What is Copy Tradingk?

This lesson will cover the following

- Why is copy trading so popular?

- Basic of copy trading

- Investing in people

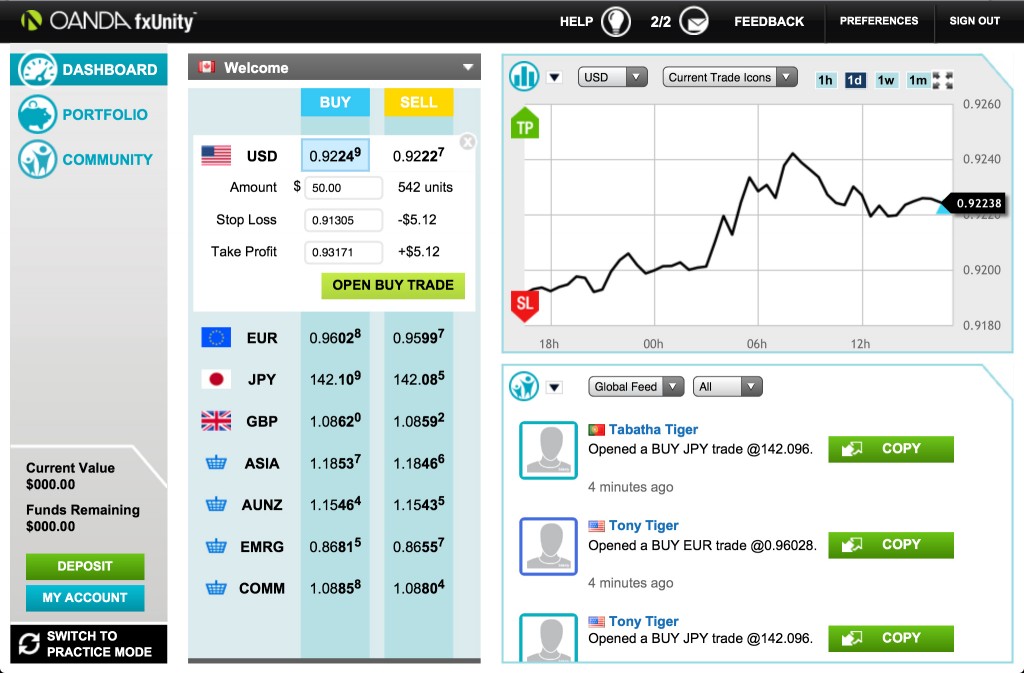

Many of the social Forex and stock trading platforms today offer the option of copy trading. Copy trading, as the name suggests allows you to directly copy the positions taken by another trader and connect a part of your portfolio with theirs. By linking your profile to another traders, you copy all of their current positions on the market, and any action they make henceforth. If they open a new trade, you open a new trade; if they close, you close; if they win, you win and sadly – if they lose, so do you. This doesnt mean that you dont have any control over the outcome. In most platforms, once youve established a connection, you still have the ability close trades, open new ones and otherwise moderate the overall outcome. However, by copying another trader, you can easily make money based on their skills.

Why is Copy Trading Popular?

This type of trading is becoming increasingly more popular due to the fact that it allows new traders to make money on the market. In fact, there are many traders who create the so-called “people-based” portfolios. This means that instead of investing in stocks or forex, they invest in other investors and dont perform trades themselves.

Basics of Copy Trading

The way copy trading is conducted can be widely variable on the platform you choose. However, the basic principle remains the same. You invest a part of your portfolio in a certain trader and copy all their trades in a percentage-based manner. In the interest of diversification, most sites wouldnt allows you to invest more than 20% of your portfolio in the hands of a single trader. This is a very good policy because sometimes traders seem better than they are or they simply hit a bad streak. When that happens, you dont want to have invested too much in them. Well cover some platforms further in the guide but this is all you need to know about it right now.

Investing in People

Just like normal trading, copy trading is based on looking at graphs and statistics (or at least it should be). However, in this case we are observing actual people instead of market movements. Its really important to look at a traders portfolio before copying them. You need to see their strategy, how successful they are, what risk management they exhibit and more. It may sound a bit intimidating right now, but dont worry – by the end of the guide you will know exactly what you need to do and how to do it.

Is Bigger Necessarily Better?

There are many new platforms that offer social and copy trading. However, we generally recommend sticking to the big guys – theyre already established and have enormous user bases which means more information and a wider variety of good traders to choose from.

That being said, some newer player in the game might also be worth it. This is not easy to determine, though. For example, a new site might have a better and improved interface to what youre used to, but if the user-base is small, does the interface really matter? Social and copy trading are based on people which means that the first thing you should be looking for in a platform is the number of users. This means that, yes, in most cases bigger is necessarily better. We will give you more information about picking your platform, as well as choosing a trader in future sections of the guide. This is all you need to know about the subject right now.

Is Copy Trading Reliable?

Different studies have been conducted in an attempt to measure the success rate of people who use copy trading. Results show that people who carefully choose their traders based on statistics and portfolio are up to 10% more successful than people who trade manually or choose their traders based on personal preferences. The moral of the story – leave your subjectivity at the door. All those stats are there for a reason – use them.

Final Words

Copy trading is great for new traders. It allows you to venture into the scary world of finances and potentially make some profits. Even if you lose, there is no way to waste your entire portfolio (unless you invest all your money in losing traders, in which case youve been really irresponsible) and even though there are no guarantees, its a nice way to begin trading. You can see what decisions they and see the statistics they see. You can try to understand what they saw that made them take the course of action they did, and learn from that. Moreover, you still have some control over the trades, which means that you dont have to put your entire faith in the said trader. All in all, copy trading is a great way to begin trading. You might stop doing in the future when you learn how things work, but in the beginning we can hardly think of a better starting position. In further sections we will explain how copy trading works (in more detail), how to choose a platform, a trader and more.