Hello there, this is tradingpedia.com and in this video we talk about gold or XAUUSD. Gold can be denominated in various currencies but usually it is in USD. It is offered by many brokers and gold recently made a new high, well above the $2,000. This was the previous top, then the market dipped lower, it consolidated for a long time before exploding to a new all-time high during the coronavirus crisis.

Why People Buy Gold?

Why is gold important and why would people buy gold and how they do it? Gold is viewed as an alternative investment and, as such, it has one big quality – to protect against inflation, basically a hedge against inflation. Inflation refers to the money losing value – the more money depreciates, the more it losses value. In order to avoid that, alternative investments offer protection, like gold.

Gold is the oldest form of money that exists. It is not really money as it differs from the fiat currency, but it is the only form that survived for thousand of years.

How to Buy Gold?

In 2020 gold can be bought in a physical aspect – bullion gold. You may buy it online and the seller will guard it in a vault. You may also buy or own shares of gold miners in order to gain exposure to the industry. If you don’t want to own physical gold or paper gold, you may buy shares in gold producing miners and you will gain exposure.

Another way is buying ETFs or Exchange Traded Funds. They track the gold sector and therefore you gain exposure to the sector. Or, when it comes to the currency market, you may simply trade the XAUUSD – the pair for gold. If you gold long, you buy gold, is you short, you reduce the exposure.

Portfolio

Imagine a portfolio. One can either trade gold from a speculative point of view or add it to a portfolio. Let’s assume that this is our portfolio and we buy shares, and this would be 50% of the portfolio. And then you diversify within the asset class, etc. But 5% of the portfolio is usually added to the portfolio because gold protects against inflation. If the price of gold jumped from $1,400 to $1,900, the USD depreciated. And it did, because the EURUSD rose from 1.08 to 1.20, GBPUSD and AUDUSD did the same, etc. So, while the USD lost value, gold increased. Therefore, by having exposure on gold, the impact of a lower USD on the portfolio is not detrimental.

Gold is only one alternative investment – many others exist, but gold is the most famous one. Therefore, to gain exposure on the gold, you may own bullion, shares of gold miners or ETFs, and the idea is to protect a portfolio. It is a bit of a controversy regarding how much gold to own, but always a bit of gold never hurts.

Related Videos

Why You Must Own Gold?

What is curious on the gold price is that everyone attributes the recent move higher to the coronavirus crisis. But gold on the monthly chart formed an inverted head and shoulders that consolidated for a long time before breaking higher one-and-a-half-years ago. Well, the coronavirus crisis came only in November-December in China, and in March it reached the Western world. But the actual breakout came almost a year earlier. So far, owning gold since 1999 paid. Inflation is nowhere to be seen in the developed world, but gold is usually owned in emerging markets. Think Turkey, Russia, Eastern Europe where inflation made victims throughout the years and the population does not trust the ability of the central bank to steam inflation.

Therefore, in order to protect your investment, you must own gold. In the Middle East gold is viewed as a protection against money debasing and a lot of people own physical gold like jewelries.

It is a fascinating market; it is one of the most important things to know in trading – how gold affects your portfolio and investment.

At this stage, keep in mind that gold is an alternative investment, it offers a hedge against inflation, and there are various ways to gain exposure on the gold market.

Gold – A Hedge Against Inflation

Gold is a commodity, an alternative investment. Alternative investments, as the name suggests, are just that – alternatives to the traditional, long-only portfolio.

The world of alternative investments comprises hedge funds, private equity, real estate, and infrastructure, collectibles, but also commodities. Traders are mostly familiar with commodities because all brokerage houses offer the possibility to speculate on the price of commodities such as precious metals (gold, silver, platinum) or energies (crude oil, natural gas).

Alternative investments are more illiquid than traditional investments. For this reason, investors in alternatives have a longer time horizon for their investments. For example, university endowments have a time horizon that spans for tens of years, having no problem investing in an illiquid asset.

Gold and Inflation

Throughout history, gold was one of the favorite ways to save and protect wealth. In the last decades, and especially after the 1970s, when the United States dropped the gold standard, gold acted as a hedge against inflation.

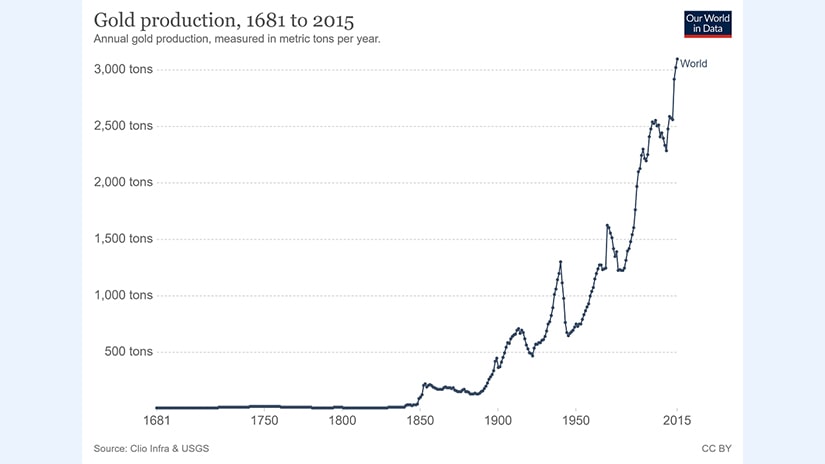

Gold production increased significantly since 1850, but the price of gold has traditionally kept pace with the rise in inflation. Inflation is triggered by an increase in the money supply, or M2, in an economy, and gold follows the money supply closely.

Nowadays, there are numerous ways to invest in gold. Paper gold is the most liquid way to own gold and investors allocate a few percentages of their portfolio to gold.

The COVID-19 pandemic has triggered an unprecedented response from most central banks and governments. The biggest monetary and fiscal package was released in the United States in a desperate effort to limit the pandemic’s economic impact.

The efforts did not go unnoticed. The United States economy recovered from the recession due to the fiscal and monetary stimulus and in 2021 is expected to grow by 7%, according to the latest forecast by the International Monetary Fund.

But the rapid recovery came at a cost – rising inflation. Inflation in the United States reached the highest in the last four decades during the pandemic. Because the United States economy is the largest in the world, the risk is that higher inflation will spill over to other economies too.

Investors, therefore, turn their attention to gold during the pandemic on fears of rising inflation.

Gold Has Reached a New All-Time High During the COVID-19 Pandemic

Gold may be denominated in any currency, but the most relevant quotation is the one against the world’s reserve currency, the US dollar. Gold is quoted under the ticker XAUUSD and it reached a new all-time high in 2020 during the COVID-19 pandemic.

As financial markets panicked in March and April 2020, investors have found safety in the US dollar. The lack of the US dollar’s liquidity in the financial system led to a strong appreciation against all other assets – gold included.

But then the Federal Reserve of the United States announced that it opened US dollar swap lines with other major central banks in the world. From that moment on, the stock market recovered, the US dollar weakened, and gold climbed all the way to a new all-time high.

Gold reached a new all-time high above $2,000 in August, a few months after the Fed opened the US dollar swap lines. By that time, investors were well aware of the size of the monetary stimulus and the promise of more fiscal stimulus fueled fears of rising inflation.

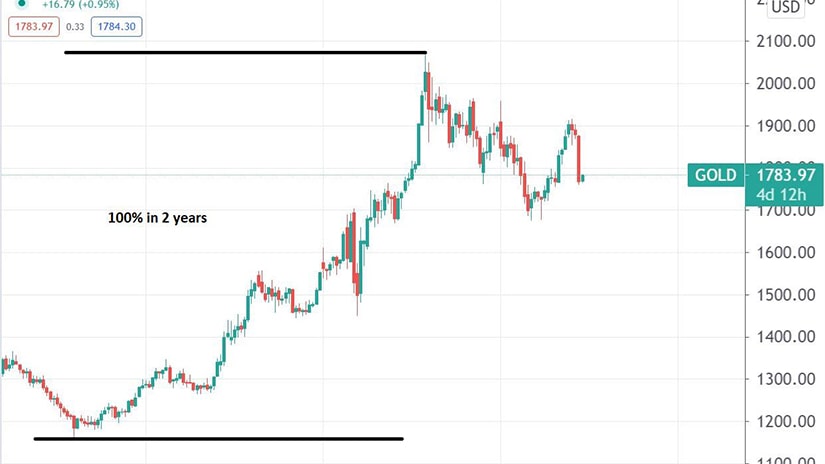

Gold – Doubled in Price in Two Years

So far we discussed that gold is viewed primarily as a hedge against inflation. But it should be mentioned that gold protects against inflation over the long run.

From time to time, the price of gold may diverge from the overall consensus. The perfect example comes from the recent performance prior to the 2020 COVID-19 pandemic.

As it turned out, when the pandemic hit the world, god was in a bullish run. The bullish trend started more than a year earlier, from close to $1,100.

A quick look at the chart above shows that the drop during the 2020 pandemic from $1,700 to $1,500 was not even strong enough to break the higher lows series. Such a series defines a bullish trend, and the market’s correction was not enough to invalidate the trend.

In other words, the market already rallied over $500 before the COVID-19 pandemic, and then the trend resumed, with the price of gold making a new all-time high above $2,000. Hence, investors bidding for the price of gold have invested way earlier, once again confirming the long-term perspective for the ones using alternative investments.

Gold and US 10-Year Yield

After a new all-time high, the price of gold corrected. The correction was so severe and unusual, that it took many by surprise.

Not only that the price of gold dropped over $400 from the highs, but it did so at a time when inflation kept rising in the United States. Therefore, many traders have wondered if the proverbial hedge against inflation still works.

A close look at the chart above shows that the correction from the highs was just that – a correction. While gold corrected since August 2020, it remains much higher than its low in 2019. Because higher inflation came much later than the rise in the price of gold, the hedge against inflation is intact.

The US 10-year yields are a headwind against the price of gold. Rising yields are the result of the ongoing economic recovery in the United States. The US 10-year is viewed as the risk-free rate, and higher yields have an inverse relationship with the price of gold.

More precisely, rising yields put pressure on the price of gold. For as long as yields continue to rise, the price of gold will correct or consolidate at best.

All in all, gold is the only form of money that survived for thousands of years. Investors still find safety in the yellow metal, especially in times of rising inflation.