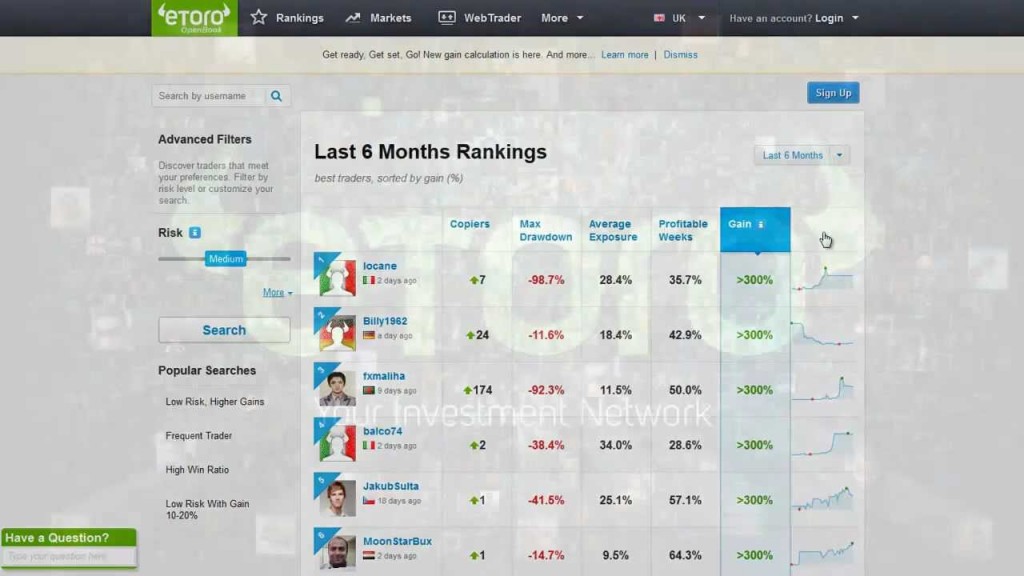

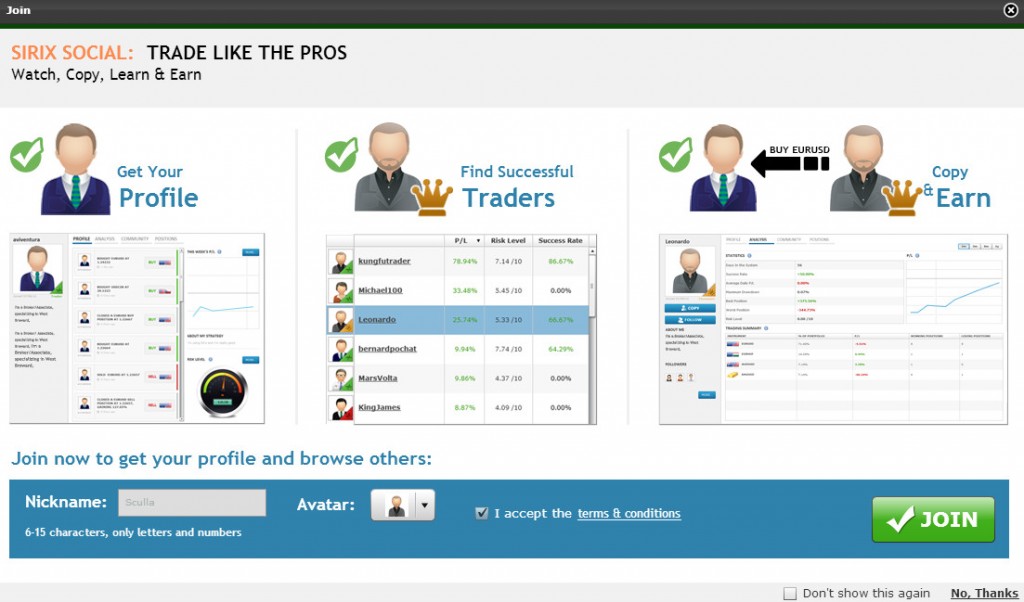

One of the most popular tools to evaluate a traders performance in the social trading sector is community feedback. If there have been traders who have followed the one youre looking for in the past, then they will have left some sort of feedback through comments and ratings. Many platforms even have their own Top 10s based on the number of followers a trader has (and other factors, of course). Point is, this is definitely one of the indicators you can look out for. Successful traders usually have many followers and are copied by many. This means that there will be a lot of feedback you can rely on when youre making the decision of whether to take his advice or copy him.

However, community feedback can only take you so far. Sometimes a trader looks much more successful than he is due to the community. Its not impossible for people to leave good comments because they like the style of the trader, even though he may have lost a bit of their money (they might be even be convinced that the short-term losses are a part of a long-term winning strategy). On the other hand, a trader can be good, yet unpopular. There might be negative comments because someone didnt like his attitude, or simply because he didnt get that 500% profit the users who copied him were counting on.

Point is, community feedback can serve as an indicator, but dont let it be the only one. Use to confirm or disprove what youre already thinking.

Trading History and Gains

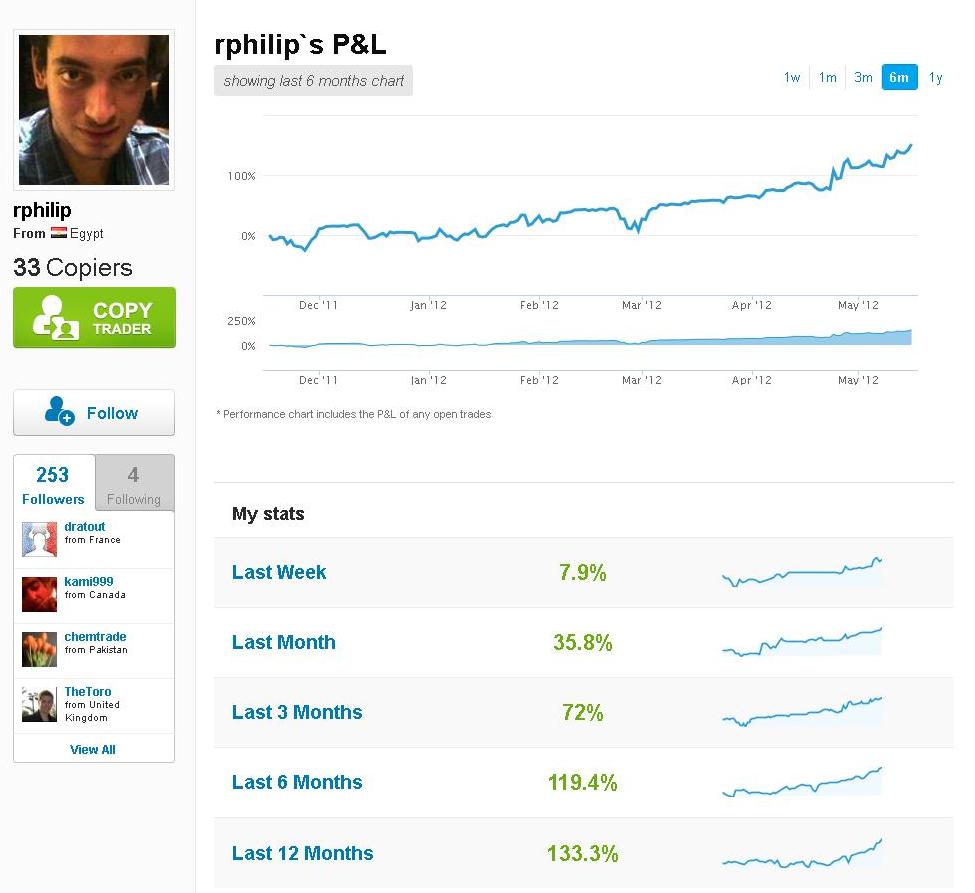

Some platforms allow you to have a look a traders investment history and current portfolio. You can see exactly how much theyve gained (usually in %) so you can deduce how good they are. However, this is also not completely reliable. There are many traders with over 400% gain in the last six months who have many losing trades. One of the things they might do in order to boost their ratings is to leave losing trades open. If you see that a trader has many losing trades open, this is usually a bad sign (unless its a part of a really long-term strategy).

That being said, its still not a bad idea to inspect those numbers. Learn as much as you can about the trader. Take a look at their previous and current actions. For example, if someone claims that certain stocks or currency is about to go way up, but is not buying anything, probably doesnt believe his own information. If they claim it and back up their words with actions, but theyve had considerable losses in the past few months, this may still mean that you shouldnt be following their advice.

Portfolio, Profile and Risk Management

As weve said, the portfolio can tell you a lot about a trader. If he is backing up his words with action ,then at least he believes in what hes saying. If he doesnt have many opened losing trades, its quite possible that he even knows what hes doing. All weve talked about so far should be used conjointly in order to form a better understanding of the nature of the trader so we know whether or not he is trustworthy and competent enough for us to follow and copy him.

The profile can tell you a lot, as well. A good trader who wants to be followed will take the time to complete his profile. If the profile is not completed, this might indicate that the trader is relatively new, or that he doesnt take too much interest in his own profile. If thats the case, better find someone else to follow. In many cases, the profile can tell you if a trader is using real money or virtual money. Dont take any action before youve confirmed that real money are traded. Anyone take huge risks with virtual money.

Finally, a good trader has good risk management. Make sure that you find a trader who has your level of risk management. You will be surprised at how sometimes people will risk much more than you would like them to, so if you dont like such surprises, make sure that you find someone with your level of risk management.

Final Words

Even if you find the right people, there is no guarantee that they will make you money. However, you can be almost certain that the wrong people will lose you money so go that extra mile and dont be lazy – find exactly whom youre looking for in order to get the best chance.